Alternative data analytics leverages unconventional data sources such as social media trends, satellite imagery, and transaction records to uncover investment insights beyond traditional financial metrics. Machine learning applies algorithms and statistical models to analyze vast datasets, identifying patterns and predicting market movements with increasing accuracy. Explore how integrating alternative data analytics with machine learning can transform investment strategies and enhance decision-making.

Why it is important

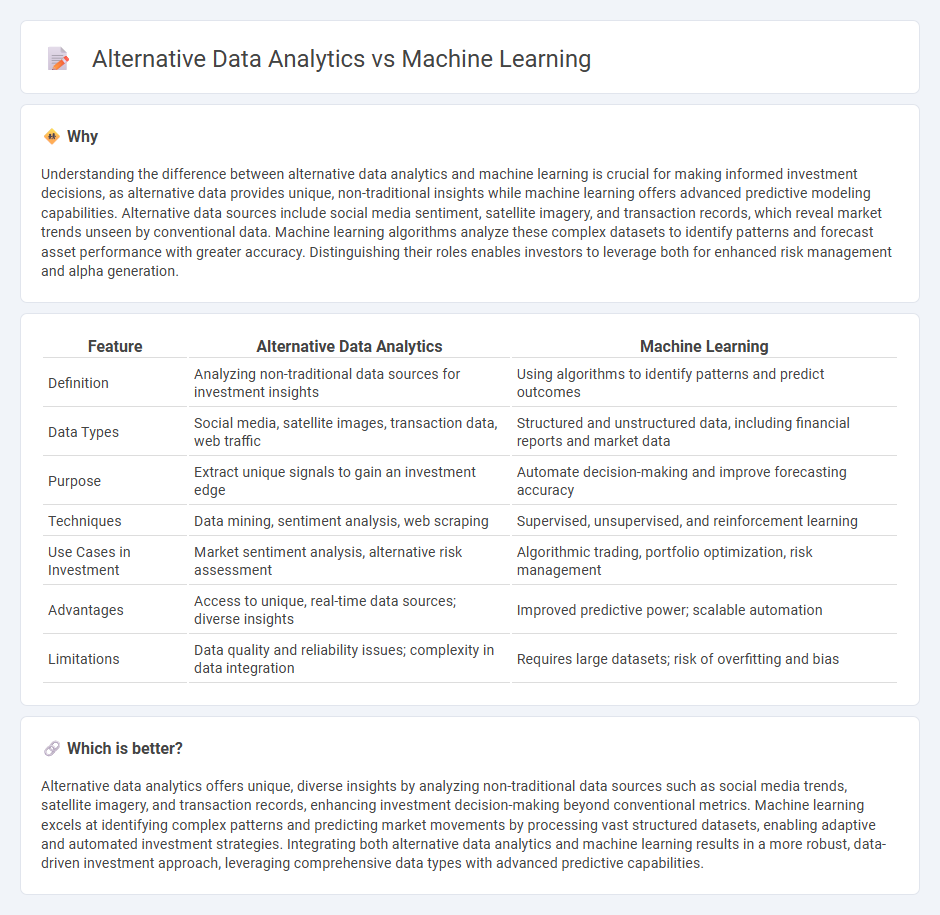

Understanding the difference between alternative data analytics and machine learning is crucial for making informed investment decisions, as alternative data provides unique, non-traditional insights while machine learning offers advanced predictive modeling capabilities. Alternative data sources include social media sentiment, satellite imagery, and transaction records, which reveal market trends unseen by conventional data. Machine learning algorithms analyze these complex datasets to identify patterns and forecast asset performance with greater accuracy. Distinguishing their roles enables investors to leverage both for enhanced risk management and alpha generation.

Comparison Table

| Feature | Alternative Data Analytics | Machine Learning |

|---|---|---|

| Definition | Analyzing non-traditional data sources for investment insights | Using algorithms to identify patterns and predict outcomes |

| Data Types | Social media, satellite images, transaction data, web traffic | Structured and unstructured data, including financial reports and market data |

| Purpose | Extract unique signals to gain an investment edge | Automate decision-making and improve forecasting accuracy |

| Techniques | Data mining, sentiment analysis, web scraping | Supervised, unsupervised, and reinforcement learning |

| Use Cases in Investment | Market sentiment analysis, alternative risk assessment | Algorithmic trading, portfolio optimization, risk management |

| Advantages | Access to unique, real-time data sources; diverse insights | Improved predictive power; scalable automation |

| Limitations | Data quality and reliability issues; complexity in data integration | Requires large datasets; risk of overfitting and bias |

Which is better?

Alternative data analytics offers unique, diverse insights by analyzing non-traditional data sources such as social media trends, satellite imagery, and transaction records, enhancing investment decision-making beyond conventional metrics. Machine learning excels at identifying complex patterns and predicting market movements by processing vast structured datasets, enabling adaptive and automated investment strategies. Integrating both alternative data analytics and machine learning results in a more robust, data-driven investment approach, leveraging comprehensive data types with advanced predictive capabilities.

Connection

Alternative data analytics leverages unconventional data sources such as social media trends, satellite imagery, and transaction records to uncover hidden investment opportunities. Machine learning algorithms process and analyze this vast, unstructured data to identify patterns and predict market movements with higher accuracy. This synergy enhances investment decision-making by providing deeper insights beyond traditional financial metrics.

Key Terms

Predictive Modeling

Machine learning leverages algorithms to analyze vast datasets, enabling highly accurate predictive modeling by identifying complex patterns and trends. Alternative data analytics incorporates unconventional data sources such as social media, satellite imagery, and sensor data to enhance model predictions and uncover unique insights not found in traditional datasets. Explore the latest advancements in predictive modeling by understanding how these approaches complement each other for superior forecasting accuracy.

Feature Engineering

Feature engineering in machine learning involves creating and selecting relevant features from raw data to improve model accuracy, using techniques such as normalization, encoding, and interaction terms. In alternative data analytics, feature engineering often integrates unconventional datasets like social media trends, satellite imagery, and transaction records, requiring specialized preprocessing to uncover hidden patterns. Explore how advanced feature engineering methodologies can unlock deeper insights across diverse data sources.

Sentiment Analysis

Sentiment analysis employs machine learning algorithms to process and interpret textual data, identifying opinions and emotions with high accuracy by training models on labeled datasets. Alternative data analytics leverages unconventional data sources such as social media posts, news articles, and online reviews to extract sentiment insights that traditional datasets might overlook. Explore how integrating these approaches can enhance predictive analytics and drive smarter decision-making.

Source and External Links

What Is Machine Learning (ML)? - IBM - Machine learning is a branch of AI that enables computers to learn from data and improve their performance on tasks without being explicitly programmed, with main types including supervised, unsupervised, and reinforcement learning.

Machine Learning: What it is and why it matters - SAS - Machine learning automates analytical model building by learning from data to identify patterns and make decisions with minimal human intervention, powering applications such as self-driving cars, recommendations, and fraud detection.

What is Machine Learning? Definition, Types, Tools & More - DataCamp - Machine learning is a subset of AI focused on developing algorithms that allow computers to learn from experience and data, improving how they make predictions or decisions without explicit programming.

dowidth.com

dowidth.com