Esports franchises and technology startups represent two dynamic investment opportunities with distinct growth trajectories and market potentials. While esports franchises capitalize on the rapidly expanding global gaming audience and media rights revenue, technology startups often focus on innovation-driven scalability and disruption across various industries. Explore detailed insights to understand which investment aligns best with your financial goals and risk appetite.

Why it is important

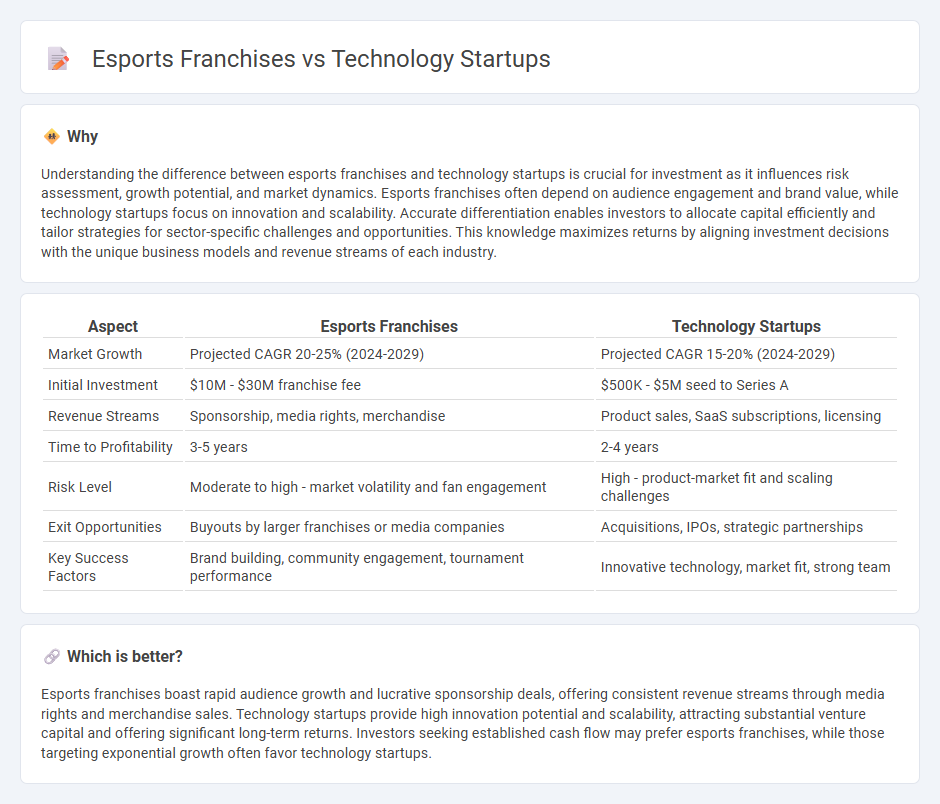

Understanding the difference between esports franchises and technology startups is crucial for investment as it influences risk assessment, growth potential, and market dynamics. Esports franchises often depend on audience engagement and brand value, while technology startups focus on innovation and scalability. Accurate differentiation enables investors to allocate capital efficiently and tailor strategies for sector-specific challenges and opportunities. This knowledge maximizes returns by aligning investment decisions with the unique business models and revenue streams of each industry.

Comparison Table

| Aspect | Esports Franchises | Technology Startups |

|---|---|---|

| Market Growth | Projected CAGR 20-25% (2024-2029) | Projected CAGR 15-20% (2024-2029) |

| Initial Investment | $10M - $30M franchise fee | $500K - $5M seed to Series A |

| Revenue Streams | Sponsorship, media rights, merchandise | Product sales, SaaS subscriptions, licensing |

| Time to Profitability | 3-5 years | 2-4 years |

| Risk Level | Moderate to high - market volatility and fan engagement | High - product-market fit and scaling challenges |

| Exit Opportunities | Buyouts by larger franchises or media companies | Acquisitions, IPOs, strategic partnerships |

| Key Success Factors | Brand building, community engagement, tournament performance | Innovative technology, market fit, strong team |

Which is better?

Esports franchises boast rapid audience growth and lucrative sponsorship deals, offering consistent revenue streams through media rights and merchandise sales. Technology startups provide high innovation potential and scalability, attracting substantial venture capital and offering significant long-term returns. Investors seeking established cash flow may prefer esports franchises, while those targeting exponential growth often favor technology startups.

Connection

Esports franchises and technology startups share a symbiotic relationship driven by innovation and digital engagement. Esports franchises leverage cutting-edge technology from startups to enhance streaming quality, analytics, and fan interaction, creating immersive experiences. Technology startups benefit from esports' rapidly growing audience and data insights, fueling product development and market expansion.

Key Terms

**Technology Startups:**

Technology startups drive innovation by developing cutting-edge software, hardware, and digital solutions that transform industries. These startups attract venture capital investment, scale rapidly through technology platforms, and create high-value intellectual property. Discover how technology startups revolutionize markets with groundbreaking advancements.

Venture Capital

Venture capital investment in technology startups often targets scalable innovations in software, AI, and fintech, with funding rounds frequently reaching hundreds of millions. Esports franchises attract venture capital through media rights, sponsorships, and expanding global audiences, with some franchises valued over $1 billion. Explore how venture capital strategies differ in fueling growth between these dynamic industries.

Equity Dilution

Technology startups often face significant equity dilution during funding rounds as they seek capital to scale operations, with founders typically giving up 20-30% equity per round. In contrast, esports franchises experience less frequent dilution, as ownership stakes are more stable with franchise fees and sponsorships providing primary revenue, preserving majority control. Explore the nuances of equity dilution in these dynamic sectors to make informed investment decisions.

Source and External Links

100 Top Startups to Watch in 2025 | Fast-Growing & VC- ... - Profiles high-growth startups across AI, ecommerce, and digital life tools, including those with innovative apps for young adults, personality-based dating, and late-night ride-sharing.

50 Fast-Growing Tech Companies & Startups (2025) - Lists emerging tech companies breaking ground in AI music creation, fintech, and digital banking, with key data on funding, growth, and user base.

Top Startups 2025 -- Sequoia, Y Combinator, A16Z, Accel - Curates a global directory of promising startups by top investors, spanning data monetization, public sector sales, medical document automation, and AI-driven security platforms.

dowidth.com

dowidth.com