Wine investing offers a tangible asset with potential appreciation tied to rarity, vintage quality, and global demand, while private equity provides access to diversified company ownership and long-term capital growth through strategic business development. Both investment types carry unique risks and benefits, with wine requiring niche market knowledge and private equity demanding significant capital and longer lock-in periods. Explore the nuances of wine investing versus private equity to determine which aligns best with your financial goals.

Why it is important

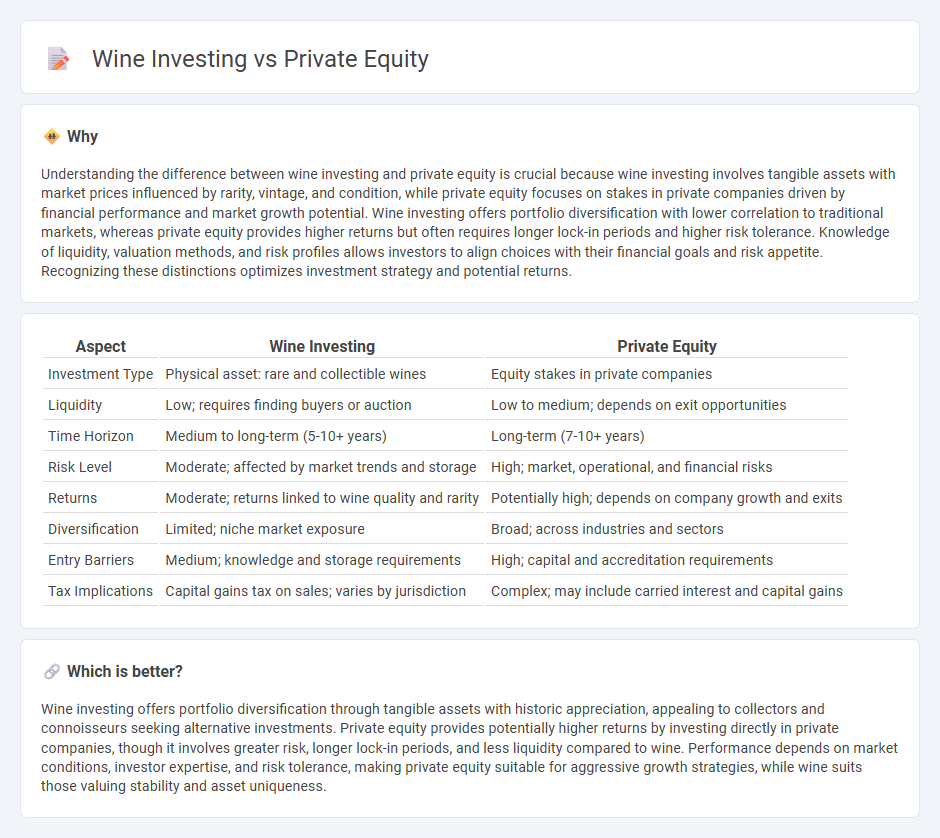

Understanding the difference between wine investing and private equity is crucial because wine investing involves tangible assets with market prices influenced by rarity, vintage, and condition, while private equity focuses on stakes in private companies driven by financial performance and market growth potential. Wine investing offers portfolio diversification with lower correlation to traditional markets, whereas private equity provides higher returns but often requires longer lock-in periods and higher risk tolerance. Knowledge of liquidity, valuation methods, and risk profiles allows investors to align choices with their financial goals and risk appetite. Recognizing these distinctions optimizes investment strategy and potential returns.

Comparison Table

| Aspect | Wine Investing | Private Equity |

|---|---|---|

| Investment Type | Physical asset: rare and collectible wines | Equity stakes in private companies |

| Liquidity | Low; requires finding buyers or auction | Low to medium; depends on exit opportunities |

| Time Horizon | Medium to long-term (5-10+ years) | Long-term (7-10+ years) |

| Risk Level | Moderate; affected by market trends and storage | High; market, operational, and financial risks |

| Returns | Moderate; returns linked to wine quality and rarity | Potentially high; depends on company growth and exits |

| Diversification | Limited; niche market exposure | Broad; across industries and sectors |

| Entry Barriers | Medium; knowledge and storage requirements | High; capital and accreditation requirements |

| Tax Implications | Capital gains tax on sales; varies by jurisdiction | Complex; may include carried interest and capital gains |

Which is better?

Wine investing offers portfolio diversification through tangible assets with historic appreciation, appealing to collectors and connoisseurs seeking alternative investments. Private equity provides potentially higher returns by investing directly in private companies, though it involves greater risk, longer lock-in periods, and less liquidity compared to wine. Performance depends on market conditions, investor expertise, and risk tolerance, making private equity suitable for aggressive growth strategies, while wine suits those valuing stability and asset uniqueness.

Connection

Wine investing and private equity are connected through their shared appeal as alternative asset classes that diversify investment portfolios and potentially yield high returns. Both involve investing in non-traditional markets--fine wine requires expertise in vintage quality and market trends, while private equity focuses on acquiring equity stakes in private companies for growth. Their long-term investment horizons and reliance on market knowledge make them attractive for investors seeking to balance risk and reward outside of public equity markets.

Key Terms

Liquidity

Private equity investments often involve long lock-up periods with limited liquidity, making it challenging for investors to access their capital quickly. In contrast, wine investing offers relatively higher liquidity through a growing secondary market where collectors and investors can buy and sell bottles with greater ease. Explore the liquidity dynamics between private equity and wine investing to optimize your portfolio strategy.

Valuation

Private equity valuation relies heavily on discounted cash flow (DCF) analysis, comparable company metrics, and precedent transactions to estimate future earnings and growth potential. Wine investing valuation depends on provenance, rarity, vintage quality, auction results, and expert ratings, making it more subjective and influenced by market trends and collector demand. Explore the nuances of valuation methods in private equity and wine investing to enhance your investment strategy.

Due diligence

Due diligence in private equity involves rigorous financial analysis, market assessment, and management evaluation to mitigate investment risks and maximize returns. In wine investing, due diligence focuses on provenance verification, storage conditions, market trends, and authenticity certification to ensure long-term value appreciation. Explore deeper insights into due diligence strategies tailored for private equity and wine investing to enhance investment success.

Source and External Links

Private equity - Wikipedia - Private equity involves investment managers raising money from institutional investors to buy equity stakes in private companies with the goal of generating returns through strategies like revenue growth, margin expansion, and debt paydown over 4-7 years.

What is Private Equity? - BVCA - Private equity is medium to long-term finance in return for equity in unquoted companies, typically supporting management buyouts and closely working with company management to drive sustainable growth over 4-7 years before exiting.

Private Equity Funds | Investor.gov - Private equity funds pool investors' money to take controlling interests in companies, actively managing them to increase value with a typical investment horizon of 10 or more years, and are not subject to regular SEC disclosure requirements.

dowidth.com

dowidth.com