Sports memorabilia trading involves buying and selling collectibles such as autographed items, rare cards, and game-worn gear, offering potential high returns driven by rarity and demand. Peer-to-peer lending connects borrowers with investors through online platforms, generating interest income with relatively predictable cash flows and risk profiles. Explore deeper insights to determine which investment aligns best with your financial goals.

Why it is important

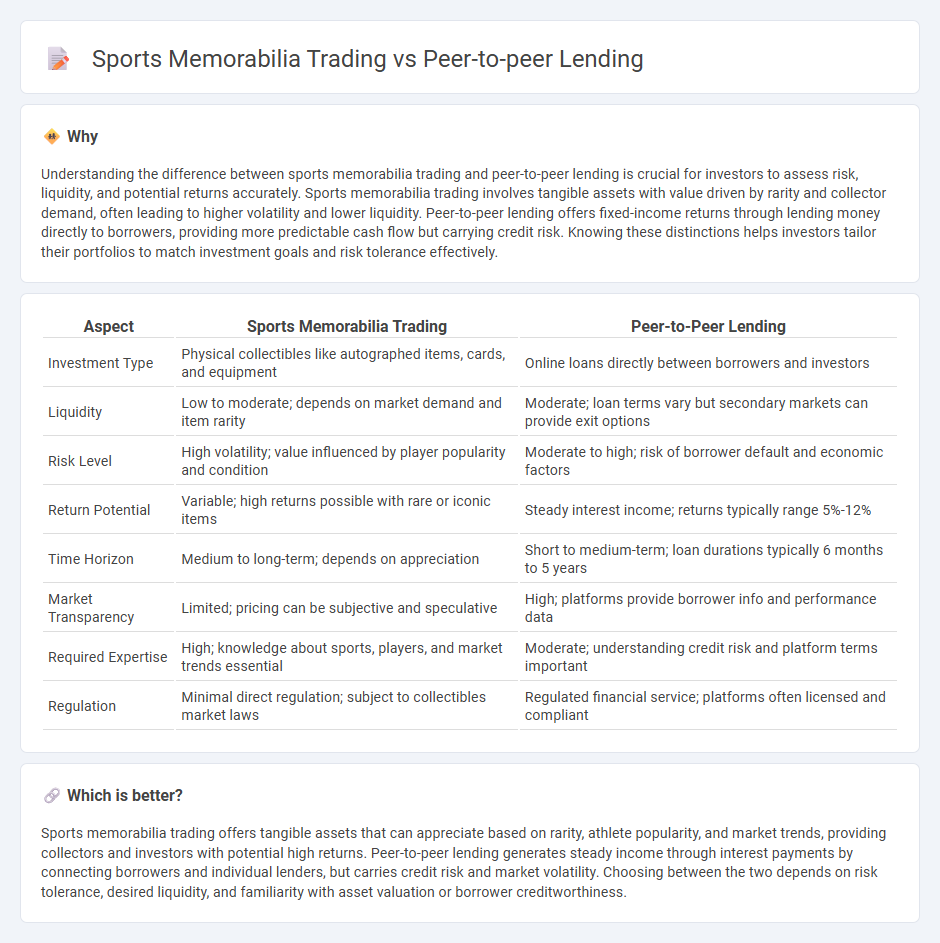

Understanding the difference between sports memorabilia trading and peer-to-peer lending is crucial for investors to assess risk, liquidity, and potential returns accurately. Sports memorabilia trading involves tangible assets with value driven by rarity and collector demand, often leading to higher volatility and lower liquidity. Peer-to-peer lending offers fixed-income returns through lending money directly to borrowers, providing more predictable cash flow but carrying credit risk. Knowing these distinctions helps investors tailor their portfolios to match investment goals and risk tolerance effectively.

Comparison Table

| Aspect | Sports Memorabilia Trading | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Physical collectibles like autographed items, cards, and equipment | Online loans directly between borrowers and investors |

| Liquidity | Low to moderate; depends on market demand and item rarity | Moderate; loan terms vary but secondary markets can provide exit options |

| Risk Level | High volatility; value influenced by player popularity and condition | Moderate to high; risk of borrower default and economic factors |

| Return Potential | Variable; high returns possible with rare or iconic items | Steady interest income; returns typically range 5%-12% |

| Time Horizon | Medium to long-term; depends on appreciation | Short to medium-term; loan durations typically 6 months to 5 years |

| Market Transparency | Limited; pricing can be subjective and speculative | High; platforms provide borrower info and performance data |

| Required Expertise | High; knowledge about sports, players, and market trends essential | Moderate; understanding credit risk and platform terms important |

| Regulation | Minimal direct regulation; subject to collectibles market laws | Regulated financial service; platforms often licensed and compliant |

Which is better?

Sports memorabilia trading offers tangible assets that can appreciate based on rarity, athlete popularity, and market trends, providing collectors and investors with potential high returns. Peer-to-peer lending generates steady income through interest payments by connecting borrowers and individual lenders, but carries credit risk and market volatility. Choosing between the two depends on risk tolerance, desired liquidity, and familiarity with asset valuation or borrower creditworthiness.

Connection

Sports memorabilia trading and peer-to-peer lending intersect through alternative investment strategies that diversify portfolios beyond traditional assets. Sports memorabilia offers tangible collectibles with potential appreciation, while peer-to-peer lending provides direct lending opportunities with fixed income returns. Both markets rely on specialized knowledge, risk assessment, and investor willingness to engage in non-traditional financial ecosystems for portfolio growth.

Key Terms

Peer-to-peer lending:

Peer-to-peer lending connects borrowers directly with individual investors, bypassing traditional financial institutions and often offering lower interest rates and faster approval processes. This alternative financing method leverages technology platforms to provide accessible credit options while enabling investors to diversify portfolios with fixed-income opportunities. Explore how peer-to-peer lending can transform your financial strategy and investment approach.

Interest Rate

Peer-to-peer lending typically offers interest rates between 5% and 12%, depending on borrower creditworthiness and platform risk. Sports memorabilia trading does not guarantee fixed returns but potential profits arise from market demand and rarity, with some items appreciating significantly over time. Explore detailed insights on interest rates and investment potential across both sectors.

Credit Risk

Peer-to-peer lending involves direct borrowing and lending between individuals, exposing lenders to credit risk associated with borrowers' potential default and financial instability. Sports memorabilia trading's credit risk centers on fraudulent transactions and counterfeit items, which can undermine trust and result in significant financial loss. Explore the nuances of credit risk management across both sectors to enhance your investment strategy.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer (P2P) lending allows borrowers to get loans from individual investors via specialized websites without involving banks, often offering lower eligibility requirements and flexible terms, while lenders earn interest on their loans but face added risk due to lack of bank protections.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending matches borrowers and lenders through online platforms that handle credit checks, payments, and servicing, operating as an alternative financial service outside traditional deposit-taking or insurance institutions, with loans that can be secured or unsecured and are not usually government insured.

Peer to peer lending: what you need to know - P2P lending is a marketplace for individuals or businesses to lend money directly to borrowers, often yielding higher interest than savings accounts but carrying greater risk, with platforms that may either pool lender money across many borrowers or let lenders choose specific loans.

dowidth.com

dowidth.com