Litigation funding involves third-party investors providing capital to plaintiffs in legal cases in exchange for a portion of the potential recovery, reducing financial risks for litigants. Hedge funds employ diverse strategies such as equity long-short, market neutral, and event-driven to maximize returns across various asset classes, often with higher risk profiles. Explore the distinct benefits and risks of litigation funding versus hedge funds to better understand their roles in investment portfolios.

Why it is important

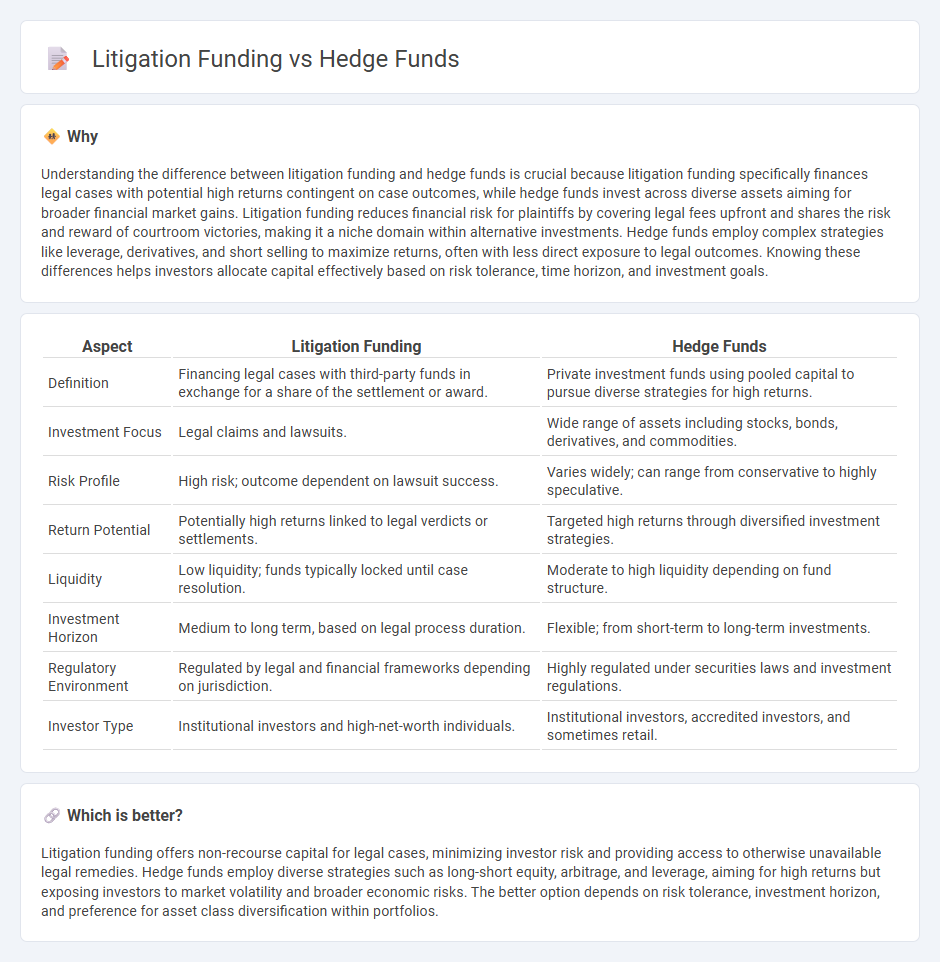

Understanding the difference between litigation funding and hedge funds is crucial because litigation funding specifically finances legal cases with potential high returns contingent on case outcomes, while hedge funds invest across diverse assets aiming for broader financial market gains. Litigation funding reduces financial risk for plaintiffs by covering legal fees upfront and shares the risk and reward of courtroom victories, making it a niche domain within alternative investments. Hedge funds employ complex strategies like leverage, derivatives, and short selling to maximize returns, often with less direct exposure to legal outcomes. Knowing these differences helps investors allocate capital effectively based on risk tolerance, time horizon, and investment goals.

Comparison Table

| Aspect | Litigation Funding | Hedge Funds |

|---|---|---|

| Definition | Financing legal cases with third-party funds in exchange for a share of the settlement or award. | Private investment funds using pooled capital to pursue diverse strategies for high returns. |

| Investment Focus | Legal claims and lawsuits. | Wide range of assets including stocks, bonds, derivatives, and commodities. |

| Risk Profile | High risk; outcome dependent on lawsuit success. | Varies widely; can range from conservative to highly speculative. |

| Return Potential | Potentially high returns linked to legal verdicts or settlements. | Targeted high returns through diversified investment strategies. |

| Liquidity | Low liquidity; funds typically locked until case resolution. | Moderate to high liquidity depending on fund structure. |

| Investment Horizon | Medium to long term, based on legal process duration. | Flexible; from short-term to long-term investments. |

| Regulatory Environment | Regulated by legal and financial frameworks depending on jurisdiction. | Highly regulated under securities laws and investment regulations. |

| Investor Type | Institutional investors and high-net-worth individuals. | Institutional investors, accredited investors, and sometimes retail. |

Which is better?

Litigation funding offers non-recourse capital for legal cases, minimizing investor risk and providing access to otherwise unavailable legal remedies. Hedge funds employ diverse strategies such as long-short equity, arbitrage, and leverage, aiming for high returns but exposing investors to market volatility and broader economic risks. The better option depends on risk tolerance, investment horizon, and preference for asset class diversification within portfolios.

Connection

Litigation funding and hedge funds intersect through alternative investment strategies that leverage legal claims as financial assets. Hedge funds allocate capital to litigation finance portfolios to diversify risk and seek high returns independent of market volatility. This integration enables hedge funds to profit from verdict outcomes and settlements while providing plaintiffs access to capital for legal expenses.

Key Terms

Risk management

Hedge funds deploy advanced risk management strategies utilizing diversified portfolios and real-time market analytics to mitigate financial exposure. Litigation funding involves assessing case merits, potential legal costs, and outcome probabilities to control investment risks in uncertain legal battles. Explore detailed comparisons of these risk management techniques to better understand their unique approaches and benefits.

Capital deployment

Hedge funds typically deploy capital across diverse asset classes aiming for high returns through active trading, while litigation funding concentrates capital on financing legal cases with potential for substantial settlements or awards. Capital allocation in hedge funds is driven by market analysis and risk appetite, whereas litigation funding emphasizes case merit and expected judgment size. Explore the nuances of capital deployment strategies in both sectors to enhance investment insights.

Return profile

Hedge funds typically pursue high-risk, high-return strategies with diversified portfolios aiming for alpha generation, while litigation funding offers returns linked to legal claim outcomes, often with less correlation to market volatility. Litigation funding presents asymmetric return potential, as investors receive a portion of settlement or judgment proceeds, balancing risk with relatively predictable case evaluations. Explore detailed analyses of return profiles to understand which investment aligns with your financial goals.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment vehicles that cater to accredited and institutional investors, using a range of sophisticated strategies to earn absolute returns--regardless of market conditions--and often employ techniques like short selling, derivatives, and event-driven investing that are not typically used by traditional asset managers.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment pools that are limited to high-net-worth individuals and institutions, and they pursue more flexible and higher-risk investment strategies than mutual funds, with fewer regulatory protections for investors.

Hedge fund - Wikipedia - Hedge funds are pooled investment funds that use advanced trading, leverage, and risk management techniques, typically charging both a management fee and a substantial performance fee, and they can collectively pose risks to financial stability due to leveraged positions and potential herding behavior in stressed markets.

dowidth.com

dowidth.com