Whiskey barrel investment leverages the aging process of rare spirits, offering potential appreciation as barrels mature and whiskey gains value over time, whereas collectibles investment focuses on acquiring tangible items like art, coins, or vintage memorabilia with intrinsic rarity and demand driving their worth. Both investment types require careful market analysis and understanding of authenticity to maximize returns. Explore the distinct benefits and risks of each to determine the best strategy for your portfolio.

Why it is important

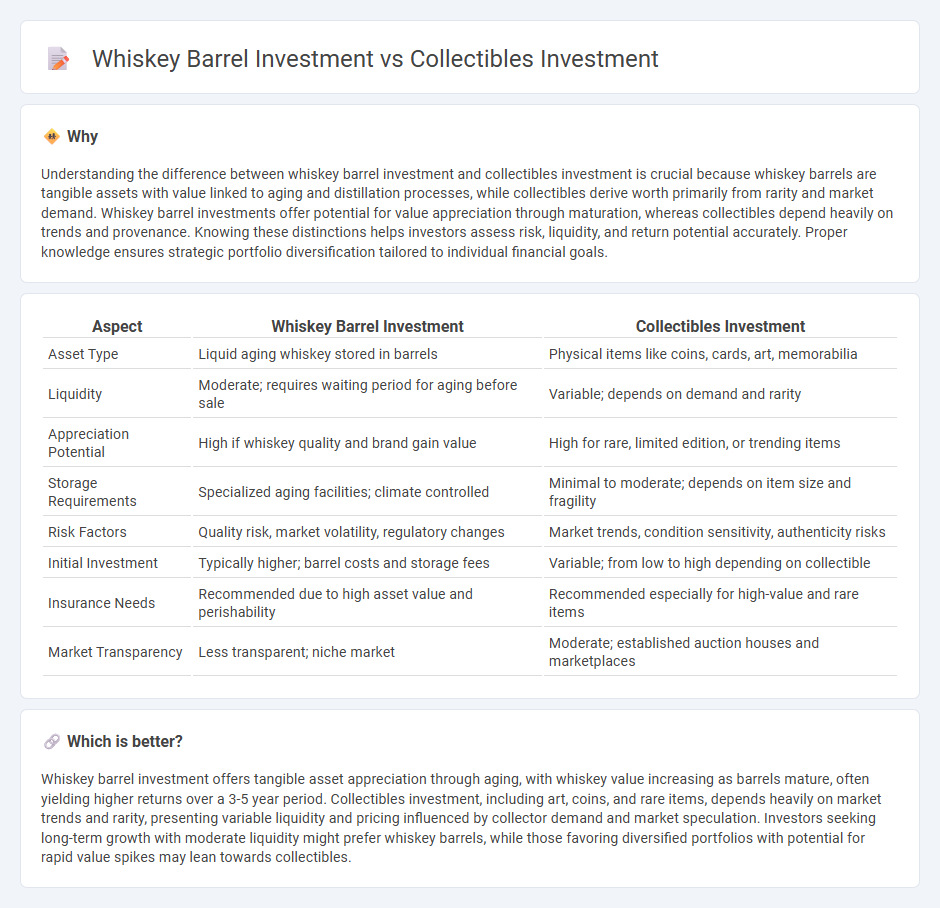

Understanding the difference between whiskey barrel investment and collectibles investment is crucial because whiskey barrels are tangible assets with value linked to aging and distillation processes, while collectibles derive worth primarily from rarity and market demand. Whiskey barrel investments offer potential for value appreciation through maturation, whereas collectibles depend heavily on trends and provenance. Knowing these distinctions helps investors assess risk, liquidity, and return potential accurately. Proper knowledge ensures strategic portfolio diversification tailored to individual financial goals.

Comparison Table

| Aspect | Whiskey Barrel Investment | Collectibles Investment |

|---|---|---|

| Asset Type | Liquid aging whiskey stored in barrels | Physical items like coins, cards, art, memorabilia |

| Liquidity | Moderate; requires waiting period for aging before sale | Variable; depends on demand and rarity |

| Appreciation Potential | High if whiskey quality and brand gain value | High for rare, limited edition, or trending items |

| Storage Requirements | Specialized aging facilities; climate controlled | Minimal to moderate; depends on item size and fragility |

| Risk Factors | Quality risk, market volatility, regulatory changes | Market trends, condition sensitivity, authenticity risks |

| Initial Investment | Typically higher; barrel costs and storage fees | Variable; from low to high depending on collectible |

| Insurance Needs | Recommended due to high asset value and perishability | Recommended especially for high-value and rare items |

| Market Transparency | Less transparent; niche market | Moderate; established auction houses and marketplaces |

Which is better?

Whiskey barrel investment offers tangible asset appreciation through aging, with whiskey value increasing as barrels mature, often yielding higher returns over a 3-5 year period. Collectibles investment, including art, coins, and rare items, depends heavily on market trends and rarity, presenting variable liquidity and pricing influenced by collector demand and market speculation. Investors seeking long-term growth with moderate liquidity might prefer whiskey barrels, while those favoring diversified portfolios with potential for rapid value spikes may lean towards collectibles.

Connection

Whiskey barrel investment and collectibles investment both involve the acquisition of rare, tangible assets that appreciate over time due to scarcity and demand. Whiskey barrels mature and increase in value as the aging process enhances their quality and rarity, similar to how collectibles like rare coins, art, or vintage toys gain worth through limited supply and cultural significance. Investors leverage these alternative assets to diversify portfolios, hedge against inflation, and capitalize on niche markets with strong appreciation potential.

Key Terms

**Collectibles Investment:**

Collectibles investment involves acquiring rare or unique items such as coins, stamps, art, or vintage toys, which often appreciate due to scarcity, historical value, and market demand. Unlike whiskey barrel investment, collectibles can offer a more tangible and diverse portfolio with potential for significant appreciation over time. Explore the benefits and strategies of collectibles investment to enhance your asset diversification and long-term wealth growth.

Rarity

Rarity plays a crucial role in both collectibles and whiskey barrel investments, significantly driving their market value over time. Collectibles often gain worth through limited editions, unique designs, or historical significance, enhancing their desirability among niche collectors. Explore deeper insights into how rarity affects investment potential in these sectors.

Provenance

Provenance is critical in collectibles investment, as documented ownership history significantly enhances the item's value and authenticity. Whiskey barrel investment relies on provenance through detailed records of distillation dates, barrel origin, and aging conditions to ensure quality and potential appreciation. Discover how provenance shapes value and mitigates risks in these unique investment markets.

Source and External Links

Types of Collectible Investments To Consider - Collectibles like fine art, rare coins, stamps, and vintage automobiles offer unique portfolio diversification and growth potential, but require careful research, storage, insurance, and face liquidity challenges as their value can be highly subjective and market-driven.

How to Invest in Collectibles - Collectibles such as rare coins, vintage wines, classic cars, and fine art blend financial opportunity with personal enjoyment, but investing in them demands market expertise, thorough research, and consideration of volatility, storage, and maintenance costs.

Collectible Investments: 10 Best Assets in 2025 + Insider Tips - Top collectible investments include investment-grade wine, comic books, toys, stamps, fine art, coins, sports memorabilia, sneakers, movie collectibles, and cars, with wine showing notable returns but all categories sharing risks like scams and high upkeep.

dowidth.com

dowidth.com