Carbon credit arbitrage exploits price differences in carbon markets to generate profit, focusing on buying low-cost carbon credits and selling them in higher-priced regions. Renewable energy certificates (RECs) represent proof that electricity was generated from renewable sources, allowing companies to meet sustainability goals or regulatory requirements. Explore the distinctions between carbon credit arbitrage and renewable energy certificates to optimize your investment strategy in sustainable assets.

Why it is important

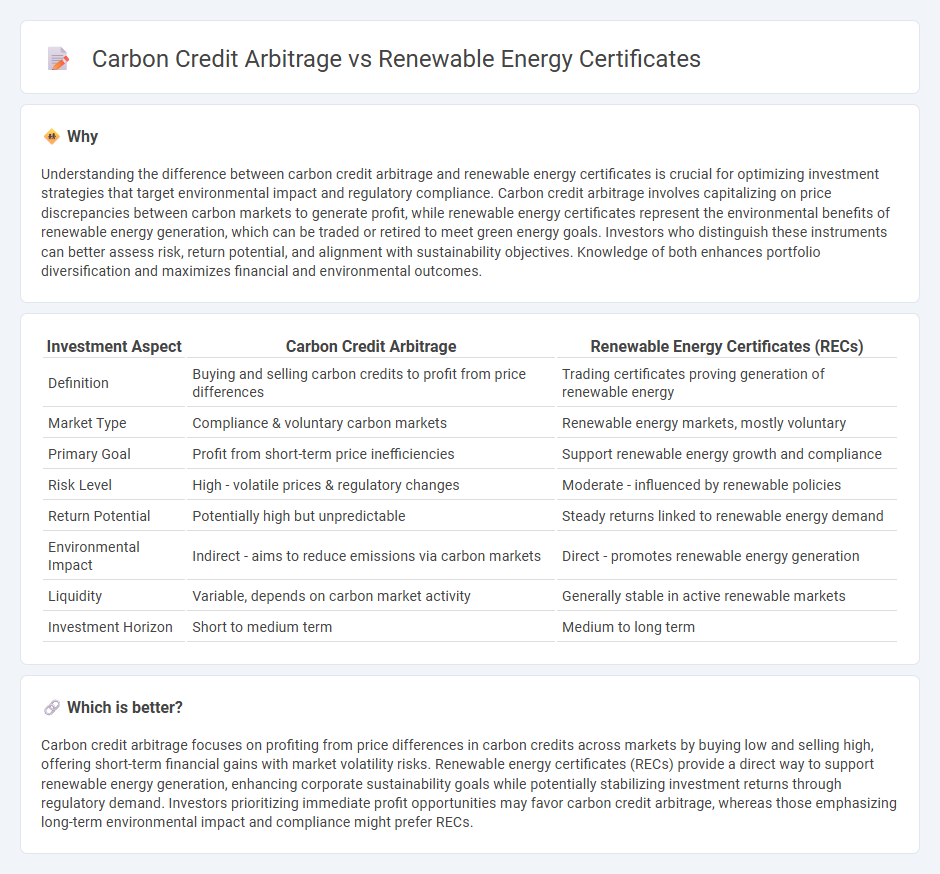

Understanding the difference between carbon credit arbitrage and renewable energy certificates is crucial for optimizing investment strategies that target environmental impact and regulatory compliance. Carbon credit arbitrage involves capitalizing on price discrepancies between carbon markets to generate profit, while renewable energy certificates represent the environmental benefits of renewable energy generation, which can be traded or retired to meet green energy goals. Investors who distinguish these instruments can better assess risk, return potential, and alignment with sustainability objectives. Knowledge of both enhances portfolio diversification and maximizes financial and environmental outcomes.

Comparison Table

| Investment Aspect | Carbon Credit Arbitrage | Renewable Energy Certificates (RECs) |

|---|---|---|

| Definition | Buying and selling carbon credits to profit from price differences | Trading certificates proving generation of renewable energy |

| Market Type | Compliance & voluntary carbon markets | Renewable energy markets, mostly voluntary |

| Primary Goal | Profit from short-term price inefficiencies | Support renewable energy growth and compliance |

| Risk Level | High - volatile prices & regulatory changes | Moderate - influenced by renewable policies |

| Return Potential | Potentially high but unpredictable | Steady returns linked to renewable energy demand |

| Environmental Impact | Indirect - aims to reduce emissions via carbon markets | Direct - promotes renewable energy generation |

| Liquidity | Variable, depends on carbon market activity | Generally stable in active renewable markets |

| Investment Horizon | Short to medium term | Medium to long term |

Which is better?

Carbon credit arbitrage focuses on profiting from price differences in carbon credits across markets by buying low and selling high, offering short-term financial gains with market volatility risks. Renewable energy certificates (RECs) provide a direct way to support renewable energy generation, enhancing corporate sustainability goals while potentially stabilizing investment returns through regulatory demand. Investors prioritizing immediate profit opportunities may favor carbon credit arbitrage, whereas those emphasizing long-term environmental impact and compliance might prefer RECs.

Connection

Carbon credit arbitrage exploits price differences between various carbon markets, enabling investors to buy low and sell high for profit while promoting emissions reduction. Renewable energy certificates (RECs) represent proof that electricity is generated from renewable sources, contributing to carbon offsetting efforts in compliance and voluntary markets. The connection lies in leveraging RECs within carbon credit arbitrage strategies to enhance returns and support sustainable energy transitions.

Key Terms

Additionality

Renewable energy certificates (RECs) represent proof that electricity was generated from renewable sources, supporting grid decarbonization without necessarily ensuring new emissions reductions, whereas carbon credit arbitrage exploits price differences between markets to maximize financial gains from carbon offset trading. The concept of additionality is crucial in distinguishing true environmental benefits; RECs often face criticism for lacking additionality since they mainly track existing renewable generation, while effective carbon credit arbitrage hinges on projects demonstrating clear, additional emissions cuts beyond business-as-usual scenarios. Explore further to understand how additionality impacts the credibility and effectiveness of carbon offset markets.

Market segmentation

Renewable energy certificates (RECs) primarily serve companies and utilities aiming to meet renewable portfolio standards by sourcing clean electricity, segmented by regional regulatory frameworks and production methods such as solar or wind. Carbon credit arbitrage targets investors and corporations seeking to exploit price differences across carbon markets, often divided by geographic region, credit type, and compliance or voluntary market status. Explore deeper into how these market segments influence strategic decision-making and investment flows in sustainable energy markets.

Price differential

Renewable energy certificates (RECs) and carbon credit arbitrage both exploit price differentials to maximize environmental and financial returns, with RECs representing proof of renewable electricity generation and carbon credits quantifying greenhouse gas reductions. The price differential in RECs arises from regional renewable energy mandates, whereas carbon credit arbitrage capitalizes on discrepancies between voluntary and compliance market prices across jurisdictions. Explore the nuances of these mechanisms to optimize your green investment strategies and market participation.

Source and External Links

Renewable Energy Certificate (United States) - Wikipedia - [Renewable Energy Certificates (RECs) are tradable, non-tangible certificates in the U.S. that prove 1 megawatt-hour of electricity was generated from an eligible renewable energy source and fed into the grid, with separate compliance and voluntary markets.]

Renewable Energy Credits (RECs): What You Need To Know - [RECs are certificates that transfer the renewable attributes of electricity to the owner, allowing individuals or businesses to claim that a portion of their electricity use comes from renewable sources, even if the physical electrons come from the general grid.]

Renewable Energy Certificates (RECs) | US EPA - [A REC is a market-based instrument representing the property rights to the environmental and social attributes of one megawatt-hour of renewable electricity generation, with detailed tracking of generation data and source information.]

dowidth.com

dowidth.com