Investment communities foster collaboration among individual investors focusing on diverse asset classes, offering real-time insights and peer support to enhance decision-making. Real Estate Investment Trusts (REITs) provide direct exposure to property markets with the benefits of liquidity and professional management, appealing to investors seeking steady income streams and portfolio diversification. Explore the advantages and dynamics of both investment communities and REITs to optimize your investment strategy.

Why it is important

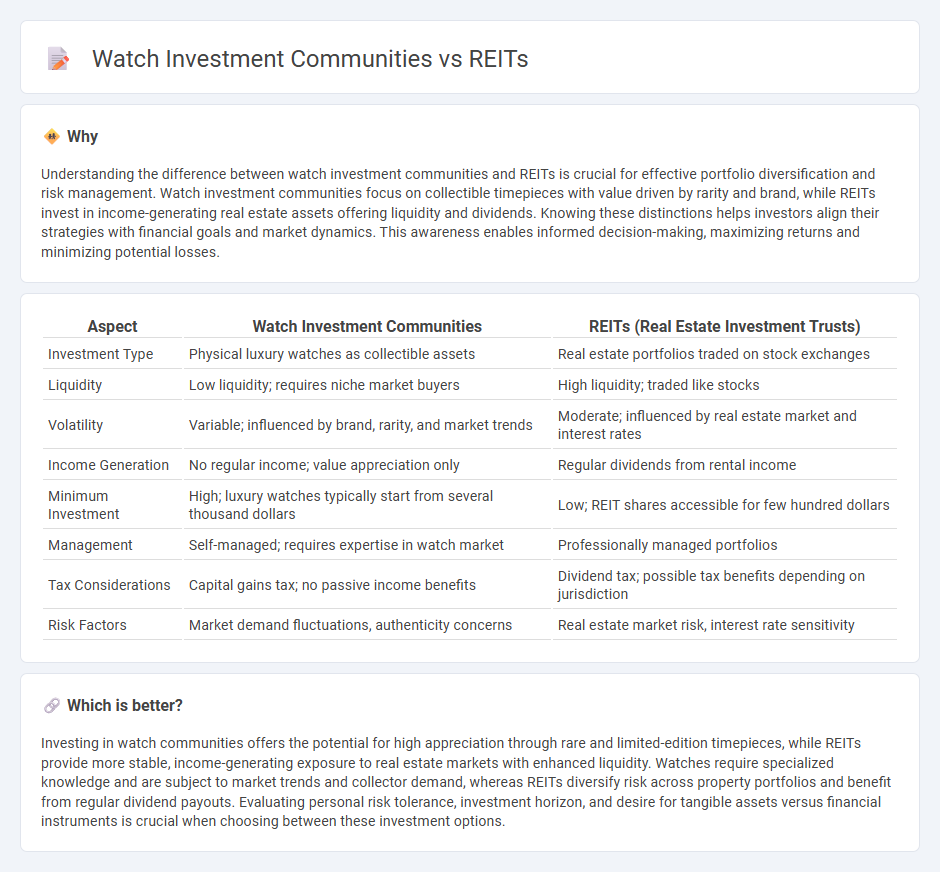

Understanding the difference between watch investment communities and REITs is crucial for effective portfolio diversification and risk management. Watch investment communities focus on collectible timepieces with value driven by rarity and brand, while REITs invest in income-generating real estate assets offering liquidity and dividends. Knowing these distinctions helps investors align their strategies with financial goals and market dynamics. This awareness enables informed decision-making, maximizing returns and minimizing potential losses.

Comparison Table

| Aspect | Watch Investment Communities | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Investment Type | Physical luxury watches as collectible assets | Real estate portfolios traded on stock exchanges |

| Liquidity | Low liquidity; requires niche market buyers | High liquidity; traded like stocks |

| Volatility | Variable; influenced by brand, rarity, and market trends | Moderate; influenced by real estate market and interest rates |

| Income Generation | No regular income; value appreciation only | Regular dividends from rental income |

| Minimum Investment | High; luxury watches typically start from several thousand dollars | Low; REIT shares accessible for few hundred dollars |

| Management | Self-managed; requires expertise in watch market | Professionally managed portfolios |

| Tax Considerations | Capital gains tax; no passive income benefits | Dividend tax; possible tax benefits depending on jurisdiction |

| Risk Factors | Market demand fluctuations, authenticity concerns | Real estate market risk, interest rate sensitivity |

Which is better?

Investing in watch communities offers the potential for high appreciation through rare and limited-edition timepieces, while REITs provide more stable, income-generating exposure to real estate markets with enhanced liquidity. Watches require specialized knowledge and are subject to market trends and collector demand, whereas REITs diversify risk across property portfolios and benefit from regular dividend payouts. Evaluating personal risk tolerance, investment horizon, and desire for tangible assets versus financial instruments is crucial when choosing between these investment options.

Connection

Investment communities often analyze Real Estate Investment Trusts (REITs) to diversify portfolios with property-based assets that provide steady income and capital appreciation. REITs attract members of these communities by offering liquidity and access to commercial real estate without direct ownership, enhancing risk management strategies. Monitoring trends and performance in REIT markets allows investors to make informed decisions aligned with broader economic indicators and sector-specific opportunities.

Key Terms

Liquidity

REITs (Real Estate Investment Trusts) offer high liquidity through public markets, allowing investors to buy and sell shares quickly compared to direct real estate investments. Investment communities, including peer-to-peer platforms, may have limited liquidity due to longer holding periods and less market transparency. Explore the benefits of liquidity differences in REITs versus watch investment communities to optimize your portfolio strategy.

Asset Diversification

REITs provide investors access to diversified portfolios of income-generating real estate assets, reducing risk through exposure to commercial, residential, and industrial properties. Investment communities, however, often offer diversification across a broader range of asset classes including equities, bonds, and alternative investments. Explore further to understand which approach best suits your asset diversification goals.

Return Profiles

REITs offer steady dividend income with relatively low volatility, making them attractive for income-focused investors seeking consistent cash flow and capital appreciation. Watch investment communities often emphasize high-growth opportunities with potential for significant returns but carry increased risk and market sensitivity. Explore these return profiles in-depth to determine the best fit for your investment strategy and risk tolerance.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and operates income-producing real estate across various property types and is categorized mainly into equity REITs and mortgage REITs, providing a tax-advantaged way for investors to gain exposure to real estate.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate, offering investors steady income streams, diversification, and potential for capital appreciation, and are often publicly traded.

Real Estate Investment Trusts (REITs) - Charles Schwab - REITs allow investors to participate in real estate markets through shares that typically generate high dividends due to their tax structure requiring most income to be paid out to shareholders.

dowidth.com

dowidth.com