Psychedelic stocks represent a rapidly emerging sector driven by innovations in mental health treatments and growing investor interest, while commodities remain a traditional asset class known for hedging against inflation and market volatility. The contrasting dynamics of high growth potential in psychedelics versus the stability and tangible value of commodities offer diverse portfolio strategies. Explore the nuances of these investment options to make informed financial decisions.

Why it is important

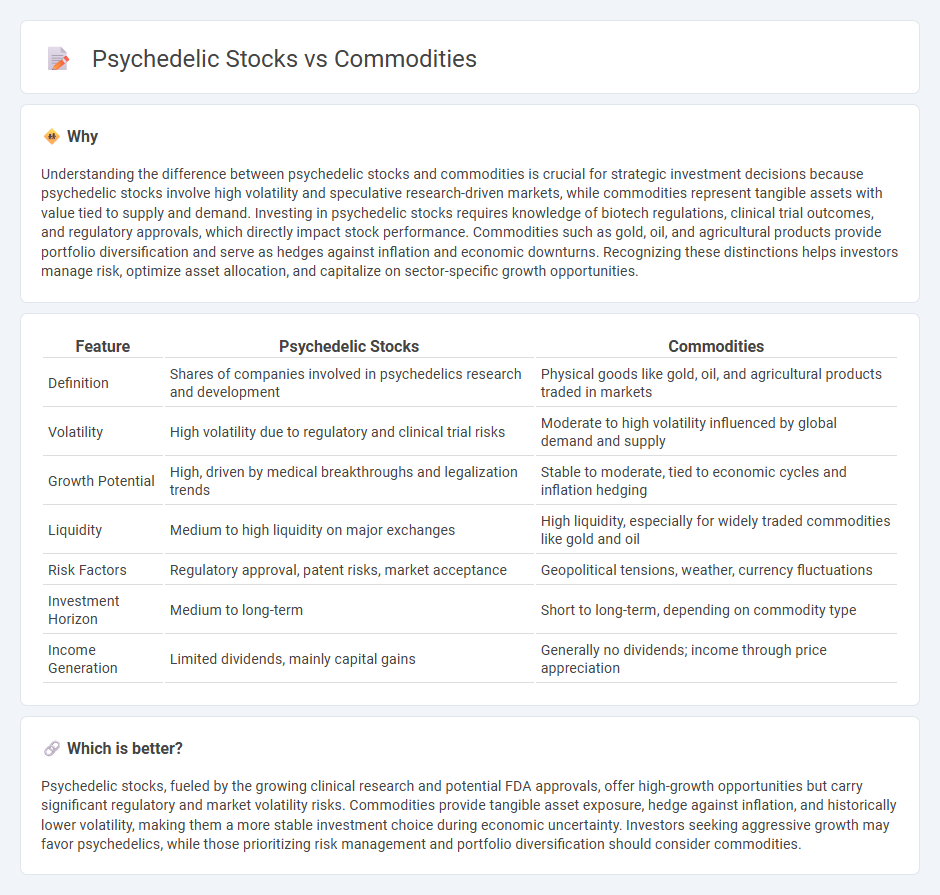

Understanding the difference between psychedelic stocks and commodities is crucial for strategic investment decisions because psychedelic stocks involve high volatility and speculative research-driven markets, while commodities represent tangible assets with value tied to supply and demand. Investing in psychedelic stocks requires knowledge of biotech regulations, clinical trial outcomes, and regulatory approvals, which directly impact stock performance. Commodities such as gold, oil, and agricultural products provide portfolio diversification and serve as hedges against inflation and economic downturns. Recognizing these distinctions helps investors manage risk, optimize asset allocation, and capitalize on sector-specific growth opportunities.

Comparison Table

| Feature | Psychedelic Stocks | Commodities |

|---|---|---|

| Definition | Shares of companies involved in psychedelics research and development | Physical goods like gold, oil, and agricultural products traded in markets |

| Volatility | High volatility due to regulatory and clinical trial risks | Moderate to high volatility influenced by global demand and supply |

| Growth Potential | High, driven by medical breakthroughs and legalization trends | Stable to moderate, tied to economic cycles and inflation hedging |

| Liquidity | Medium to high liquidity on major exchanges | High liquidity, especially for widely traded commodities like gold and oil |

| Risk Factors | Regulatory approval, patent risks, market acceptance | Geopolitical tensions, weather, currency fluctuations |

| Investment Horizon | Medium to long-term | Short to long-term, depending on commodity type |

| Income Generation | Limited dividends, mainly capital gains | Generally no dividends; income through price appreciation |

Which is better?

Psychedelic stocks, fueled by the growing clinical research and potential FDA approvals, offer high-growth opportunities but carry significant regulatory and market volatility risks. Commodities provide tangible asset exposure, hedge against inflation, and historically lower volatility, making them a more stable investment choice during economic uncertainty. Investors seeking aggressive growth may favor psychedelics, while those prioritizing risk management and portfolio diversification should consider commodities.

Connection

Psychedelic stocks and commodities are connected through the emerging market dynamics where raw materials like psilocybin mushrooms and specialized cultivation components influence the valuation of companies involved in psychedelic drug development. The supply chain for psychedelic compounds relies heavily on agricultural commodities, linking commodity price fluctuations to the profitability of psychedelic stocks. Investors track these relationships to capitalize on trends driven by regulatory changes and increased demand for mental health treatments using psychedelics.

Key Terms

Volatility

Commodity stocks exhibit high volatility driven by fluctuating global supply and demand, geopolitical tensions, and changes in currency rates. Psychedelic stocks show volatility mainly due to regulatory uncertainties, evolving clinical trial outcomes, and shifting investor sentiment in the emerging therapeutic market. Explore deeper insights into the comparative volatility trends and investment strategies in these sectors.

Regulation

Commodities markets often face established regulatory frameworks that ensure transparency and stability, while psychedelic stocks operate under emerging and evolving regulations due to the novel nature of psychedelic therapies. Regulatory agencies like the FDA and DEA play critical roles in approving and monitoring psychedelic substances, creating significant legal and market uncertainties compared to traditional commodity trading. Explore the latest regulatory developments to understand the distinct challenges and opportunities in commodities versus psychedelic stocks.

Diversification

Diversification between commodities and psychedelic stocks enhances portfolio resilience by balancing traditional asset stability with high-growth potential in emerging markets. Commodities like gold and oil provide hedge against inflation and market volatility, while psychedelic stocks offer exposure to the rapidly expanding mental health treatment sector driven by innovative biotech research. Explore more strategies to effectively balance these asset classes for optimized investment outcomes.

Source and External Links

Understanding Commodities - PIMCO - Commodities are raw materials including agricultural products, energy, and metals, traded via standardized futures contracts on global exchanges and considered a distinct asset class largely independent of stocks and bonds.

Commodities Versus Differentiated Products | Ag Decision Maker - Commodities are fungible, identical products such as corn or oil, with prices set by the market as producers are price takers, unlike differentiated products which vary by producer.

Futures and Commodities | FINRA.org - Investors gain commodity exposure through direct purchase, futures contracts, or exchange-traded products, with futures typically used by commercial enterprises to manage price risk and investors to speculate on price changes.

dowidth.com

dowidth.com