Music royalties platforms offer investors a unique opportunity to earn passive income through streaming revenue and licensing fees, leveraging the growing digital music market. Collectible sneakers investment platforms capitalize on the rising demand for rare and limited-edition footwear, driven by a thriving resale market and sneaker culture. Explore how these alternative investment platforms can diversify your portfolio and create new income streams.

Why it is important

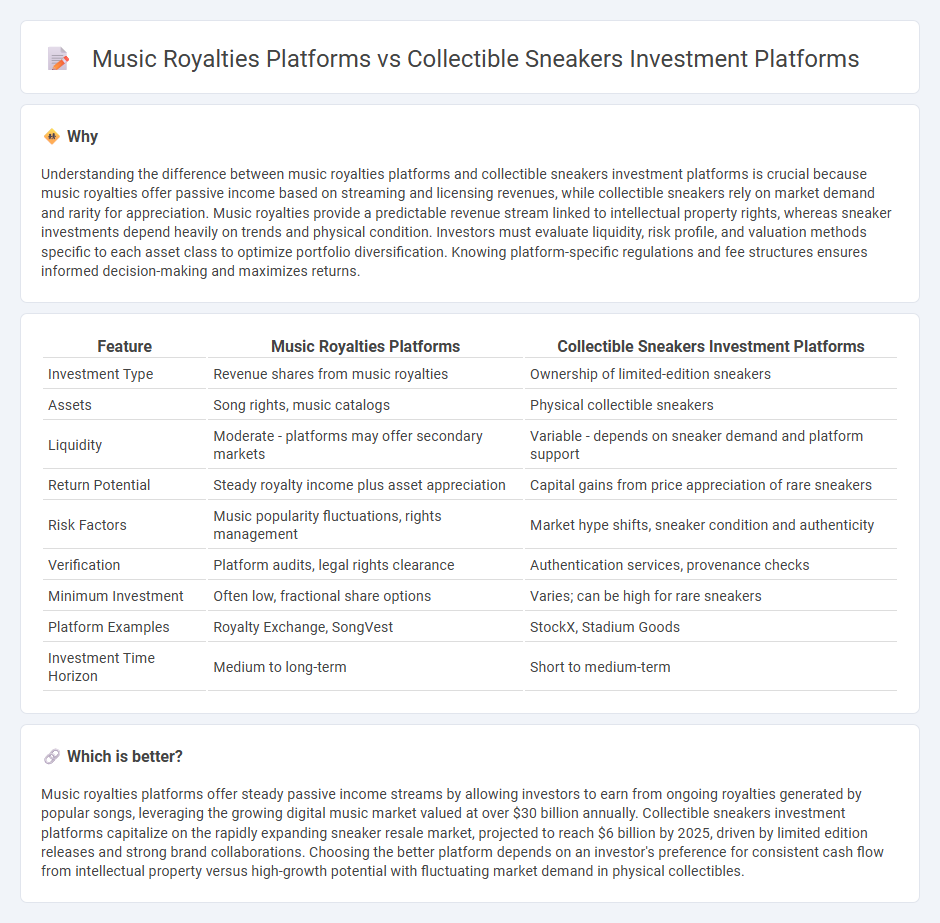

Understanding the difference between music royalties platforms and collectible sneakers investment platforms is crucial because music royalties offer passive income based on streaming and licensing revenues, while collectible sneakers rely on market demand and rarity for appreciation. Music royalties provide a predictable revenue stream linked to intellectual property rights, whereas sneaker investments depend heavily on trends and physical condition. Investors must evaluate liquidity, risk profile, and valuation methods specific to each asset class to optimize portfolio diversification. Knowing platform-specific regulations and fee structures ensures informed decision-making and maximizes returns.

Comparison Table

| Feature | Music Royalties Platforms | Collectible Sneakers Investment Platforms |

|---|---|---|

| Investment Type | Revenue shares from music royalties | Ownership of limited-edition sneakers |

| Assets | Song rights, music catalogs | Physical collectible sneakers |

| Liquidity | Moderate - platforms may offer secondary markets | Variable - depends on sneaker demand and platform support |

| Return Potential | Steady royalty income plus asset appreciation | Capital gains from price appreciation of rare sneakers |

| Risk Factors | Music popularity fluctuations, rights management | Market hype shifts, sneaker condition and authenticity |

| Verification | Platform audits, legal rights clearance | Authentication services, provenance checks |

| Minimum Investment | Often low, fractional share options | Varies; can be high for rare sneakers |

| Platform Examples | Royalty Exchange, SongVest | StockX, Stadium Goods |

| Investment Time Horizon | Medium to long-term | Short to medium-term |

Which is better?

Music royalties platforms offer steady passive income streams by allowing investors to earn from ongoing royalties generated by popular songs, leveraging the growing digital music market valued at over $30 billion annually. Collectible sneakers investment platforms capitalize on the rapidly expanding sneaker resale market, projected to reach $6 billion by 2025, driven by limited edition releases and strong brand collaborations. Choosing the better platform depends on an investor's preference for consistent cash flow from intellectual property versus high-growth potential with fluctuating market demand in physical collectibles.

Connection

Music royalties platforms and collectible sneakers investment platforms both operate within alternative asset markets, allowing investors to diversify portfolios beyond traditional stocks and bonds. These platforms leverage digital infrastructure to fractionalize high-value assets, enabling fractional ownership and liquidity. By capitalizing on niche markets with strong fan bases and cultural value, they attract investors seeking unique revenue streams and potential appreciation.

Key Terms

**Collectible Sneakers Investment Platforms:**

Collectible sneakers investment platforms enable users to buy, sell, and trade shares of rare sneakers, leveraging blockchain technology to ensure authenticity and fractional ownership. These platforms, such as StockX and Rally Rd, provide transparent pricing, liquidity, and access to high-value sneaker assets traditionally limited to collectors. Explore how collectible sneaker investments can diversify your portfolio and capitalize on the booming sneaker resale market.

Authentication

Authentication in collectible sneakers investment platforms relies heavily on advanced forensic analysis, including microscopic examination and blockchain-based provenance tracking to verify originality and prevent counterfeits. Music royalties platforms implement smart contracts and decentralized ledgers to ensure transparent ownership rights and accurate distribution of earnings to artists and investors. Explore how these authentication methods secure your investments by learning more about each platform's technology.

Fractional Ownership

Fractional ownership in collectible sneaker investment platforms enables users to purchase shares in rare and limited-edition shoes, leveraging market demand and historical price appreciation for potential profits. Music royalties platforms offer fractional ownership by allowing investors to buy portions of royalty streams from popular songs, providing steady, passive income linked to the artist's success and song popularity. Explore detailed insights on how fractional ownership diversifies portfolios across tangible and intangible assets.

Source and External Links

Investing Platform Public Debuts Rare Sneaker Portfolio - Public.com offers a unique investing platform bundling 77 rare and iconic sneakers into a single investable asset, allowing investors broad exposure to the sneaker resale market valued at $30 billion by 2030.

Timeless Guide: How to invest in Sneakers - This guide highlights collectible sneaker investment through platforms like StockX and GOAT, explaining how fractional ownership models simplify access to rare sneakers by addressing authentication, storage, and resale challenges.

Why Invest in Sneakers? Step Up Your Portfolio ... - Splint Invest enables sneaker investment starting at EUR50 with due diligence validation, insured storage, and auctions on platforms like StockX and GOAT, supporting sneaker assets as a promising alternative investment class.

dowidth.com

dowidth.com