Fractional real estate offers individual investors the opportunity to buy partial ownership in specific properties, providing direct asset control and potential rental income. Real estate limited partnerships pool capital from multiple investors to fund large-scale projects managed by general partners, distributing profits based on partnership shares. Explore the advantages and risks of each investment method to determine the best fit for your portfolio.

Why it is important

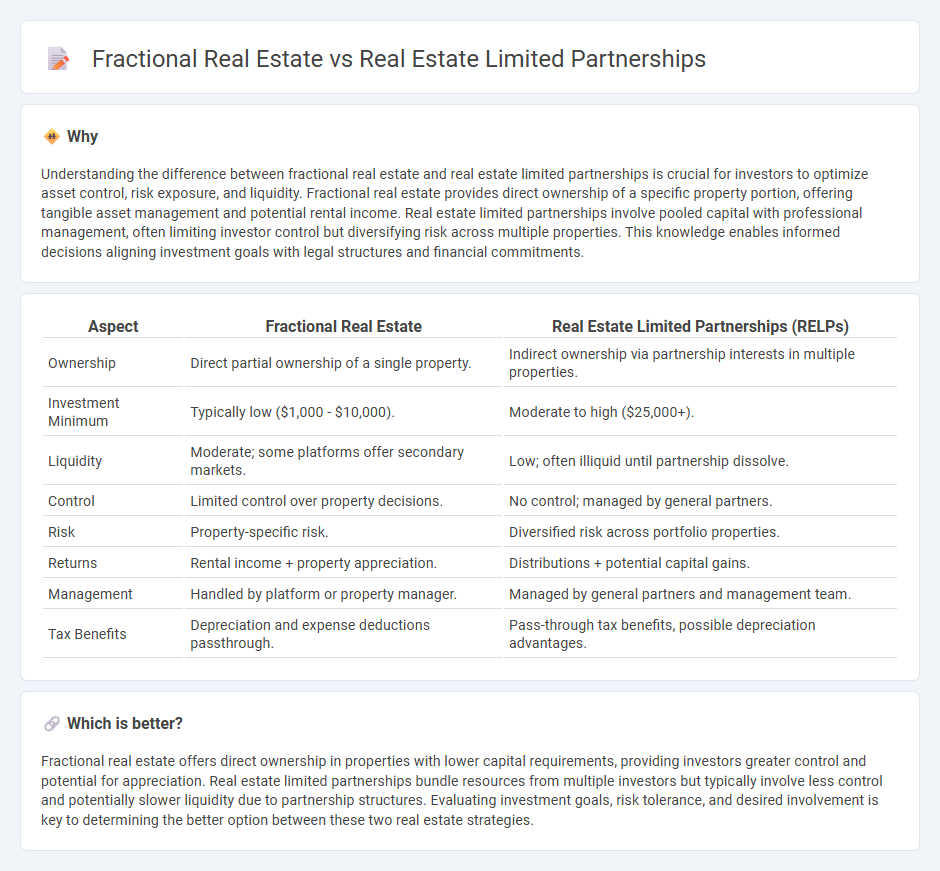

Understanding the difference between fractional real estate and real estate limited partnerships is crucial for investors to optimize asset control, risk exposure, and liquidity. Fractional real estate provides direct ownership of a specific property portion, offering tangible asset management and potential rental income. Real estate limited partnerships involve pooled capital with professional management, often limiting investor control but diversifying risk across multiple properties. This knowledge enables informed decisions aligning investment goals with legal structures and financial commitments.

Comparison Table

| Aspect | Fractional Real Estate | Real Estate Limited Partnerships (RELPs) |

|---|---|---|

| Ownership | Direct partial ownership of a single property. | Indirect ownership via partnership interests in multiple properties. |

| Investment Minimum | Typically low ($1,000 - $10,000). | Moderate to high ($25,000+). |

| Liquidity | Moderate; some platforms offer secondary markets. | Low; often illiquid until partnership dissolve. |

| Control | Limited control over property decisions. | No control; managed by general partners. |

| Risk | Property-specific risk. | Diversified risk across portfolio properties. |

| Returns | Rental income + property appreciation. | Distributions + potential capital gains. |

| Management | Handled by platform or property manager. | Managed by general partners and management team. |

| Tax Benefits | Depreciation and expense deductions passthrough. | Pass-through tax benefits, possible depreciation advantages. |

Which is better?

Fractional real estate offers direct ownership in properties with lower capital requirements, providing investors greater control and potential for appreciation. Real estate limited partnerships bundle resources from multiple investors but typically involve less control and potentially slower liquidity due to partnership structures. Evaluating investment goals, risk tolerance, and desired involvement is key to determining the better option between these two real estate strategies.

Connection

Fractional real estate and real estate limited partnerships both enable investors to participate in property markets with reduced capital by sharing ownership stakes. Fractional real estate allows multiple investors to own specific portions of a property, while real estate limited partnerships pool investor funds to collectively invest in larger projects managed by general partners. Both investment methods offer diversified exposure and potential income streams without the need for full property ownership.

Key Terms

Ownership Structure

Real estate limited partnerships involve investors holding limited partnership interests with passive roles, while general partners manage the property and decision-making. Fractional real estate offers direct ownership of a specific property fraction, granting investors more control and usage rights. Explore the differences in ownership structure to determine which investment aligns with your goals.

Liquidity

Real estate limited partnerships typically offer lower liquidity due to longer lock-up periods and restricted transferability of shares, while fractional real estate ownership provides enhanced liquidity through easier resale options and shorter holding commitments. Investors seeking flexibility and quicker access to capital may prefer fractional ownership models that facilitate more fluid market transactions. Explore detailed comparisons to identify which investment structure aligns best with your liquidity needs.

Liability

Real estate limited partnerships (RELPs) offer liability protection by limiting investors' exposure to their capital contributions, while general partners bear full liability for management decisions. Fractional real estate ownership typically involves shared property rights with proportional liability tied directly to the investor's ownership percentage. Explore further to understand how each structure impacts your risk and investment control.

Source and External Links

What Is a Real Estate Limited Partnership (RELP)? - This article explains how real estate limited partnerships work, including the roles of general and limited partners, and how they provide a structured way for passive investors to engage in real estate investments.

How Real Estate Partnerships Work: The Pros and Cons - This webpage discusses the pros and cons of real estate partnerships, including the differences between real estate limited partnerships and general partnerships, highlighting liability and management responsibilities.

Limited Partner: Definition, Role, and Benefits - This page defines the role of a limited partner in a real estate syndication, outlining their limited liability and passive role in management while still benefiting from real estate investments.

dowidth.com

dowidth.com