Whiskey barrel investment offers a tangible asset with the potential for appreciation as the whiskey matures over time, appealing to those interested in alternative, consumable assets. Art investment provides value through aesthetic appreciation and historical significance, often influenced by market trends and artist reputation. Discover the nuances and benefits of both to make informed investment decisions.

Why it is important

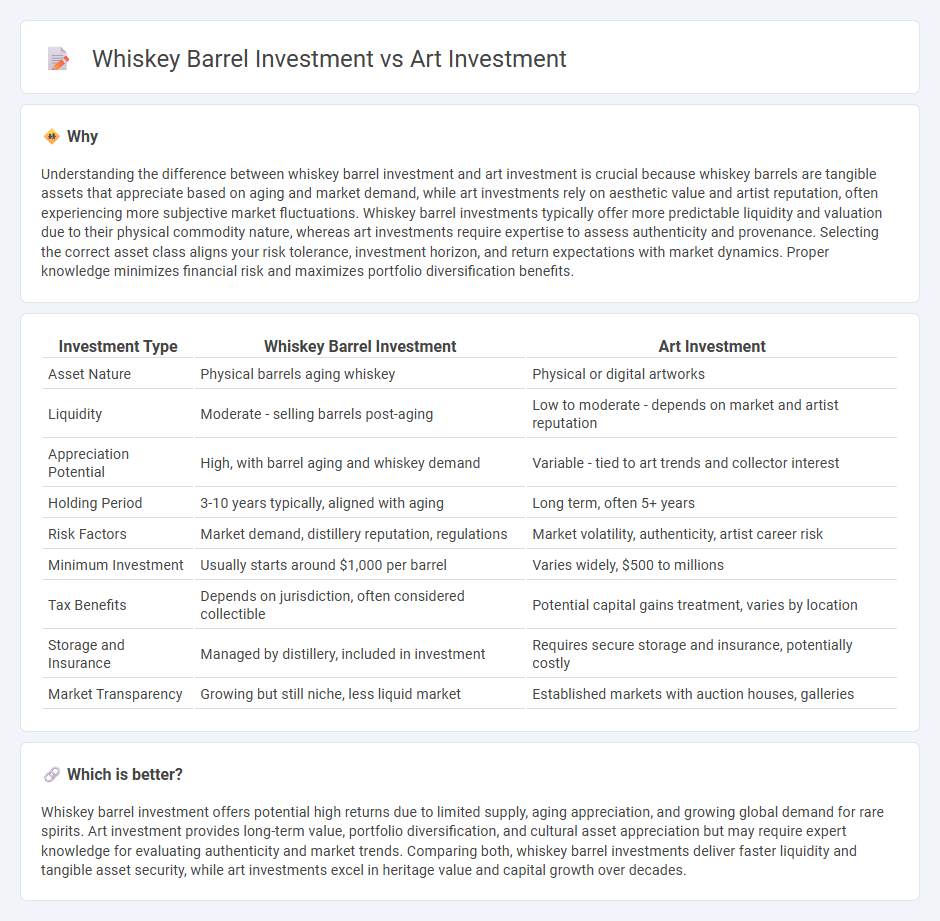

Understanding the difference between whiskey barrel investment and art investment is crucial because whiskey barrels are tangible assets that appreciate based on aging and market demand, while art investments rely on aesthetic value and artist reputation, often experiencing more subjective market fluctuations. Whiskey barrel investments typically offer more predictable liquidity and valuation due to their physical commodity nature, whereas art investments require expertise to assess authenticity and provenance. Selecting the correct asset class aligns your risk tolerance, investment horizon, and return expectations with market dynamics. Proper knowledge minimizes financial risk and maximizes portfolio diversification benefits.

Comparison Table

| Investment Type | Whiskey Barrel Investment | Art Investment |

|---|---|---|

| Asset Nature | Physical barrels aging whiskey | Physical or digital artworks |

| Liquidity | Moderate - selling barrels post-aging | Low to moderate - depends on market and artist reputation |

| Appreciation Potential | High, with barrel aging and whiskey demand | Variable - tied to art trends and collector interest |

| Holding Period | 3-10 years typically, aligned with aging | Long term, often 5+ years |

| Risk Factors | Market demand, distillery reputation, regulations | Market volatility, authenticity, artist career risk |

| Minimum Investment | Usually starts around $1,000 per barrel | Varies widely, $500 to millions |

| Tax Benefits | Depends on jurisdiction, often considered collectible | Potential capital gains treatment, varies by location |

| Storage and Insurance | Managed by distillery, included in investment | Requires secure storage and insurance, potentially costly |

| Market Transparency | Growing but still niche, less liquid market | Established markets with auction houses, galleries |

Which is better?

Whiskey barrel investment offers potential high returns due to limited supply, aging appreciation, and growing global demand for rare spirits. Art investment provides long-term value, portfolio diversification, and cultural asset appreciation but may require expert knowledge for evaluating authenticity and market trends. Comparing both, whiskey barrel investments deliver faster liquidity and tangible asset security, while art investments excel in heritage value and capital growth over decades.

Connection

Whiskey barrel investment and art investment both serve as alternative assets offering portfolio diversification and potential for high returns outside traditional financial markets. These investments rely on scarcity and cultural value, with whiskey barrels appreciating as they mature and limited-edition artworks gaining value through rarity and demand. Collectors and investors leverage market trends and provenance history to maximize capital growth in both sectors.

Key Terms

**Art Investment:**

Art investment offers tangible value through unique masterpieces and limited editions that often appreciate over time due to cultural significance and market demand. Unlike whiskey barrel investments, art provides historical and aesthetic appeal, attracting collectors and investors seeking diversification and long-term capital growth. Explore the advantages and strategies of art investment to enhance your portfolio today.

Provenance

Provenance plays a crucial role in both art investment and whiskey barrel investment, as it authenticates the origin and history of the asset, directly impacting its value and market desirability. Art provenance involves documented ownership history, artist certification, and exhibition records, while whiskey barrel provenance includes details about distillation date, aging period, and prior ownership within the beverage industry. Explore the distinctive importance of provenance in securing profitable and credible investments in art and whiskey barrels.

Authenticity

Art investment thrives on the provenance and authenticity verified through artists' signatures, certificates, and documented ownership history, making it essential for valuation and resale potential. Whiskey barrel investment requires assurance of origin, distillery reputation, and aging process authenticity to guarantee the unique flavor profile and collectible value tied to genuine heritage. Explore deeper insights on how authenticity shapes the dynamics and returns of art and whiskey barrel investments.

Source and External Links

Art Fund Association - Art funds are investment vehicles that capitalize on various strategies in the art market to generate returns, including geographic arbitrage and emerging artists' investments.

RBC Wealth Management - Investing in art can provide portfolio diversification, inflation protection, and potential high returns, but it carries risks such as liquidity issues and market trends.

YieldStreet - YieldStreet offers investors the opportunity to own shares in contemporary fine art through fractional ownership, providing access to a diversified pool of artworks.

dowidth.com

dowidth.com