Carbon credits trading enables companies to offset emissions by purchasing credits from verified environmental projects, promoting sustainability and compliance with climate regulations. Social impact bonds fund social programs through private investment, with returns tied to the achievement of specific social outcomes, enhancing community development and accountability. Explore in-depth insights on how these innovative financial tools reshape investment strategies and impact-driven finance.

Why it is important

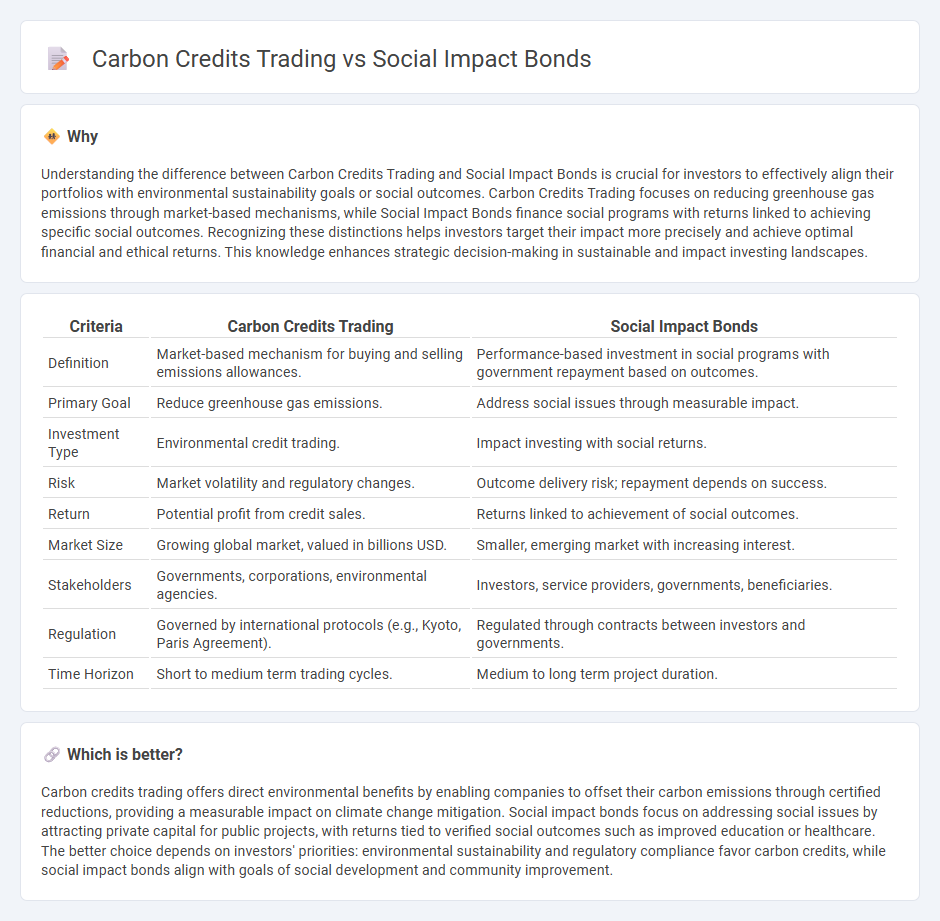

Understanding the difference between Carbon Credits Trading and Social Impact Bonds is crucial for investors to effectively align their portfolios with environmental sustainability goals or social outcomes. Carbon Credits Trading focuses on reducing greenhouse gas emissions through market-based mechanisms, while Social Impact Bonds finance social programs with returns linked to achieving specific social outcomes. Recognizing these distinctions helps investors target their impact more precisely and achieve optimal financial and ethical returns. This knowledge enhances strategic decision-making in sustainable and impact investing landscapes.

Comparison Table

| Criteria | Carbon Credits Trading | Social Impact Bonds |

|---|---|---|

| Definition | Market-based mechanism for buying and selling emissions allowances. | Performance-based investment in social programs with government repayment based on outcomes. |

| Primary Goal | Reduce greenhouse gas emissions. | Address social issues through measurable impact. |

| Investment Type | Environmental credit trading. | Impact investing with social returns. |

| Risk | Market volatility and regulatory changes. | Outcome delivery risk; repayment depends on success. |

| Return | Potential profit from credit sales. | Returns linked to achievement of social outcomes. |

| Market Size | Growing global market, valued in billions USD. | Smaller, emerging market with increasing interest. |

| Stakeholders | Governments, corporations, environmental agencies. | Investors, service providers, governments, beneficiaries. |

| Regulation | Governed by international protocols (e.g., Kyoto, Paris Agreement). | Regulated through contracts between investors and governments. |

| Time Horizon | Short to medium term trading cycles. | Medium to long term project duration. |

Which is better?

Carbon credits trading offers direct environmental benefits by enabling companies to offset their carbon emissions through certified reductions, providing a measurable impact on climate change mitigation. Social impact bonds focus on addressing social issues by attracting private capital for public projects, with returns tied to verified social outcomes such as improved education or healthcare. The better choice depends on investors' priorities: environmental sustainability and regulatory compliance favor carbon credits, while social impact bonds align with goals of social development and community improvement.

Connection

Carbon credits trading and social impact bonds intersect through their focus on sustainable investment and measurable environmental or social outcomes. Carbon credits trading incentivizes companies to reduce emissions by assigning a market value to carbon reductions, while social impact bonds finance projects delivering specific social or environmental benefits with returns linked to success metrics. Both mechanisms leverage private capital to drive positive changes, aligning financial returns with societal and ecological goals.

Key Terms

Outcomes-based financing

Social impact bonds (SIBs) and carbon credits trading are key mechanisms in outcomes-based financing, targeting social and environmental results respectively. SIBs mobilize private investment to fund social programs, with returns tied to measurable social outcomes, while carbon credits trading allows companies to offset emissions by purchasing credits that fund emission-reduction projects. Explore how these financial tools leverage performance metrics to drive impactful change and foster sustainable investments.

Emissions reduction

Social impact bonds (SIBs) channel private investment into verified emissions reduction projects, linking financial returns to measurable environmental outcomes and fostering accountability. Carbon credits trading involves buying and selling emission allowances or offsets, incentivizing companies to reduce pollution while creating a market-driven approach to meet regulatory targets. Explore how these financial mechanisms uniquely drive global emissions reduction and sustainability goals.

Verification

Social impact bonds undergo rigorous third-party verification to ensure funded social projects achieve targeted outcomes, emphasizing transparency and accountability. Carbon credits trading relies on standardized verification protocols, often certified by recognized bodies like the Verified Carbon Standard (VCS), to confirm quantifiable emission reductions. Explore the detailed mechanisms behind verification processes in social impact bonds and carbon credits trading to understand their effectiveness.

Source and External Links

Social Impact Bonds | Local Workforce System Guide - A social impact bond is a financing mechanism where private investors fund social programs upfront and are repaid by the government only if the program meets its predetermined success outcomes, thus shifting financial risk from government to private entities.

Social Impact Bond - Wikipedia - Social impact bonds, also known as pay-for-success financing, are outcomes-based contracts where payment to contractors depends on achieving specific government policy goals, and as of 2023, 23 countries have implemented 276 projects worth $745 million globally.

Overview of Social Impact Bonds: A briefing note for senior managers in local government - Social impact bonds are partnerships involving social investors who provide upfront capital and take on financial risk to fund social services that aim to improve measurable social outcomes for targeted groups.

dowidth.com

dowidth.com