Music royalties offer investors a unique income stream by earning continuous revenue from licensed song usage, while mutual funds provide diversified portfolio growth through pooled investments in stocks and bonds. Music royalties tend to deliver passive income linked to the popularity and licensing of the music, contrasting with mutual funds' returns shaped by market fluctuations and fund management strategies. Explore the distinct benefits and risks of music royalties versus mutual funds to optimize your investment portfolio.

Why it is important

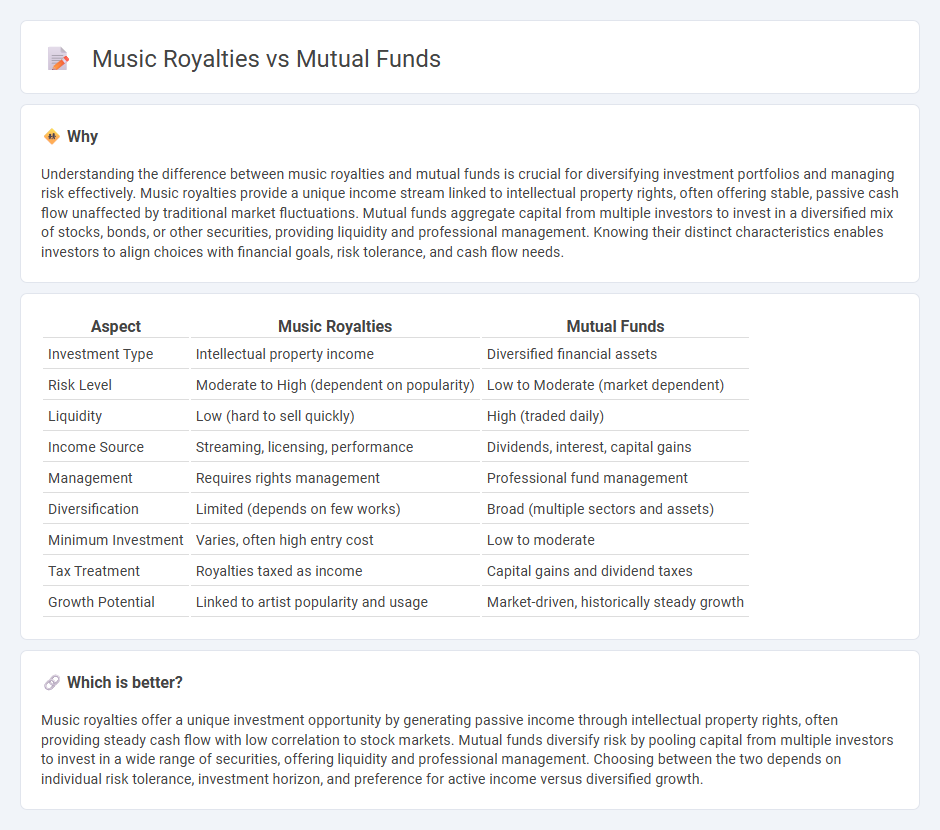

Understanding the difference between music royalties and mutual funds is crucial for diversifying investment portfolios and managing risk effectively. Music royalties provide a unique income stream linked to intellectual property rights, often offering stable, passive cash flow unaffected by traditional market fluctuations. Mutual funds aggregate capital from multiple investors to invest in a diversified mix of stocks, bonds, or other securities, providing liquidity and professional management. Knowing their distinct characteristics enables investors to align choices with financial goals, risk tolerance, and cash flow needs.

Comparison Table

| Aspect | Music Royalties | Mutual Funds |

|---|---|---|

| Investment Type | Intellectual property income | Diversified financial assets |

| Risk Level | Moderate to High (dependent on popularity) | Low to Moderate (market dependent) |

| Liquidity | Low (hard to sell quickly) | High (traded daily) |

| Income Source | Streaming, licensing, performance | Dividends, interest, capital gains |

| Management | Requires rights management | Professional fund management |

| Diversification | Limited (depends on few works) | Broad (multiple sectors and assets) |

| Minimum Investment | Varies, often high entry cost | Low to moderate |

| Tax Treatment | Royalties taxed as income | Capital gains and dividend taxes |

| Growth Potential | Linked to artist popularity and usage | Market-driven, historically steady growth |

Which is better?

Music royalties offer a unique investment opportunity by generating passive income through intellectual property rights, often providing steady cash flow with low correlation to stock markets. Mutual funds diversify risk by pooling capital from multiple investors to invest in a wide range of securities, offering liquidity and professional management. Choosing between the two depends on individual risk tolerance, investment horizon, and preference for active income versus diversified growth.

Connection

Music royalties generate steady income streams from intellectual property rights, making them attractive alternative investments within diversified portfolios. Mutual funds increasingly include music royalty trusts or stocks in their asset mix to enhance yield stability and hedge against market volatility. This connection leverages the consistent cash flow of royalties alongside traditional equity and fixed-income assets, optimizing risk-adjusted returns for investors.

Key Terms

Diversification

Mutual funds offer extensive diversification by pooling investments across various asset classes and sectors, reducing risk through broad market exposure. Music royalties provide diversification through the acquisition of rights from multiple artists and genres, generating income streams independent of traditional financial markets. Explore the advantages of each investment for a well-rounded portfolio strategy.

Royalty Streams

Royalty Streams offers a unique investment opportunity by providing direct access to music royalties, allowing investors to generate passive income from popular songs and artist catalogs. Unlike mutual funds, which pool capital across various sectors and securities, Royalty Streams focuses on acquiring and managing music rights to ensure consistent royalty payments. Discover how Royalty Streams can diversify your portfolio with asset-backed music royalties and explore their potential returns.

Net Asset Value (NAV)

Net Asset Value (NAV) in mutual funds represents the per-share value of the fund's assets minus liabilities, calculated daily to reflect market fluctuations and investor activity. Music royalties, though less commonly associated with NAV, can be valued similarly by assessing the present value of future royalty income streams, providing investors an estimate of the asset's worth. Explore further to understand how NAV impacts investment decisions across these asset classes.

Source and External Links

Mutual Funds - A mutual fund is an SEC-registered investment company pooling money from many investors to invest in stocks, bonds, and other securities, offering professional management, diversification, liquidity, and a low minimum investment.

Mutual fund - Wikipedia - Mutual funds pool money from investors to buy securities and are classified by investment type; they provide diversification, professional management, liquidity, and have various fee structures.

Understanding mutual funds - Mutual funds let investors pool money to buy diversified stocks, bonds, and other assets managed by professionals, providing low costs, diversification, convenience, and exposure to multiple investment strategies.

dowidth.com

dowidth.com