Fractional farmland ownership allows investors to purchase a tangible share of agricultural land, offering potential steady income through crop yields and land appreciation. Crowdfunding real estate pools funds from multiple investors to finance larger property projects, providing diversified opportunities with relatively low individual investment thresholds. Explore the benefits and risks of each method to optimize your investment portfolio.

Why it is important

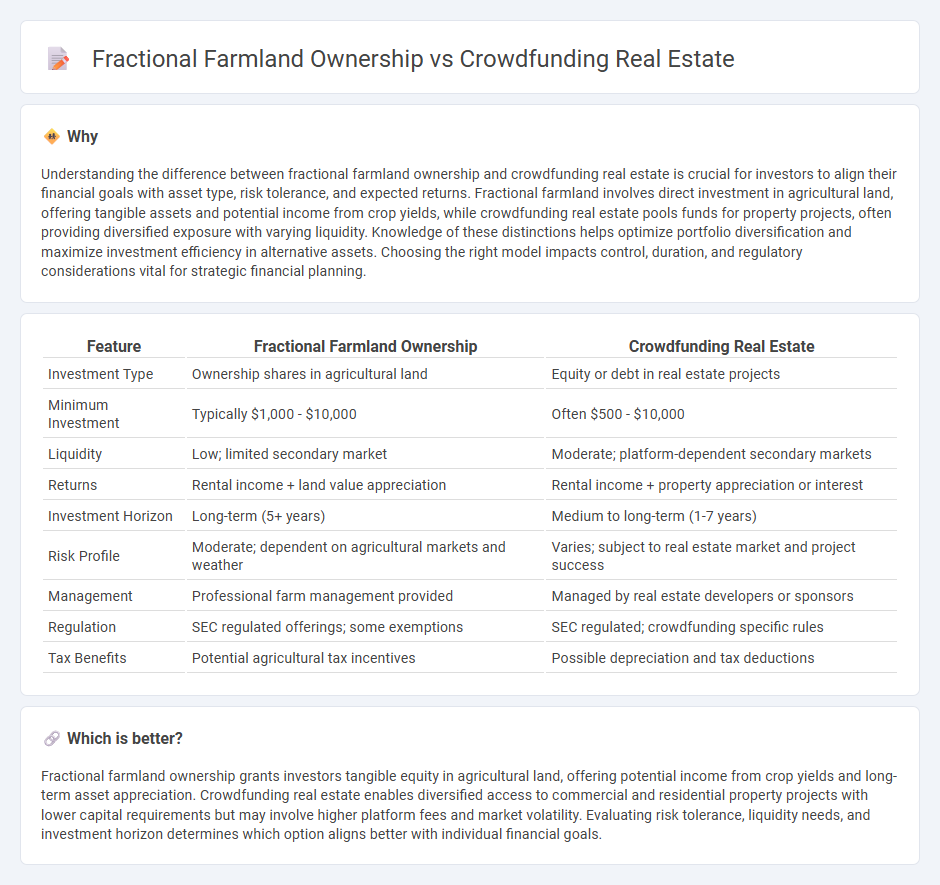

Understanding the difference between fractional farmland ownership and crowdfunding real estate is crucial for investors to align their financial goals with asset type, risk tolerance, and expected returns. Fractional farmland involves direct investment in agricultural land, offering tangible assets and potential income from crop yields, while crowdfunding real estate pools funds for property projects, often providing diversified exposure with varying liquidity. Knowledge of these distinctions helps optimize portfolio diversification and maximize investment efficiency in alternative assets. Choosing the right model impacts control, duration, and regulatory considerations vital for strategic financial planning.

Comparison Table

| Feature | Fractional Farmland Ownership | Crowdfunding Real Estate |

|---|---|---|

| Investment Type | Ownership shares in agricultural land | Equity or debt in real estate projects |

| Minimum Investment | Typically $1,000 - $10,000 | Often $500 - $10,000 |

| Liquidity | Low; limited secondary market | Moderate; platform-dependent secondary markets |

| Returns | Rental income + land value appreciation | Rental income + property appreciation or interest |

| Investment Horizon | Long-term (5+ years) | Medium to long-term (1-7 years) |

| Risk Profile | Moderate; dependent on agricultural markets and weather | Varies; subject to real estate market and project success |

| Management | Professional farm management provided | Managed by real estate developers or sponsors |

| Regulation | SEC regulated offerings; some exemptions | SEC regulated; crowdfunding specific rules |

| Tax Benefits | Potential agricultural tax incentives | Possible depreciation and tax deductions |

Which is better?

Fractional farmland ownership grants investors tangible equity in agricultural land, offering potential income from crop yields and long-term asset appreciation. Crowdfunding real estate enables diversified access to commercial and residential property projects with lower capital requirements but may involve higher platform fees and market volatility. Evaluating risk tolerance, liquidity needs, and investment horizon determines which option aligns better with individual financial goals.

Connection

Fractional farmland ownership and crowdfunding real estate both allow investors to buy smaller, more affordable shares in large-scale property assets, diversifying portfolios while reducing entry barriers. These models leverage digital platforms to pool funds from multiple investors, expanding access to traditionally high-cost markets such as agriculture and commercial real estate. By enabling partial ownership, they provide liquidity and growth potential in asset classes that were historically illiquid and capital-intensive.

Key Terms

Equity Shares

Crowdfunding real estate allows investors to purchase equity shares in commercial or residential properties, pooling funds to access larger, diversified portfolios with professional management. Fractional farmland ownership involves acquiring equity shares in agricultural land, providing returns from crop yields and land appreciation while supporting sustainable farming practices. Explore the benefits and risks of both investment types to determine which aligns with your financial goals and values.

Platform Fees

Crowdfunding real estate platforms typically charge fees ranging from 1% to 5% of the investment amount, often including annual asset management fees around 1% to 2%, whereas fractional farmland ownership platforms might have similar upfront fees but can incur additional costs related to land management and maintenance. Real estate crowdfunding fees cover property acquisition, management, and potential resale, while farmland ownership fees often reflect ongoing agricultural management and operational expenses. Explore detailed comparisons of platform fee structures to choose the best investment option for your financial goals.

Liquidity

Crowdfunding real estate offers higher liquidity as investors can often sell shares on secondary markets or receive dividends regularly, whereas fractional farmland ownership typically involves longer-term commitments with limited resale options. Real estate crowdfunding platforms frequently provide more transparent pricing and quicker access to funds compared to the illiquid nature of agricultural land investments. Explore further to understand which investment suits your liquidity needs best.

Source and External Links

What Is Real Estate Crowdfunding & How Does It Work - Real estate crowdfunding pools money from multiple investors through online platforms, enabling participation in residential or commercial projects with options for equity or debt investments, offering diversified access and potential returns with associated risks and lock-up periods.

Crowdfunding real estate: What to know - Real estate crowdfunding allows investors to collaborate via online platforms to invest in properties they couldn't afford alone, providing portfolio diversification and opportunities for both accredited and nonaccredited investors.

Best Real Estate Crowdfunding Platforms for 2025 - Top platforms like CrowdStreet, Fundrise, and RealtyMogul enable investing in real estate projects or funds with varying minimums, fees, and investment structures to suit different investor preferences.

dowidth.com

dowidth.com