Wine futures offer investors early access to select vintages, providing potential gains through cultivated appreciation and market scarcity. Private equity investments involve direct stakes in private companies, aiming for significant returns via operational improvements and strategic growth. Explore the nuances of wine futures versus private equity to discover which aligns with your investment goals.

Why it is important

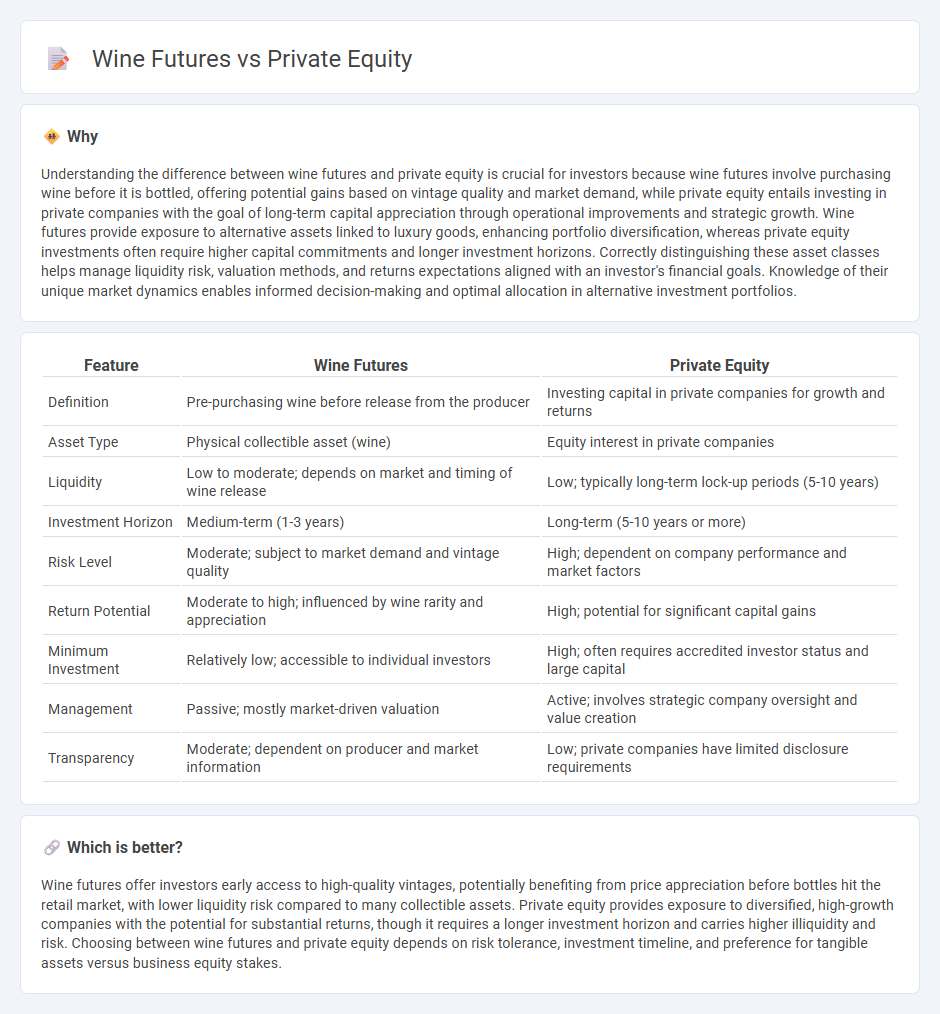

Understanding the difference between wine futures and private equity is crucial for investors because wine futures involve purchasing wine before it is bottled, offering potential gains based on vintage quality and market demand, while private equity entails investing in private companies with the goal of long-term capital appreciation through operational improvements and strategic growth. Wine futures provide exposure to alternative assets linked to luxury goods, enhancing portfolio diversification, whereas private equity investments often require higher capital commitments and longer investment horizons. Correctly distinguishing these asset classes helps manage liquidity risk, valuation methods, and returns expectations aligned with an investor's financial goals. Knowledge of their unique market dynamics enables informed decision-making and optimal allocation in alternative investment portfolios.

Comparison Table

| Feature | Wine Futures | Private Equity |

|---|---|---|

| Definition | Pre-purchasing wine before release from the producer | Investing capital in private companies for growth and returns |

| Asset Type | Physical collectible asset (wine) | Equity interest in private companies |

| Liquidity | Low to moderate; depends on market and timing of wine release | Low; typically long-term lock-up periods (5-10 years) |

| Investment Horizon | Medium-term (1-3 years) | Long-term (5-10 years or more) |

| Risk Level | Moderate; subject to market demand and vintage quality | High; dependent on company performance and market factors |

| Return Potential | Moderate to high; influenced by wine rarity and appreciation | High; potential for significant capital gains |

| Minimum Investment | Relatively low; accessible to individual investors | High; often requires accredited investor status and large capital |

| Management | Passive; mostly market-driven valuation | Active; involves strategic company oversight and value creation |

| Transparency | Moderate; dependent on producer and market information | Low; private companies have limited disclosure requirements |

Which is better?

Wine futures offer investors early access to high-quality vintages, potentially benefiting from price appreciation before bottles hit the retail market, with lower liquidity risk compared to many collectible assets. Private equity provides exposure to diversified, high-growth companies with the potential for substantial returns, though it requires a longer investment horizon and carries higher illiquidity and risk. Choosing between wine futures and private equity depends on risk tolerance, investment timeline, and preference for tangible assets versus business equity stakes.

Connection

Wine futures and private equity share investment principles through acquiring stakes in non-traditional assets with potential high returns and illiquidity. Both require specialized market knowledge, long-term commitment, and risk tolerance as investors commit capital upfront to assets appreciating over time. Diversification benefits arise as private equity funds may include wine futures to hedge against market volatility and enhance portfolio performance.

Key Terms

Liquidity

Private equity investments typically exhibit low liquidity due to long lock-up periods and limited secondary markets, often requiring years before exit opportunities arise. Wine futures offer comparatively higher liquidity with seasonal trading windows and emerging platforms facilitating easier resale before physical delivery. Explore detailed insights on liquidity dynamics between private equity and wine futures to optimize your investment strategy.

Risk profile

Private equity investments typically exhibit higher risk due to illiquidity, long holding periods, and market fluctuations, while wine futures risk revolves around market volatility, storage conditions, and authenticity challenges. Diversification and expert valuation can mitigate some uncertainties in both asset classes. Explore detailed risk assessments to make informed investment decisions.

Holding period

Private equity investments typically require a holding period of 5 to 10 years, emphasizing long-term value creation through active management and operational improvements. Wine futures, on the other hand, often have shorter holding periods ranging from 1 to 3 years, allowing investors to lock in prices before the wine is bottled and sold, capitalizing on potential appreciation. Explore more to understand how holding periods impact risk and returns across these asset classes.

Source and External Links

Private equity - Private equity is investment in private companies (not publicly traded) with capital raised from institutional investors, aiming to improve company performance and generate returns typically over a 4-7 year period.

What is Private Equity? - Private equity provides medium to long-term finance in exchange for equity in potentially high-growth, unlisted companies, actively working with management to drive growth and operational improvements before exiting the investment.

Private Equity: What You Need to Know - Private equity involves investing in non-public companies to enhance their value through management improvements, acquisitions, operational streamlining, and strategic repositioning, aiming for superior returns compared to public markets.

dowidth.com

dowidth.com