Virtual land real estate offers unique investment opportunities by allowing buyers to purchase, develop, and trade digital plots within metaverse platforms, leveraging blockchain technology for secure ownership. Peer-to-peer lending connects investors directly with borrowers, typically yielding higher returns by bypassing traditional financial institutions and reducing overhead costs. Explore the distinct benefits and risks of these innovative investment avenues to make informed financial decisions.

Why it is important

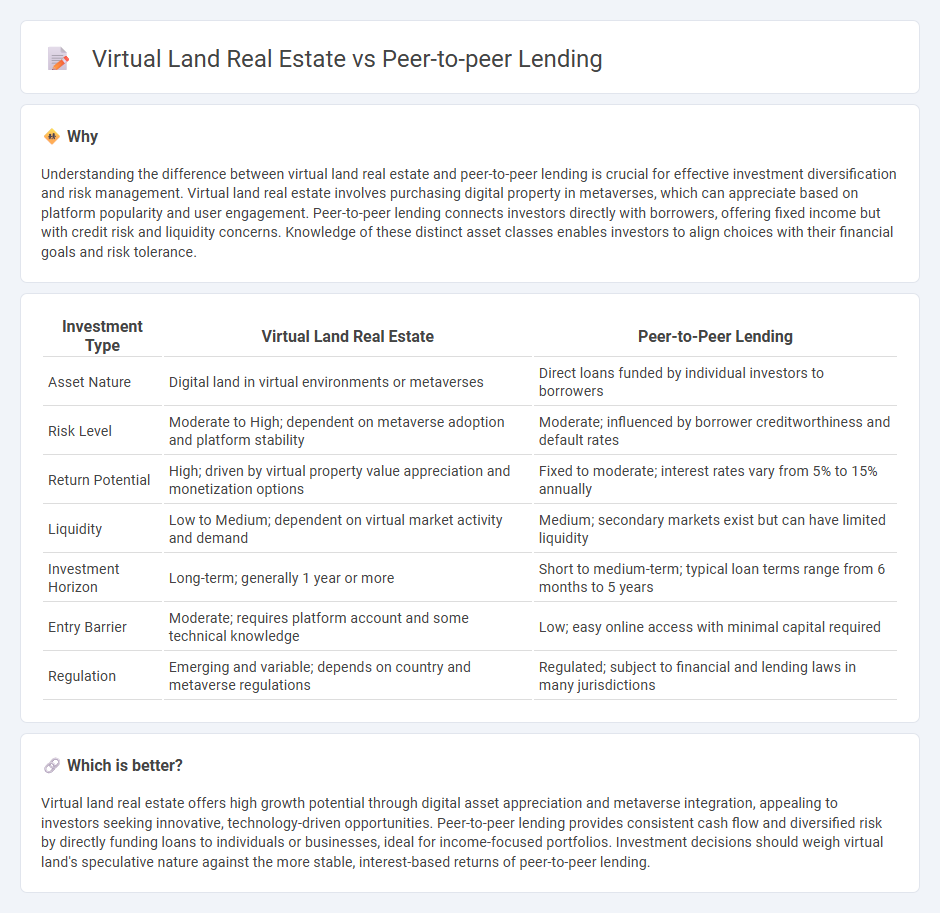

Understanding the difference between virtual land real estate and peer-to-peer lending is crucial for effective investment diversification and risk management. Virtual land real estate involves purchasing digital property in metaverses, which can appreciate based on platform popularity and user engagement. Peer-to-peer lending connects investors directly with borrowers, offering fixed income but with credit risk and liquidity concerns. Knowledge of these distinct asset classes enables investors to align choices with their financial goals and risk tolerance.

Comparison Table

| Investment Type | Virtual Land Real Estate | Peer-to-Peer Lending |

|---|---|---|

| Asset Nature | Digital land in virtual environments or metaverses | Direct loans funded by individual investors to borrowers |

| Risk Level | Moderate to High; dependent on metaverse adoption and platform stability | Moderate; influenced by borrower creditworthiness and default rates |

| Return Potential | High; driven by virtual property value appreciation and monetization options | Fixed to moderate; interest rates vary from 5% to 15% annually |

| Liquidity | Low to Medium; dependent on virtual market activity and demand | Medium; secondary markets exist but can have limited liquidity |

| Investment Horizon | Long-term; generally 1 year or more | Short to medium-term; typical loan terms range from 6 months to 5 years |

| Entry Barrier | Moderate; requires platform account and some technical knowledge | Low; easy online access with minimal capital required |

| Regulation | Emerging and variable; depends on country and metaverse regulations | Regulated; subject to financial and lending laws in many jurisdictions |

Which is better?

Virtual land real estate offers high growth potential through digital asset appreciation and metaverse integration, appealing to investors seeking innovative, technology-driven opportunities. Peer-to-peer lending provides consistent cash flow and diversified risk by directly funding loans to individuals or businesses, ideal for income-focused portfolios. Investment decisions should weigh virtual land's speculative nature against the more stable, interest-based returns of peer-to-peer lending.

Connection

Virtual land real estate and peer-to-peer lending converge through decentralized finance platforms enabling direct investment opportunities without traditional intermediaries. Investors can leverage blockchain technology to buy virtual land assets or provide loans in peer-to-peer lending markets, enhancing liquidity and portfolio diversification. Both sectors harness smart contracts to ensure transparent, secure transactions and facilitate fractional ownership or lending.

Key Terms

Yield (Peer-to-peer lending)

Peer-to-peer lending often offers higher yields compared to traditional investment options, with average annual returns ranging from 6% to 12%, depending on the risk profile and platform used. Virtual land real estate yields can vary widely, influenced by factors like platform popularity and market demand, often offering lower or more speculative returns compared to steady cash flow from loans. Explore detailed comparisons of yield performance between peer-to-peer lending and virtual land real estate to optimize your investment portfolio.

Tokenization (Virtual land real estate)

Tokenization in virtual land real estate transforms physical property into digital assets on a blockchain, enabling fractional ownership and increased liquidity compared to peer-to-peer lending, which primarily deals with direct loan agreements between individuals. Virtual land tokenization offers transparency, secure transactions, and global accessibility, attracting investors to decentralized platforms and enhancing market efficiency. Explore how tokenization is reshaping virtual land investments and compare its advantages over traditional P2P lending models.

Risk assessment (applies distinctively to both)

Peer-to-peer lending risk assessment centers on borrower creditworthiness, repayment capacity, and platform reliability, emphasizing financial data and borrower history to minimize default rates. Virtual land real estate risk assessment involves platform authenticity, digital asset liquidity, and market volatility within metaverse economies, focusing on technological security and regulatory frameworks. Explore these contrasting risk factors further to make informed investment decisions in emerging financial landscapes.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer (P2P) lending enables borrowers to get loans from individual investors through specialized websites, bypassing banks, often with lower eligibility requirements and flexible terms, while offering lenders a chance for profit through interest charged on the loans.

Peer-to-peer lending - Wikipedia - P2P lending is the practice of lending money online between individuals or businesses facilitated by an intermediary platform that verifies borrowers, processes payments, and manages loans, with characteristics including lack of government insurance and the ability for lenders to select borrowers.

Peer to peer lending: what you need to know - MoneyHelper - Peer-to-peer lending is a marketplace connecting lenders and borrowers outside traditional banks, typically offering higher interest rates but higher risk, with some platforms automatically diversifying lenders' money across multiple borrowers.

dowidth.com

dowidth.com