Wine futures offer investors the opportunity to purchase wine before it is bottled, potentially securing rare vintages at lower prices with the prospect of value appreciation over time. Peer-to-peer lending connects individual borrowers with investors willing to fund loans, providing attractive interest rates and diversified investment portfolios. Explore the benefits and risks of these unique investment options to determine which aligns best with your financial goals.

Why it is important

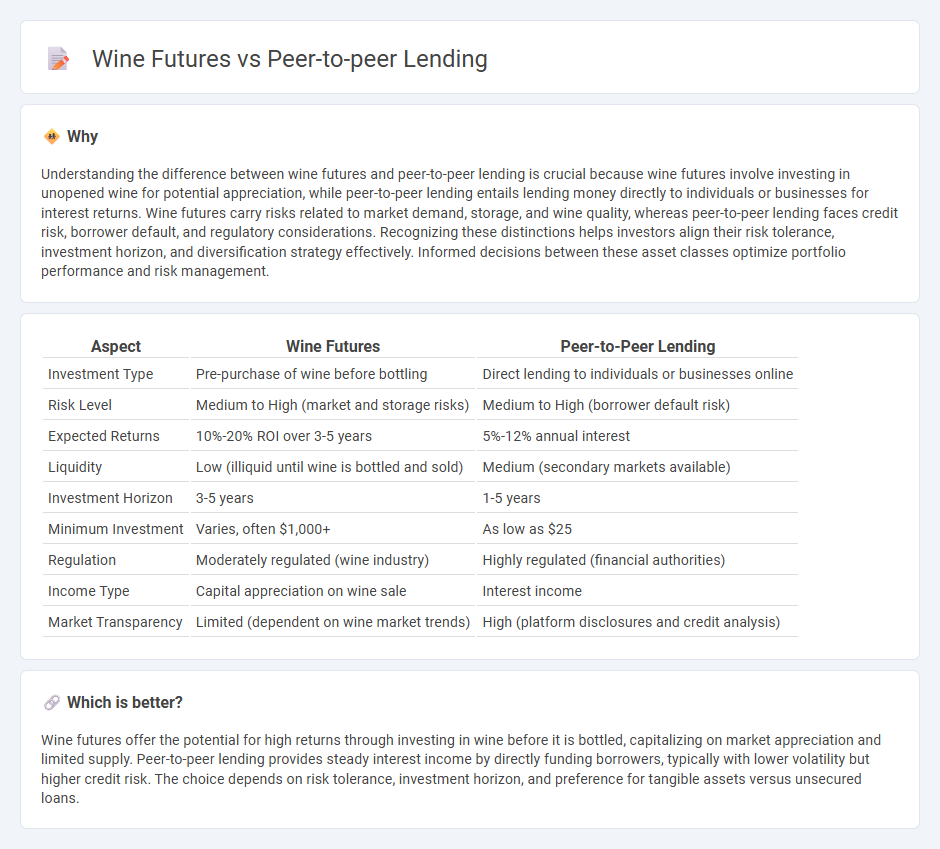

Understanding the difference between wine futures and peer-to-peer lending is crucial because wine futures involve investing in unopened wine for potential appreciation, while peer-to-peer lending entails lending money directly to individuals or businesses for interest returns. Wine futures carry risks related to market demand, storage, and wine quality, whereas peer-to-peer lending faces credit risk, borrower default, and regulatory considerations. Recognizing these distinctions helps investors align their risk tolerance, investment horizon, and diversification strategy effectively. Informed decisions between these asset classes optimize portfolio performance and risk management.

Comparison Table

| Aspect | Wine Futures | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Pre-purchase of wine before bottling | Direct lending to individuals or businesses online |

| Risk Level | Medium to High (market and storage risks) | Medium to High (borrower default risk) |

| Expected Returns | 10%-20% ROI over 3-5 years | 5%-12% annual interest |

| Liquidity | Low (illiquid until wine is bottled and sold) | Medium (secondary markets available) |

| Investment Horizon | 3-5 years | 1-5 years |

| Minimum Investment | Varies, often $1,000+ | As low as $25 |

| Regulation | Moderately regulated (wine industry) | Highly regulated (financial authorities) |

| Income Type | Capital appreciation on wine sale | Interest income |

| Market Transparency | Limited (dependent on wine market trends) | High (platform disclosures and credit analysis) |

Which is better?

Wine futures offer the potential for high returns through investing in wine before it is bottled, capitalizing on market appreciation and limited supply. Peer-to-peer lending provides steady interest income by directly funding borrowers, typically with lower volatility but higher credit risk. The choice depends on risk tolerance, investment horizon, and preference for tangible assets versus unsecured loans.

Connection

Wine futures and peer-to-peer lending intersect through their roles as alternative investment opportunities offering portfolio diversification beyond traditional stocks and bonds. Both markets use online platforms to connect investors directly with sellers or borrowers, enhancing transparency and reducing intermediary costs. These investment strategies appeal to individuals seeking unique assets with potential high returns linked to niche markets.

Key Terms

Platform Risk (Peer-to-peer lending)

Platform risk in peer-to-peer lending refers to the potential failure or fraud of the online platform facilitating loans, which can lead to loss of investor funds and disrupted loan repayments. Unlike wine futures, where risks are tied to storage and market demand, P2P lending platforms depend heavily on the stability, security, and regulatory compliance of the digital marketplace. Explore further to understand how platform risk impacts investor protections and risk management strategies in peer-to-peer lending.

Default Risk (Peer-to-peer lending)

Peer-to-peer lending exhibits a notable default risk, with rates varying from 2% to over 10% depending on borrower credit profiles and platform risk management practices. Default occurrences can result in partial or total loss of principal, emphasizing the importance of rigorous borrower assessment and diversification strategies for investors. Explore further to understand how risk mitigation techniques can optimize returns in peer-to-peer lending.

Vintage Risk (Wine futures)

Vintage risk in wine futures refers to the variability in grape quality and weather conditions during a specific harvest year, which significantly impacts the wine's eventual value and aging potential. Peer-to-peer lending risk centers on borrower creditworthiness and default probability, making it a financial credit risk rather than an agricultural or vintage-dependent uncertainty. Explore more about how vintage risk uniquely affects wine futures investments compared to the credit dynamics of peer-to-peer lending.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending allows borrowers to obtain loans directly from individual investors via online platforms, bypassing traditional banks and often offering more flexible terms and potentially lower eligibility requirements for borrowers.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending is an alternative financial service where individuals or businesses borrow and lend money through online intermediaries that match lenders with borrowers, typically without requiring a prior relationship and often involving unsecured loans not protected by government insurance.

Peer to peer lending: what you need to know - MoneyHelper - Peer-to-peer lending platforms act as marketplaces connecting lenders with borrowers, offering potentially higher interest rates than savings accounts but carrying greater risk, as lenders may lose money if borrowers default.

dowidth.com

dowidth.com