Whisky cask investment offers potential high returns through the appreciation of rare and aged spirits, benefiting from increasing global demand and limited supply. Antique furniture investment provides value growth by acquiring historically significant pieces that appreciate as collectibles, influenced by craftsmanship, provenance, and market trends. Explore the unique advantages and risks of whisky cask versus antique furniture investment to determine the best fit for your portfolio.

Why it is important

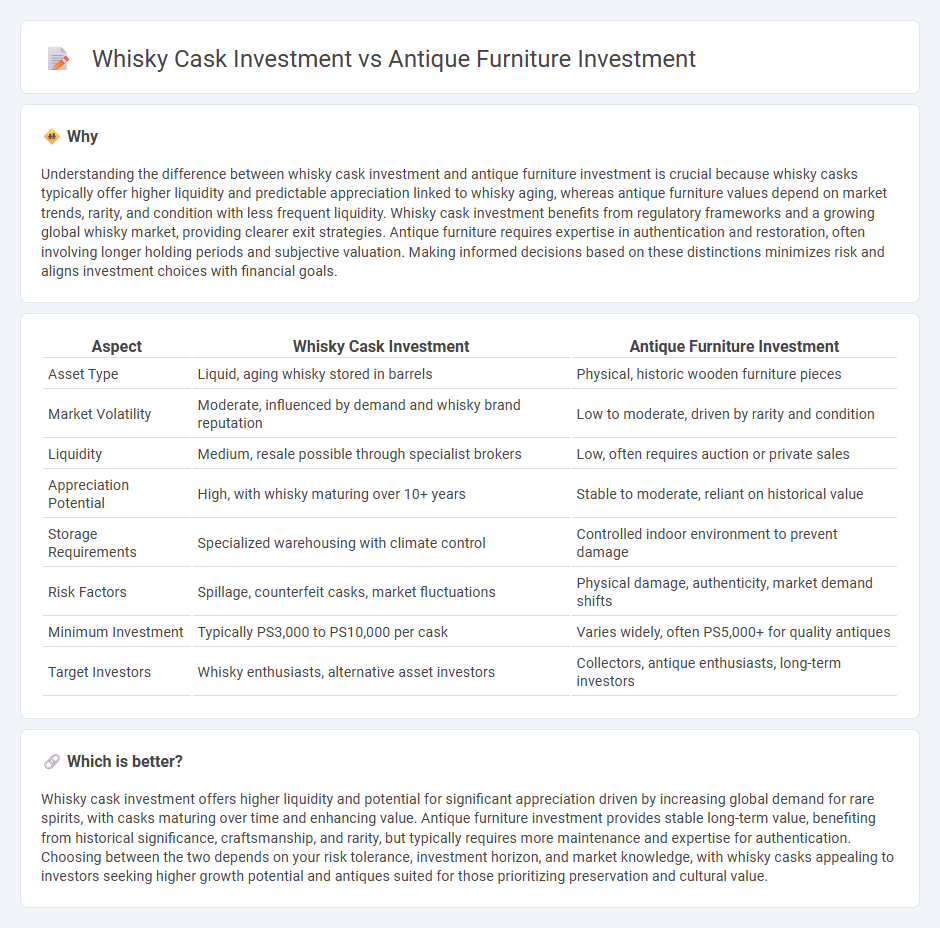

Understanding the difference between whisky cask investment and antique furniture investment is crucial because whisky casks typically offer higher liquidity and predictable appreciation linked to whisky aging, whereas antique furniture values depend on market trends, rarity, and condition with less frequent liquidity. Whisky cask investment benefits from regulatory frameworks and a growing global whisky market, providing clearer exit strategies. Antique furniture requires expertise in authentication and restoration, often involving longer holding periods and subjective valuation. Making informed decisions based on these distinctions minimizes risk and aligns investment choices with financial goals.

Comparison Table

| Aspect | Whisky Cask Investment | Antique Furniture Investment |

|---|---|---|

| Asset Type | Liquid, aging whisky stored in barrels | Physical, historic wooden furniture pieces |

| Market Volatility | Moderate, influenced by demand and whisky brand reputation | Low to moderate, driven by rarity and condition |

| Liquidity | Medium, resale possible through specialist brokers | Low, often requires auction or private sales |

| Appreciation Potential | High, with whisky maturing over 10+ years | Stable to moderate, reliant on historical value |

| Storage Requirements | Specialized warehousing with climate control | Controlled indoor environment to prevent damage |

| Risk Factors | Spillage, counterfeit casks, market fluctuations | Physical damage, authenticity, market demand shifts |

| Minimum Investment | Typically PS3,000 to PS10,000 per cask | Varies widely, often PS5,000+ for quality antiques |

| Target Investors | Whisky enthusiasts, alternative asset investors | Collectors, antique enthusiasts, long-term investors |

Which is better?

Whisky cask investment offers higher liquidity and potential for significant appreciation driven by increasing global demand for rare spirits, with casks maturing over time and enhancing value. Antique furniture investment provides stable long-term value, benefiting from historical significance, craftsmanship, and rarity, but typically requires more maintenance and expertise for authentication. Choosing between the two depends on your risk tolerance, investment horizon, and market knowledge, with whisky casks appealing to investors seeking higher growth potential and antiques suited for those prioritizing preservation and cultural value.

Connection

Whisky cask investment and antique furniture investment both offer unique opportunities for portfolio diversification by investing in tangible, appreciating assets with historical and cultural significance. These alternative investments share characteristics such as limited supply, craftsmanship value, and growing demand among collectors and enthusiasts, which can drive long-term value appreciation. Market trends indicate increasing interest in experiential and heritage assets, enhancing the appeal of whisky casks and antique furniture as hedge instruments against traditional market volatility.

Key Terms

Antique furniture investment:

Antique furniture investment offers unique value through its historical significance, craftsmanship, and potential for substantial appreciation over time, appealing to collectors and investors alike. Market demand for rare pieces from renowned periods like Georgian, Victorian, or Art Deco continues to drive prices upward, especially for well-preserved and authenticated items. Explore expert insights and market trends to maximize returns on antique furniture investments.

Provenance

Provenance plays a crucial role in both antique furniture and whisky cask investments, significantly impacting their value and authenticity. Antique furniture with well-documented history from renowned makers or previous notable ownership commands higher prices, while whisky casks aged under established distillery labels with clear origin attract premium returns. Explore further to understand how provenance influences these asset classes and guides investment decisions.

Restoration

Investing in antique furniture often demands meticulous restoration to maintain historical authenticity and enhance value, requiring skilled craftsmanship and sourcing period-appropriate materials. Whisky cask investment, while also benefiting from careful preservation, revolves around aging conditions and cask integrity to maximize flavor development and market worth. Explore further insights on how restoration impacts these distinct investment avenues.

Source and External Links

10 Types of Antiques to Consider for an Investment - SmartAsset - Antique furniture remains a popular investment choice due to its enduring appeal, historical significance, superior craftsmanship, and potential for value appreciation over time, making it both beautiful and valuable.

Why Antique Furniture is the Best Investment for Your Home - Antique furniture made from high-quality, sustainable materials often appreciates in value, adds unique character to a home, and represents a tangible piece of history that can financially benefit investors in the long term.

Investing in Antique Furniture: A Lucrative Portfolio Addition - Antique furniture's rarity, craftsmanship, durability, and lasting desirability make it a sought-after asset that can enhance an investment portfolio with potential for significant profit.

dowidth.com

dowidth.com