Vintage sneaker portfolios offer unique asset diversification by capitalizing on limited-edition releases and cultural trends, often yielding high returns through rarity and brand prestige. Real Estate Investment Trusts (REITs) provide a more traditional, stable income stream by investing in commercial or residential properties with regular dividends and liquidity in public markets. Explore the benefits and risks of these distinct investment vehicles to tailor your portfolio strategy effectively.

Why it is important

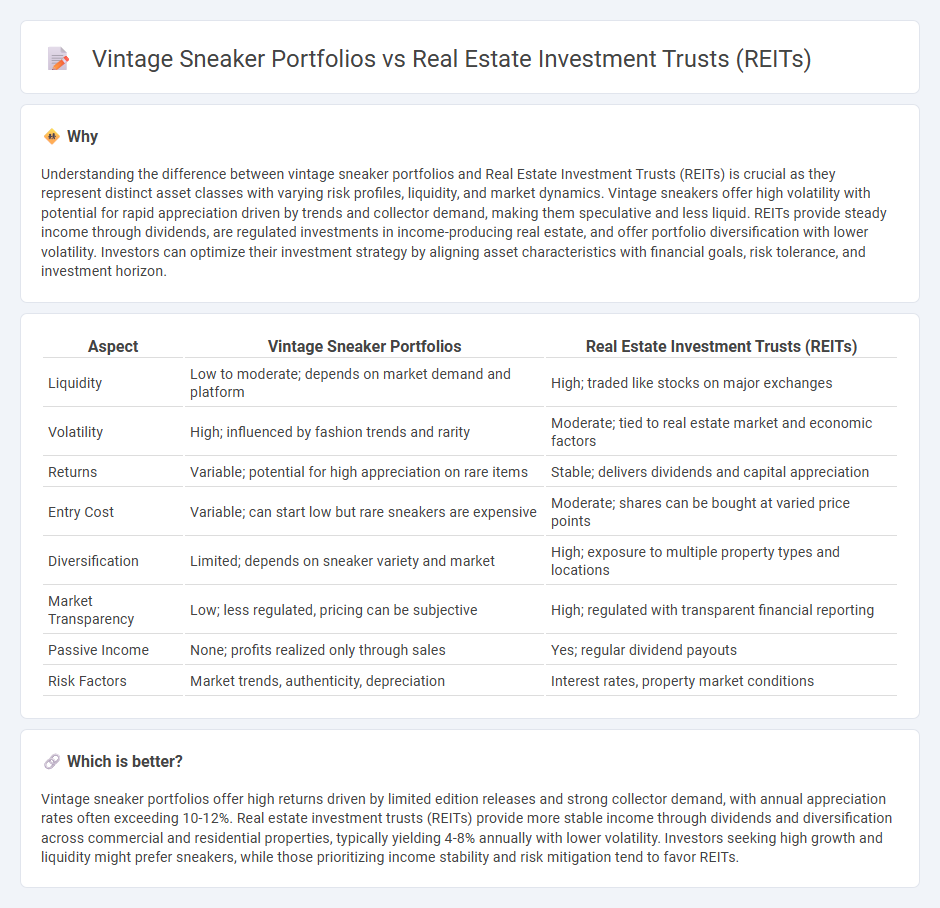

Understanding the difference between vintage sneaker portfolios and Real Estate Investment Trusts (REITs) is crucial as they represent distinct asset classes with varying risk profiles, liquidity, and market dynamics. Vintage sneakers offer high volatility with potential for rapid appreciation driven by trends and collector demand, making them speculative and less liquid. REITs provide steady income through dividends, are regulated investments in income-producing real estate, and offer portfolio diversification with lower volatility. Investors can optimize their investment strategy by aligning asset characteristics with financial goals, risk tolerance, and investment horizon.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Liquidity | Low to moderate; depends on market demand and platform | High; traded like stocks on major exchanges |

| Volatility | High; influenced by fashion trends and rarity | Moderate; tied to real estate market and economic factors |

| Returns | Variable; potential for high appreciation on rare items | Stable; delivers dividends and capital appreciation |

| Entry Cost | Variable; can start low but rare sneakers are expensive | Moderate; shares can be bought at varied price points |

| Diversification | Limited; depends on sneaker variety and market | High; exposure to multiple property types and locations |

| Market Transparency | Low; less regulated, pricing can be subjective | High; regulated with transparent financial reporting |

| Passive Income | None; profits realized only through sales | Yes; regular dividend payouts |

| Risk Factors | Market trends, authenticity, depreciation | Interest rates, property market conditions |

Which is better?

Vintage sneaker portfolios offer high returns driven by limited edition releases and strong collector demand, with annual appreciation rates often exceeding 10-12%. Real estate investment trusts (REITs) provide more stable income through dividends and diversification across commercial and residential properties, typically yielding 4-8% annually with lower volatility. Investors seeking high growth and liquidity might prefer sneakers, while those prioritizing income stability and risk mitigation tend to favor REITs.

Connection

Vintage sneaker portfolios and Real Estate Investment Trusts (REITs) both represent alternative investment assets that diversify traditional portfolios while targeting unique market segments with potential high returns. Vintage sneakers appreciate due to limited supply and cultural trends, paralleling REITs' value driven by property market dynamics and rental income streams. Both asset classes leverage scarcity and demand fundamentals, making them complementary alternatives for investors seeking non-correlated growth and inflation hedges.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer high liquidity through publicly traded shares, enabling investors to buy and sell quickly on stock exchanges. In contrast, vintage sneaker portfolios require more time to find buyers and authenticate items, resulting in lower liquidity and longer holding periods. Discover more about how liquidity impacts investment strategies between REITs and collectible assets.

Asset valuation

Asset valuation in real estate investment trusts (REITs) relies heavily on property appraisals, rental income, and market trends to determine the net asset value (NAV) of the portfolio. Vintage sneaker portfolios, by contrast, derive valuation from rarity, condition, brand provenance, and auction results, often reflecting collector demand rather than predictable cash flows. Explore further to understand the nuances and potential returns in both asset classes.

Diversification

Real estate investment trusts (REITs) offer diversification by providing exposure to income-generating commercial and residential properties, spreading risk across various real estate sectors. Vintage sneaker portfolios diversify through limited-edition collectibles with potential appreciation driven by rarity, brand, and market trends, but they carry higher market volatility and liquidity risks. Explore how combining REITs and vintage sneaker investments can optimize diversification and balance risk in your portfolio.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and usually operates income-producing real estate across various sectors, offering investors exposure to real estate without direct property ownership, and is classified into equity and mortgage REITs, with specific tax advantages and certain regulatory requirements.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies modeled after mutual funds that own, operate, or finance income-producing real estate, providing investors with regular income, diversification, and potential long-term growth, and most trade publicly on major exchanges.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-producing real estate by buying shares, offering a way to earn from commercial real estate without purchasing physical properties, and include both publicly traded and non-traded forms.

dowidth.com

dowidth.com