Tax lien certificates offer investors secured, high-yield opportunities backed by property tax debts, often generating returns through interest or property acquisition. Corporate bonds represent debt investments where companies borrow funds from investors, typically providing fixed interest payments and varying risk levels based on the issuer's creditworthiness. Explore the differences between these investment options to make informed financial decisions.

Why it is important

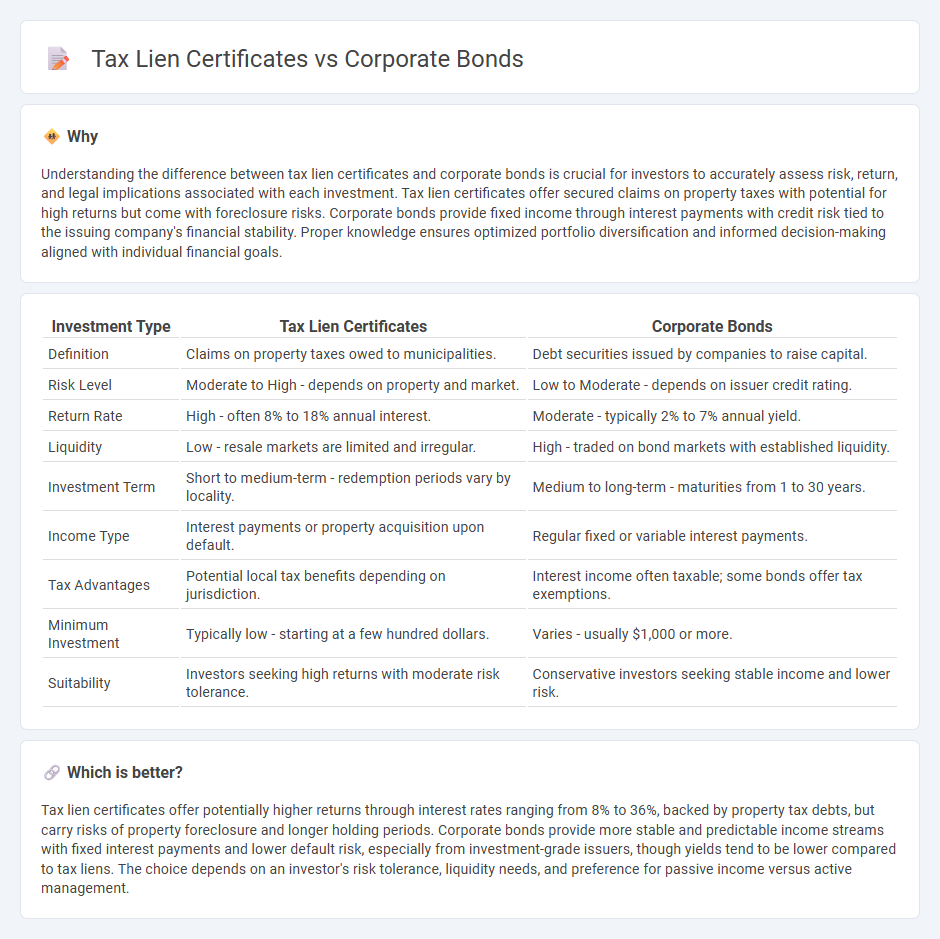

Understanding the difference between tax lien certificates and corporate bonds is crucial for investors to accurately assess risk, return, and legal implications associated with each investment. Tax lien certificates offer secured claims on property taxes with potential for high returns but come with foreclosure risks. Corporate bonds provide fixed income through interest payments with credit risk tied to the issuing company's financial stability. Proper knowledge ensures optimized portfolio diversification and informed decision-making aligned with individual financial goals.

Comparison Table

| Investment Type | Tax Lien Certificates | Corporate Bonds |

|---|---|---|

| Definition | Claims on property taxes owed to municipalities. | Debt securities issued by companies to raise capital. |

| Risk Level | Moderate to High - depends on property and market. | Low to Moderate - depends on issuer credit rating. |

| Return Rate | High - often 8% to 18% annual interest. | Moderate - typically 2% to 7% annual yield. |

| Liquidity | Low - resale markets are limited and irregular. | High - traded on bond markets with established liquidity. |

| Investment Term | Short to medium-term - redemption periods vary by locality. | Medium to long-term - maturities from 1 to 30 years. |

| Income Type | Interest payments or property acquisition upon default. | Regular fixed or variable interest payments. |

| Tax Advantages | Potential local tax benefits depending on jurisdiction. | Interest income often taxable; some bonds offer tax exemptions. |

| Minimum Investment | Typically low - starting at a few hundred dollars. | Varies - usually $1,000 or more. |

| Suitability | Investors seeking high returns with moderate risk tolerance. | Conservative investors seeking stable income and lower risk. |

Which is better?

Tax lien certificates offer potentially higher returns through interest rates ranging from 8% to 36%, backed by property tax debts, but carry risks of property foreclosure and longer holding periods. Corporate bonds provide more stable and predictable income streams with fixed interest payments and lower default risk, especially from investment-grade issuers, though yields tend to be lower compared to tax liens. The choice depends on an investor's risk tolerance, liquidity needs, and preference for passive income versus active management.

Connection

Tax lien certificates and corporate bonds both represent forms of investment that generate income through interest payments, appealing to investors seeking fixed returns. Tax lien certificates allow investors to purchase delinquent property tax debt secured by real estate, potentially earning high interest rates or acquiring property in case of default, while corporate bonds are debt securities issued by corporations to raise capital, offering periodic interest payments and principal repayment at maturity. Both instruments involve varying degrees of risk and reward, with tax lien certificates tied to local government tax systems and corporate bonds linked to the issuing company's creditworthiness.

Key Terms

Yield

Corporate bonds typically offer yields ranging from 2% to 6%, depending on the issuer's credit rating and market conditions. Tax lien certificates can provide higher yields, often between 8% and 18%, but carry increased risk due to variability in property redemption rates and legal complexities. Explore the detailed risk-reward profiles to determine which investment aligns with your financial goals.

Default Risk

Corporate bonds carry a default risk tied to the issuing company's financial health, with investment-grade bonds posing lower default probabilities compared to high-yield, or junk, bonds. Tax lien certificates present a unique risk where the property owner fails to pay overdue taxes, potentially leading to foreclosure but often secured by the property value underlying the lien. Explore the intricacies of default risk for these investment types to enhance portfolio strategy and risk management.

Seniority

Corporate bonds typically have a clear priority structure, with senior bonds holding precedence over subordinated debt, ensuring higher repayment security in insolvency situations. Tax lien certificates, representing claims on delinquent property taxes, generally hold seniority over most unsecured debts but their enforcement depends on local tax laws and property lien hierarchies. Explore how seniority impacts investment risks by delving deeper into both corporate bonds and tax lien certificates.

Source and External Links

Corporate Bonds - Fidelity - Corporate bonds are debt obligations issued by companies to fund projects and operations, usually paying a fixed-rate coupon periodically and categorized as either investment grade or high yield based on credit risk and rating agencies.

Corporate Bonds - U.S. SEC Investor.gov - Corporate bonds are loans investors make to companies, which pay periodic interest and return principal at maturity, offering priority over shareholders in bankruptcy but carrying default risk tied to the issuer's creditworthiness.

Corporate bond - Wikipedia - Corporate bonds are issued by corporations to raise capital for operations or acquisitions, trading primarily over-the-counter, and classified into high grade (investment grade) or high yield (junk) bonds based on credit ratings.

dowidth.com

dowidth.com