Investment in collectible sneakers offers rapid market fluctuations and potential for high short-term returns driven by brand hype and limited editions, contrasting with real estate's long-term stability and steady appreciation through rental income and property value growth. Collectible sneakers attract investors seeking liquidity and trend-driven gains, while real estate appeals to those prioritizing tangible assets and financial security. Explore deeper insights into how each investment type aligns with your financial goals and risk tolerance.

Why it is important

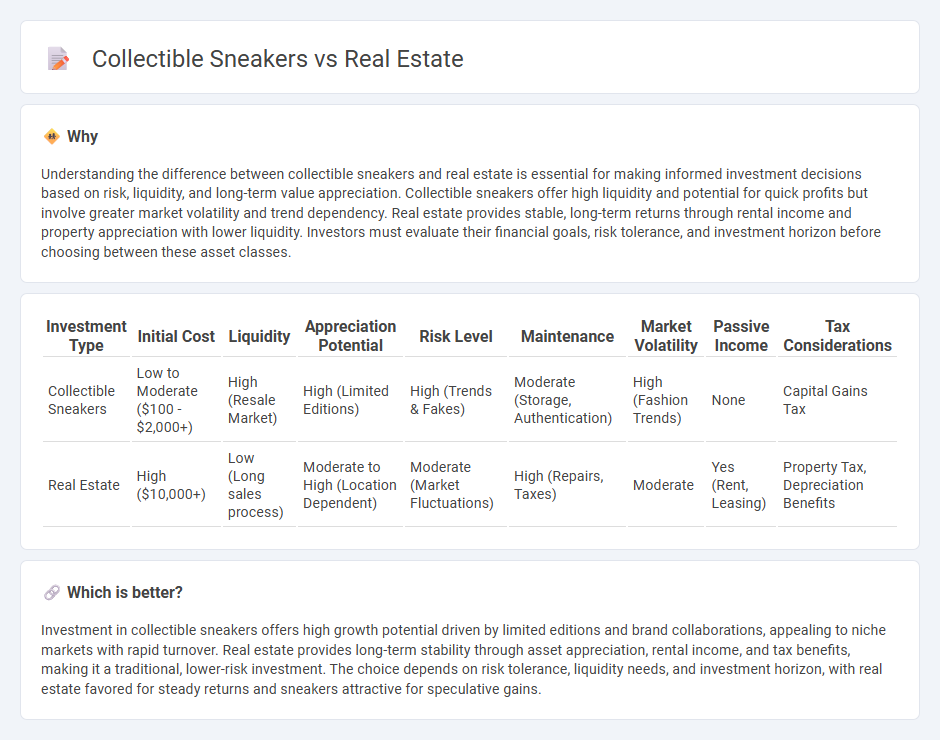

Understanding the difference between collectible sneakers and real estate is essential for making informed investment decisions based on risk, liquidity, and long-term value appreciation. Collectible sneakers offer high liquidity and potential for quick profits but involve greater market volatility and trend dependency. Real estate provides stable, long-term returns through rental income and property appreciation with lower liquidity. Investors must evaluate their financial goals, risk tolerance, and investment horizon before choosing between these asset classes.

Comparison Table

| Investment Type | Initial Cost | Liquidity | Appreciation Potential | Risk Level | Maintenance | Market Volatility | Passive Income | Tax Considerations |

|---|---|---|---|---|---|---|---|---|

| Collectible Sneakers | Low to Moderate ($100 - $2,000+) | High (Resale Market) | High (Limited Editions) | High (Trends & Fakes) | Moderate (Storage, Authentication) | High (Fashion Trends) | None | Capital Gains Tax |

| Real Estate | High ($10,000+) | Low (Long sales process) | Moderate to High (Location Dependent) | Moderate (Market Fluctuations) | High (Repairs, Taxes) | Moderate | Yes (Rent, Leasing) | Property Tax, Depreciation Benefits |

Which is better?

Investment in collectible sneakers offers high growth potential driven by limited editions and brand collaborations, appealing to niche markets with rapid turnover. Real estate provides long-term stability through asset appreciation, rental income, and tax benefits, making it a traditional, lower-risk investment. The choice depends on risk tolerance, liquidity needs, and investment horizon, with real estate favored for steady returns and sneakers attractive for speculative gains.

Connection

Collectible sneakers and real estate share a unique connection through their potential as alternative investment assets that appreciate over time due to scarcity and demand. Both markets rely on trends, historical value, and exclusivity, which drive value increases and attract investors seeking diversification beyond traditional stocks and bonds. The rise of digital platforms and auctions has further facilitated liquidity and accessibility for investors in these niche markets.

Key Terms

Liquidity

Real estate typically exhibits lower liquidity due to lengthy transaction processes involving inspections, financing, and legalities, often taking weeks to months for completion. Collectible sneakers offer higher liquidity, benefiting from rapid online marketplaces and a large, engaged community of buyers and sellers that can facilitate quick sales. Explore detailed comparisons to understand which asset aligns best with your investment goals.

Valuation

Real estate valuation relies on factors such as location, market trends, property condition, and comparable sales, providing a more stable and predictable appreciation over time. Collectible sneakers' valuation depends on rarity, brand collaboration, condition, and cultural demand, often resulting in volatile price fluctuations influenced by hype and limited releases. Explore the nuanced valuation methods for both assets to understand their investment potential better.

Market volatility

Real estate markets typically exhibit lower volatility due to long-term asset stability and income generation from rentals, while collectible sneakers experience high market volatility driven by trends, scarcity, and consumer demand fluctuations. Real estate investments benefit from relatively predictable price movements and regulatory protections, contrasting sharply with the speculative nature and rapid price swings seen in collectible sneaker markets. Explore further to understand how volatility impacts investment strategies in these unique asset classes.

Source and External Links

Los Angeles CA Real Estate & Homes For Sale - Offers a wide range of homes for sale in Los Angeles, including luxury properties and diverse real estate options.

RE/MAX Real Estate Agents in Bellflower, CA - Provides access to a list of real estate agents and brokers in the Bellflower area ready to assist with buying or selling properties.

Los Angeles Real Estate Listings - Features various homes and properties for sale across Los Angeles, enabling users to browse and find suitable listings.

Los Angeles Times Real Estate - Covers real estate news, trends, and market insights in Los Angeles, including luxury homes and commercial properties.

California Department of Real Estate - Regulates and oversees real estate licensing, education, and enforcement in California to protect public interests.

Los Angeles Real Estate by Century21 - Offers a comprehensive search tool for homes in Los Angeles, highlighting local listings and real estate services.

Los Angeles Times Real Estate Market Trends - Provides insights into the current real estate market in Los Angeles, including shifts in sales and property values.

California Real Estate Market Regulation - Oversees the real estate market in California, focusing on licensing and regulatory compliance to ensure fair practices.

Zillow Los Angeles Real Estate Market - Offers detailed analytics and listings that reflect the current state of the Los Angeles real estate market.

dowidth.com

dowidth.com