Vintage sneaker portfolios offer high liquidity and rapid market growth driven by fashion trends and limited releases, attracting younger investors with shorter investment horizons. Classic car funds provide long-term value appreciation through rarity, historical significance, and meticulous restoration, appealing to collectors seeking tangible assets with cultural heritage. Explore the unique benefits and risks of these alternative investment avenues to diversify your portfolio effectively.

Why it is important

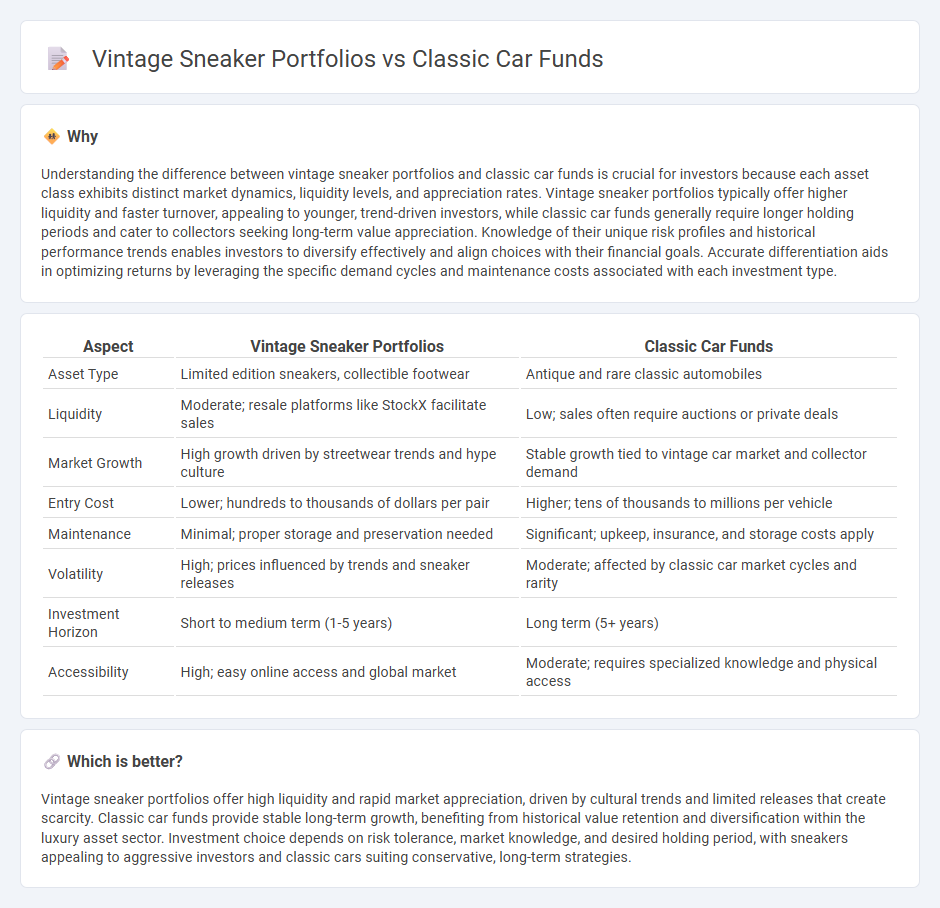

Understanding the difference between vintage sneaker portfolios and classic car funds is crucial for investors because each asset class exhibits distinct market dynamics, liquidity levels, and appreciation rates. Vintage sneaker portfolios typically offer higher liquidity and faster turnover, appealing to younger, trend-driven investors, while classic car funds generally require longer holding periods and cater to collectors seeking long-term value appreciation. Knowledge of their unique risk profiles and historical performance trends enables investors to diversify effectively and align choices with their financial goals. Accurate differentiation aids in optimizing returns by leveraging the specific demand cycles and maintenance costs associated with each investment type.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | Classic Car Funds |

|---|---|---|

| Asset Type | Limited edition sneakers, collectible footwear | Antique and rare classic automobiles |

| Liquidity | Moderate; resale platforms like StockX facilitate sales | Low; sales often require auctions or private deals |

| Market Growth | High growth driven by streetwear trends and hype culture | Stable growth tied to vintage car market and collector demand |

| Entry Cost | Lower; hundreds to thousands of dollars per pair | Higher; tens of thousands to millions per vehicle |

| Maintenance | Minimal; proper storage and preservation needed | Significant; upkeep, insurance, and storage costs apply |

| Volatility | High; prices influenced by trends and sneaker releases | Moderate; affected by classic car market cycles and rarity |

| Investment Horizon | Short to medium term (1-5 years) | Long term (5+ years) |

| Accessibility | High; easy online access and global market | Moderate; requires specialized knowledge and physical access |

Which is better?

Vintage sneaker portfolios offer high liquidity and rapid market appreciation, driven by cultural trends and limited releases that create scarcity. Classic car funds provide stable long-term growth, benefiting from historical value retention and diversification within the luxury asset sector. Investment choice depends on risk tolerance, market knowledge, and desired holding period, with sneakers appealing to aggressive investors and classic cars suiting conservative, long-term strategies.

Connection

Vintage sneaker portfolios and classic car funds both capitalize on the growing demand for rare, tangible assets that appreciate over time due to their cultural significance and limited supply. Investors in these alternative asset classes benefit from market trends driven by nostalgia, exclusivity, and the scarcity of high-quality items, which contribute to long-term value growth. The intersection of these markets highlights a broader shift towards diversified investment strategies focusing on collectibles with strong community-driven valuation dynamics.

Key Terms

Asset Valuation

Classic car funds capitalize on tangible asset appreciation driven by rarity, historical significance, and market demand, often supported by expert appraisals and auction results to determine precise valuation. Vintage sneaker portfolios rely on limited editions, cultural trends, and brand collaborations, with resale platforms and authentication playing critical roles in pricing accuracy. Explore detailed insights on asset valuation methodologies in alternative investments for a comprehensive understanding.

Liquidity

Classic car funds often exhibit lower liquidity due to the niche market and high transaction costs, making quick asset liquidation challenging. Vintage sneaker portfolios typically offer higher liquidity, fueled by a more active secondary market and digital platforms that facilitate faster sales. Explore detailed comparisons to understand liquidity dynamics in alternative investment vehicles.

Provenance

Classic car funds offer tangible assets with verifiable Provenance through detailed ownership history and maintenance records, enhancing investment credibility and value retention. Vintage sneaker portfolios leverage Provenance via auction certificates and wear history, solidifying authenticity and driving premium market prices. Explore how Provenance influences asset performance and investor confidence in both markets.

Source and External Links

Classic Car Investment Funds: Do These Portfolios Pay Off? - Classic car investment funds are private equity or hedge funds that acquire fleets of classic cars expected to appreciate over time, offering fractional investment with fees commonly structured as 2% management and 20% profit-sharing, focusing on "blue chip" cars with long histories of price appreciation.

Classic Car Fund - FalconCo - FalconCo's Classic Car Fund offers fractional ownership in vintage automobiles, diversifying portfolios with professionally managed, historically appreciating assets that provide liquidity and an enjoyable experience of classic car ownership without full financial burden.

Classic Car Investing - Alts.co - The Classic Car Fund was a hedge fund targeting 8-12% returns but collapsed in 2021 amid investigations, while other funds like Hetica Klassic Fund offer closed-end funds with annual targets of 9-12%, though typically only available to accredited investors.

dowidth.com

dowidth.com