Investing in viticulture land offers tangible assets, potential for vineyard profitability, and long-term value appreciation linked to wine industry trends, contrasting with stock market equities that provide liquidity, diversified portfolios, and rapid market accessibility. Land investments involve agricultural risks and operational management, while equities fluctuate based on market volatility and economic factors. Explore detailed comparisons to determine the optimal investment strategy for your financial goals.

Why it is important

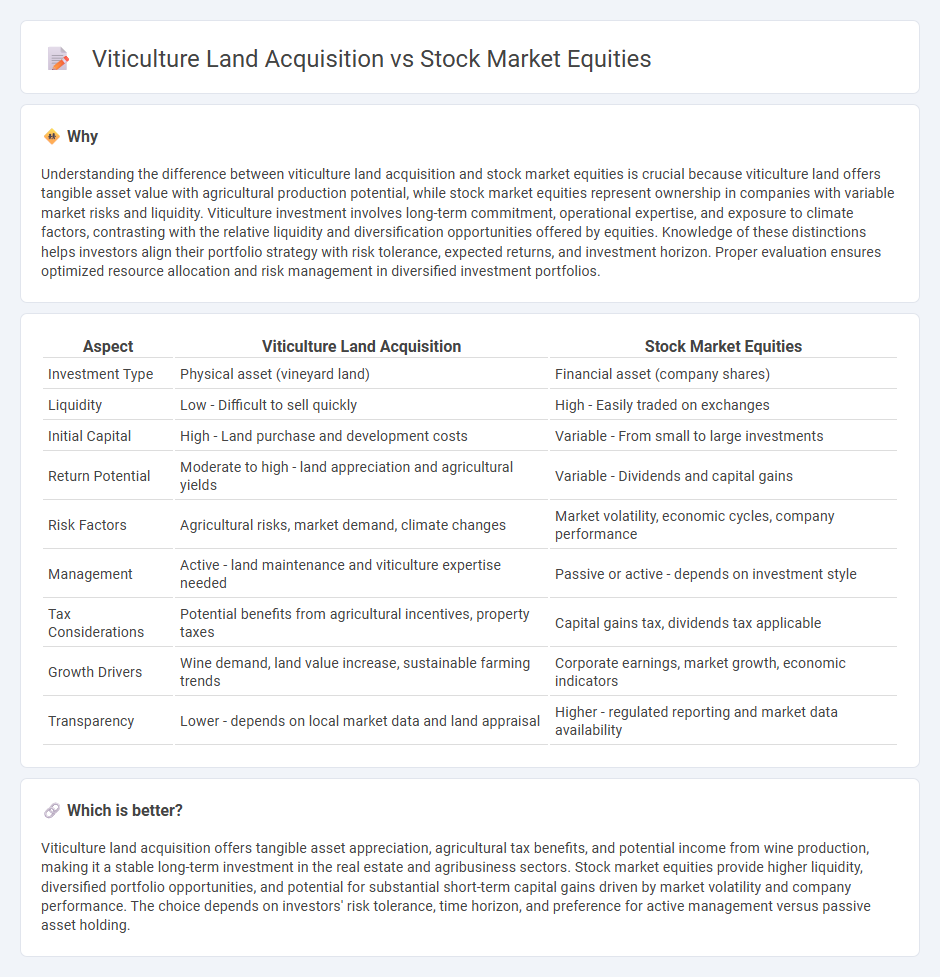

Understanding the difference between viticulture land acquisition and stock market equities is crucial because viticulture land offers tangible asset value with agricultural production potential, while stock market equities represent ownership in companies with variable market risks and liquidity. Viticulture investment involves long-term commitment, operational expertise, and exposure to climate factors, contrasting with the relative liquidity and diversification opportunities offered by equities. Knowledge of these distinctions helps investors align their portfolio strategy with risk tolerance, expected returns, and investment horizon. Proper evaluation ensures optimized resource allocation and risk management in diversified investment portfolios.

Comparison Table

| Aspect | Viticulture Land Acquisition | Stock Market Equities |

|---|---|---|

| Investment Type | Physical asset (vineyard land) | Financial asset (company shares) |

| Liquidity | Low - Difficult to sell quickly | High - Easily traded on exchanges |

| Initial Capital | High - Land purchase and development costs | Variable - From small to large investments |

| Return Potential | Moderate to high - land appreciation and agricultural yields | Variable - Dividends and capital gains |

| Risk Factors | Agricultural risks, market demand, climate changes | Market volatility, economic cycles, company performance |

| Management | Active - land maintenance and viticulture expertise needed | Passive or active - depends on investment style |

| Tax Considerations | Potential benefits from agricultural incentives, property taxes | Capital gains tax, dividends tax applicable |

| Growth Drivers | Wine demand, land value increase, sustainable farming trends | Corporate earnings, market growth, economic indicators |

| Transparency | Lower - depends on local market data and land appraisal | Higher - regulated reporting and market data availability |

Which is better?

Viticulture land acquisition offers tangible asset appreciation, agricultural tax benefits, and potential income from wine production, making it a stable long-term investment in the real estate and agribusiness sectors. Stock market equities provide higher liquidity, diversified portfolio opportunities, and potential for substantial short-term capital gains driven by market volatility and company performance. The choice depends on investors' risk tolerance, time horizon, and preference for active management versus passive asset holding.

Connection

Viticulture land acquisition and stock market equities intersect through investment diversification strategies, where investors allocate capital between tangible agricultural assets and financial instruments to hedge risks and optimize returns. The performance of viticulture land, influenced by factors like climate and global wine demand, often correlates with consumer discretionary sectors represented in stock market equities. This connection allows investors to balance portfolio volatility by combining real asset stability with equity market liquidity and growth potential.

Key Terms

Capital Appreciation

Stock market equities offer high liquidity and potential for rapid capital appreciation driven by market volatility and corporate earnings growth. Viticulture land acquisition provides long-term value through land scarcity, agricultural productivity, and wine industry demand, contributing to stable asset appreciation. Explore the comparative benefits of these investment options for informed capital growth strategies.

Liquidity

Stock market equities offer high liquidity with the ability to quickly buy or sell shares during trading hours, facilitating rapid capital access. In contrast, viticulture land acquisition entails lower liquidity due to longer transaction times, regulatory approvals, and the specialized nature of vineyard assets. Explore the comparative advantages of each investment type to optimize your portfolio strategy.

Asset Diversification

Stock market equities offer liquidity and potential for capital gains through diversified portfolios across sectors and geographies, while viticulture land acquisition provides tangible assets with income from vineyard operations and potential land value appreciation. Equities are subject to market volatility and regulatory changes, whereas viticulture land investment entails agricultural risks, climate impacts, and requires specialized management. Explore the strategic benefits of blending these assets for optimized diversification and risk management.

Source and External Links

Stocks | Investor.gov - Stocks, also called equities, represent ownership shares in a company and include common stock with voting rights and dividends and preferred stock with priority dividends and bankruptcy claims, categorized by growth, income, value, blue-chip, and market capitalization sizes.

Stocks | FINRA.org - Stocks are ownership stakes in companies, primarily divided into common stock, which may pay dividends and fluctuates in price, and preferred stock, which pays fixed dividends and has priority over common stock in bankruptcy but lower price volatility.

Stock market - Wikipedia - The stock market aggregates buyers and sellers of shares representing ownership claims, with markets influenced by economic factors and investor confidence, featuring indices that track price movements and derivatives based on stock prices.

dowidth.com

dowidth.com