Spice trading involves the direct purchase and sale of physical spices such as cinnamon, cloves, and pepper, focusing on quality, origin, and seasonal availability. Commodity futures contract standardized agreements to buy or sell specified quantities of commodities like grains, metals, or spices at predetermined prices and future dates, offering hedging and speculative opportunities. Discover how each investment approach can diversify your portfolio and manage market risks effectively.

Why it is important

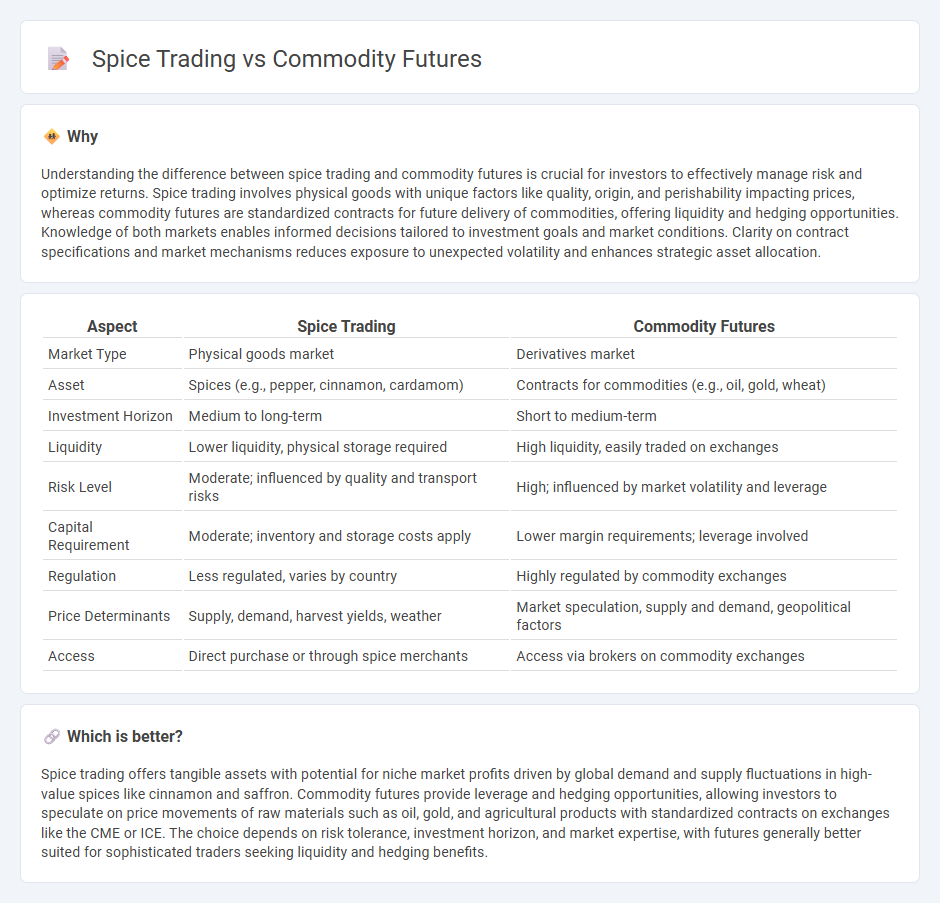

Understanding the difference between spice trading and commodity futures is crucial for investors to effectively manage risk and optimize returns. Spice trading involves physical goods with unique factors like quality, origin, and perishability impacting prices, whereas commodity futures are standardized contracts for future delivery of commodities, offering liquidity and hedging opportunities. Knowledge of both markets enables informed decisions tailored to investment goals and market conditions. Clarity on contract specifications and market mechanisms reduces exposure to unexpected volatility and enhances strategic asset allocation.

Comparison Table

| Aspect | Spice Trading | Commodity Futures |

|---|---|---|

| Market Type | Physical goods market | Derivatives market |

| Asset | Spices (e.g., pepper, cinnamon, cardamom) | Contracts for commodities (e.g., oil, gold, wheat) |

| Investment Horizon | Medium to long-term | Short to medium-term |

| Liquidity | Lower liquidity, physical storage required | High liquidity, easily traded on exchanges |

| Risk Level | Moderate; influenced by quality and transport risks | High; influenced by market volatility and leverage |

| Capital Requirement | Moderate; inventory and storage costs apply | Lower margin requirements; leverage involved |

| Regulation | Less regulated, varies by country | Highly regulated by commodity exchanges |

| Price Determinants | Supply, demand, harvest yields, weather | Market speculation, supply and demand, geopolitical factors |

| Access | Direct purchase or through spice merchants | Access via brokers on commodity exchanges |

Which is better?

Spice trading offers tangible assets with potential for niche market profits driven by global demand and supply fluctuations in high-value spices like cinnamon and saffron. Commodity futures provide leverage and hedging opportunities, allowing investors to speculate on price movements of raw materials such as oil, gold, and agricultural products with standardized contracts on exchanges like the CME or ICE. The choice depends on risk tolerance, investment horizon, and market expertise, with futures generally better suited for sophisticated traders seeking liquidity and hedging benefits.

Connection

Spice trading, one of the oldest forms of commerce, laid the groundwork for the development of commodity futures by introducing standardized contracts for the future delivery of goods, ensuring price stability and mitigating risk. Commodity futures markets enable investors to hedge against price volatility of spices like pepper, cinnamon, and cardamom, fostering liquidity and price discovery. This connection between spice trading and commodity futures enhances global trade efficiency while providing investment opportunities in agricultural commodities.

Key Terms

Hedging

Commodity futures involve standardized contracts for buying or selling raw materials like oil, metals, or agricultural products at a predetermined price and date, primarily used by producers and consumers to hedge against price volatility. Spice trading, often conducted through spot markets or less standardized forward contracts, presents unique challenges due to perishability and quality variability, making precise hedging more complex but critical for exporters and buyers. Explore detailed strategies and market dynamics to optimize risk management in both commodity futures and spice trading.

Speculation

Commodity futures trading involves contracts to buy or sell raw materials like oil, metals, or agricultural products at predetermined prices and dates, often driven by speculation on price movements. Spice trading, a subset of commodity trading, specifically targets spices such as pepper, cinnamon, and cardamom, with speculation focusing on factors like climate impact and geopolitical events affecting supply. Discover more about how speculation shapes market opportunities and risks in both commodity futures and spice trading.

Delivery

Commodity futures contracts typically involve standardized delivery terms with established quality, quantity, and delivery dates, crucial for ensuring market stability and hedging risks. Spice trading, while sometimes facilitated through futures markets, often relies on spot transactions or contracts emphasizing physical delivery due to the perishable nature and quality variability of spices like pepper, cinnamon, and cardamom. Explore detailed insights to understand the specific delivery mechanisms and risk management strategies in commodity futures and spice trading.

Source and External Links

Corn Futures Overview - CME Group - Corn futures are standardized contracts traded on CME Group, providing a central, transparent price discovery platform where investors can profit from or hedge against price movements in the US's most widely grown crop, with high liquidity and flexible trading options.

Basics of Futures Trading | CFTC - A commodity futures contract is an agreement to buy or sell a particular commodity at a future date at a price and quantity fixed when the contract is made, primarily used by hedgers to manage price risk and speculators seeking profit from price changes, with most contracts liquidated before delivery occurs.

Futures and Commodities | FINRA.org - Commodity futures are derivative contracts that offer diversification and potential inflation protection, but carry significant risk due to price volatility and leverage, and the performance of futures-based investments can diverge from the spot price of the underlying commodity over time.

dowidth.com

dowidth.com