Whiskey barrel investment offers a unique alternative asset class with potential for appreciation driven by aging and rarity, contrasting with real estate investment's tangible assets that generate income through rental yields and capital growth. While whiskey barrels provide diversification and lower entry barriers, real estate typically requires higher capital and offers more stability and liquidity. Explore deeper insights to understand which investment aligns best with your financial goals.

Why it is important

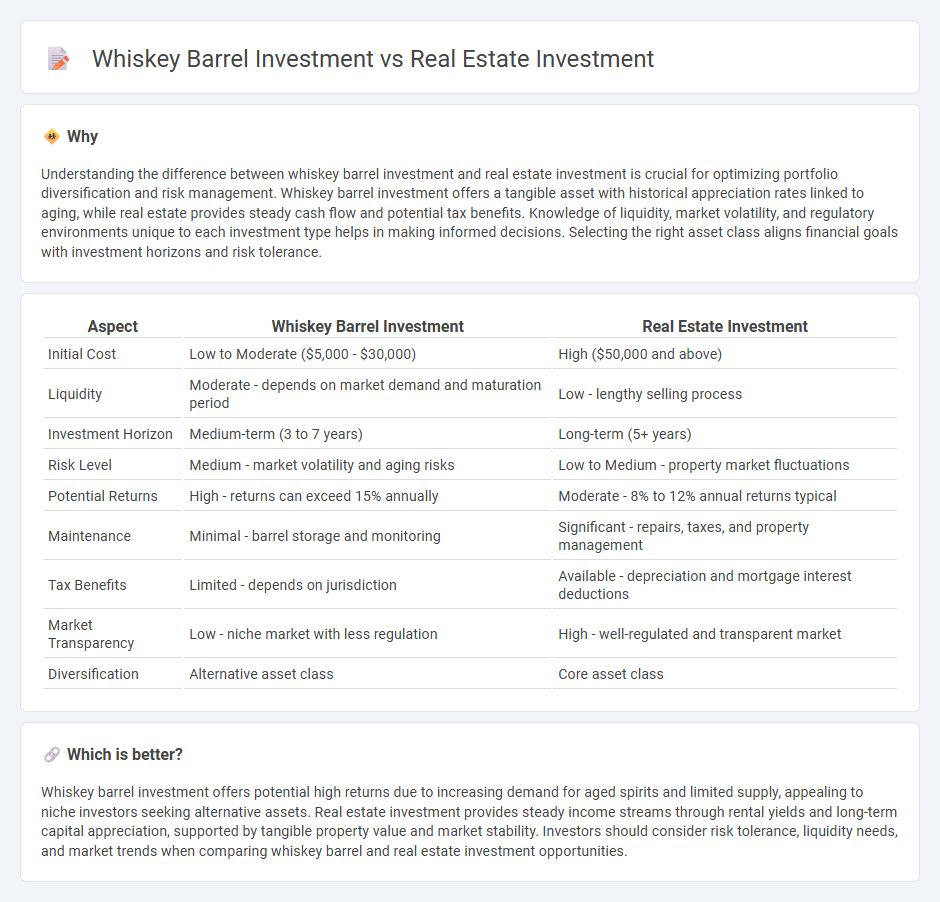

Understanding the difference between whiskey barrel investment and real estate investment is crucial for optimizing portfolio diversification and risk management. Whiskey barrel investment offers a tangible asset with historical appreciation rates linked to aging, while real estate provides steady cash flow and potential tax benefits. Knowledge of liquidity, market volatility, and regulatory environments unique to each investment type helps in making informed decisions. Selecting the right asset class aligns financial goals with investment horizons and risk tolerance.

Comparison Table

| Aspect | Whiskey Barrel Investment | Real Estate Investment |

|---|---|---|

| Initial Cost | Low to Moderate ($5,000 - $30,000) | High ($50,000 and above) |

| Liquidity | Moderate - depends on market demand and maturation period | Low - lengthy selling process |

| Investment Horizon | Medium-term (3 to 7 years) | Long-term (5+ years) |

| Risk Level | Medium - market volatility and aging risks | Low to Medium - property market fluctuations |

| Potential Returns | High - returns can exceed 15% annually | Moderate - 8% to 12% annual returns typical |

| Maintenance | Minimal - barrel storage and monitoring | Significant - repairs, taxes, and property management |

| Tax Benefits | Limited - depends on jurisdiction | Available - depreciation and mortgage interest deductions |

| Market Transparency | Low - niche market with less regulation | High - well-regulated and transparent market |

| Diversification | Alternative asset class | Core asset class |

Which is better?

Whiskey barrel investment offers potential high returns due to increasing demand for aged spirits and limited supply, appealing to niche investors seeking alternative assets. Real estate investment provides steady income streams through rental yields and long-term capital appreciation, supported by tangible property value and market stability. Investors should consider risk tolerance, liquidity needs, and market trends when comparing whiskey barrel and real estate investment opportunities.

Connection

Whiskey barrel investment and real estate investment both capitalize on tangible asset appreciation, providing investors with alternative portfolios beyond traditional stocks. Whiskey barrels appreciate as the spirit matures, similar to how real estate values increase through market demand and property improvements. Both investments offer potential passive income, with whiskey barrels sold after extensive aging and real estate generating rental income or capital gains upon sale.

Key Terms

**Real Estate Investment:**

Real estate investment offers tangible asset growth through property appreciation, rental income, and tax advantages, making it a reliable choice for long-term wealth building. Properties located in high-demand urban areas often yield significant returns, supported by market trends and demographic shifts. Discover detailed strategies and data-driven insights on maximizing your real estate portfolio performance.

Property Valuation

Property valuation in real estate investment relies on factors such as location, market trends, comparable sales, and income potential, providing a tangible asset with measurable appreciation. Whiskey barrel investment valuation depends on the age, brand reputation, production quality, and rarity, with value often increasing as the whiskey matures. Explore detailed comparisons to understand which asset aligns best with your investment goals.

Rental Yield

Real estate investment typically offers consistent rental yields averaging 4-8% annually, driven by property location, demand, and management efficiency. Whiskey barrel investment yields are less predictable, influenced by aging duration, market demand, and whiskey brand, often providing niche market returns. Discover detailed comparisons and strategies to optimize your rental yield in both investment types.

Source and External Links

Fidelity: How to Invest in Real Estate - Offers perspectives on various methods for investing in real estate, including becoming a homeowner and investing in REITs.

Investor.gov: Real Estate Investment Trusts (REITs) - Explains how REITs allow individuals to invest in income-producing real estate without directly owning properties.

Arrived - Provides a platform for easy real estate investment by buying shares in rental properties starting from $100.

dowidth.com

dowidth.com