Whiskey cask investment offers tangible asset ownership with potential for value appreciation linked to aging and rarity, contrasting with private equity investment, which involves purchasing equity stakes in private companies aiming for high financial returns through business growth or restructuring. Whiskey casks provide diversification and a hedge against market volatility, while private equity demands longer lock-in periods and higher risk tolerance due to market and operational uncertainties. Discover comprehensive insights to determine which investment aligns best with your financial goals.

Why it is important

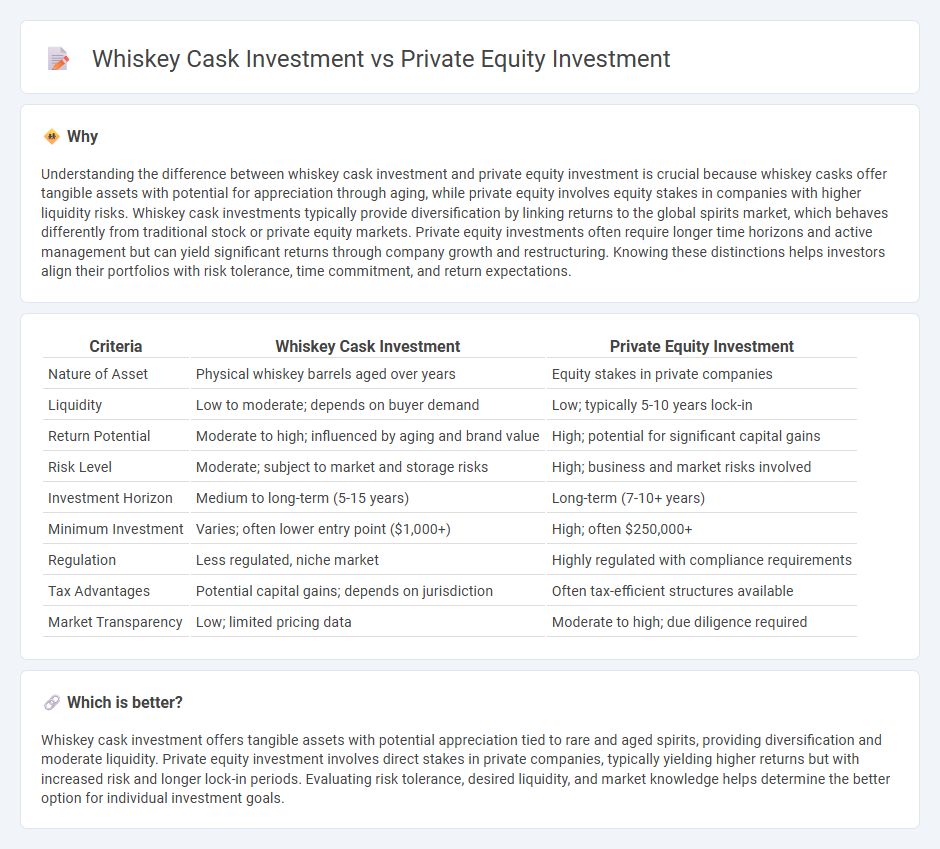

Understanding the difference between whiskey cask investment and private equity investment is crucial because whiskey casks offer tangible assets with potential for appreciation through aging, while private equity involves equity stakes in companies with higher liquidity risks. Whiskey cask investments typically provide diversification by linking returns to the global spirits market, which behaves differently from traditional stock or private equity markets. Private equity investments often require longer time horizons and active management but can yield significant returns through company growth and restructuring. Knowing these distinctions helps investors align their portfolios with risk tolerance, time commitment, and return expectations.

Comparison Table

| Criteria | Whiskey Cask Investment | Private Equity Investment |

|---|---|---|

| Nature of Asset | Physical whiskey barrels aged over years | Equity stakes in private companies |

| Liquidity | Low to moderate; depends on buyer demand | Low; typically 5-10 years lock-in |

| Return Potential | Moderate to high; influenced by aging and brand value | High; potential for significant capital gains |

| Risk Level | Moderate; subject to market and storage risks | High; business and market risks involved |

| Investment Horizon | Medium to long-term (5-15 years) | Long-term (7-10+ years) |

| Minimum Investment | Varies; often lower entry point ($1,000+) | High; often $250,000+ |

| Regulation | Less regulated, niche market | Highly regulated with compliance requirements |

| Tax Advantages | Potential capital gains; depends on jurisdiction | Often tax-efficient structures available |

| Market Transparency | Low; limited pricing data | Moderate to high; due diligence required |

Which is better?

Whiskey cask investment offers tangible assets with potential appreciation tied to rare and aged spirits, providing diversification and moderate liquidity. Private equity investment involves direct stakes in private companies, typically yielding higher returns but with increased risk and longer lock-in periods. Evaluating risk tolerance, desired liquidity, and market knowledge helps determine the better option for individual investment goals.

Connection

Whiskey cask investment and private equity investment both provide alternative asset classes that diversify traditional portfolios and offer potential high returns. Whiskey cask investment involves purchasing aging spirits stored in barrels, capitalizing on increasing rarity and market demand, while private equity investment focuses on acquiring equity stakes in private companies with growth potential. Both approaches require expertise in asset valuation, market timing, and long-term holding strategies to maximize investor profits.

Key Terms

Private Equity Investment:

Private equity investment involves acquiring ownership stakes in private companies, offering potential for high returns through company growth, restructuring, and strategic management. Unlike whiskey cask investment, which relies on asset appreciation and market demand for rare casks, private equity provides direct influence and active involvement in portfolio companies, often leading to substantial financial outcomes through exits like IPOs or buyouts. Explore further to understand how private equity shapes investment portfolios and drives business growth.

Buyout

Buyout private equity investments focus on acquiring controlling stakes in established companies, aiming to enhance value through strategic management and operational improvements over time. Whiskey cask investment involves purchasing aged whiskey barrels that appreciate in value due to rarity, age, and quality, offering a tangible asset alternative with lower correlation to financial markets. Explore the detailed comparisons and potential returns of these distinct investment opportunities to make informed decisions.

Limited Partner (LP)

Limited Partners (LPs) in private equity investments typically commit substantial capital to diversified portfolios managed by General Partners, seeking long-term capital appreciation through structured fund mechanisms. In contrast, whiskey cask investments offer LPs an alternative asset class with potential value appreciation driven by the rare and aging process of casks, though they carry liquidity and market volatility risks. Discover the nuanced benefits and challenges LPs face in each investment type to better align choices with financial goals.

Source and External Links

An Introduction to Private Equity Basics | Morgan Stanley - Private equity refers to equity or equity-like investments in private, non-publicly traded companies or assets, managed by general partners who aim to generate returns over several years through portfolio company improvements and eventual exit via sale or IPO.

Private equity - Wikipedia - Private equity involves investment managers raising capital from institutions to acquire equity stakes in private companies, using strategies like revenue growth, cost reduction, and operational restructuring to increase value before exiting the investment, typically within 4-7 years.

What is Private Equity? - BVCA - Private equity provides medium to long-term capital to unquoted companies in exchange for an equity stake, focusing on active ownership to drive business growth, operational improvements, and value creation before a planned exit after several years.

dowidth.com

dowidth.com