Secondaries in venture capital involve purchasing existing shares from early investors or employees, providing liquidity without entering new funding rounds, while direct investments focus on injecting capital directly into startups for ownership stakes. Secondaries offer diversified risk and quicker returns by accessing mature assets, contrasting with the higher growth potential but longer horizons typical of direct investments. Explore how combining secondaries and direct investments can optimize your venture capital portfolio.

Why it is important

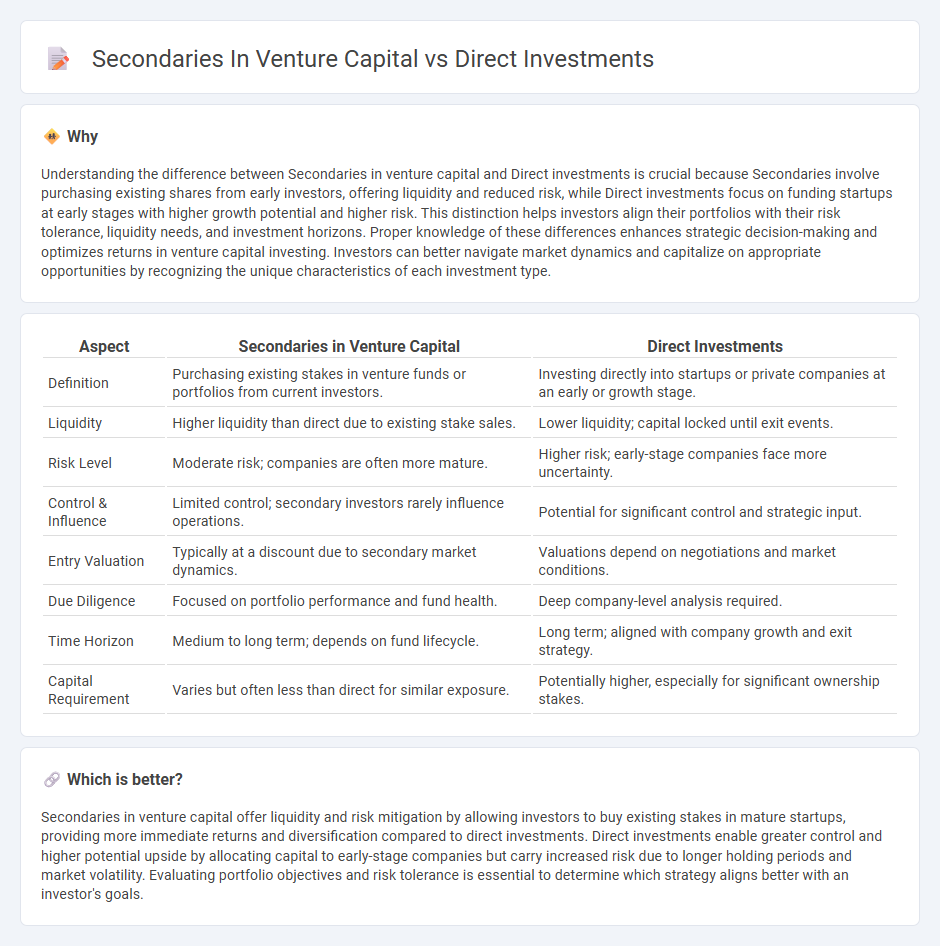

Understanding the difference between Secondaries in venture capital and Direct investments is crucial because Secondaries involve purchasing existing shares from early investors, offering liquidity and reduced risk, while Direct investments focus on funding startups at early stages with higher growth potential and higher risk. This distinction helps investors align their portfolios with their risk tolerance, liquidity needs, and investment horizons. Proper knowledge of these differences enhances strategic decision-making and optimizes returns in venture capital investing. Investors can better navigate market dynamics and capitalize on appropriate opportunities by recognizing the unique characteristics of each investment type.

Comparison Table

| Aspect | Secondaries in Venture Capital | Direct Investments |

|---|---|---|

| Definition | Purchasing existing stakes in venture funds or portfolios from current investors. | Investing directly into startups or private companies at an early or growth stage. |

| Liquidity | Higher liquidity than direct due to existing stake sales. | Lower liquidity; capital locked until exit events. |

| Risk Level | Moderate risk; companies are often more mature. | Higher risk; early-stage companies face more uncertainty. |

| Control & Influence | Limited control; secondary investors rarely influence operations. | Potential for significant control and strategic input. |

| Entry Valuation | Typically at a discount due to secondary market dynamics. | Valuations depend on negotiations and market conditions. |

| Due Diligence | Focused on portfolio performance and fund health. | Deep company-level analysis required. |

| Time Horizon | Medium to long term; depends on fund lifecycle. | Long term; aligned with company growth and exit strategy. |

| Capital Requirement | Varies but often less than direct for similar exposure. | Potentially higher, especially for significant ownership stakes. |

Which is better?

Secondaries in venture capital offer liquidity and risk mitigation by allowing investors to buy existing stakes in mature startups, providing more immediate returns and diversification compared to direct investments. Direct investments enable greater control and higher potential upside by allocating capital to early-stage companies but carry increased risk due to longer holding periods and market volatility. Evaluating portfolio objectives and risk tolerance is essential to determine which strategy aligns better with an investor's goals.

Connection

Secondaries in venture capital involve buying existing stakes in startups from early investors, providing liquidity while preserving portfolio exposure to high-growth companies. Direct investments, on the other hand, entail funding startups at an early stage, creating primary ownership and value creation opportunities. The connection lies in portfolio management, where secondaries offer flexibility and risk mitigation for investors initially engaged through direct investments in venture funds or startups.

Key Terms

Primary Investment

Direct investments in venture capital involve committing capital directly to startups or growth-stage companies during their primary funding rounds, providing ownership and influence from the outset. These primary investments typically offer higher potential returns due to early entry but also carry increased risk from unproven business models. Explore the nuances between primary direct investments and secondary market transactions to optimize your venture capital strategy.

Secondary Market

The Secondary Market in venture capital involves purchasing existing stakes in startups from early investors or employees, providing liquidity without the need to wait for an exit event. This market offers quicker access to mature companies and reduced risk compared to Direct Investments, where capital is put into new rounds of funding at earlier stages. Explore the advantages and dynamics of Secondary Market investments to enhance your venture capital strategy.

Liquidity

Direct investments in venture capital typically involve higher risk and lower liquidity due to long holding periods and limited exit opportunities. In contrast, secondaries offer enhanced liquidity by allowing investors to buy or sell pre-existing stakes in startups, often enabling quicker access to capital. Explore the nuances of liquidity differences between direct investments and secondaries to make informed venture capital decisions.

Source and External Links

Direct Investments - Direct investments are favored by wealthy individuals and family offices as they eliminate intermediary management fees and allow alignment with investor values, comprising standalone or co-investments unlike indirect investment through funds; the trend is growing with many expecting to increase allocations to direct investments in coming years.

Direct Investing - Direct investing allows individuals to buy stock directly from companies via direct stock plans (DSP) or dividend reinvestment plans (DRIP), which can reduce fees and allow automatic reinvestment of dividends but may involve specific rules or fees depending on the company.

What Is Direct Investment? - Back to Basics Compilation Book - Direct investment includes foreign enterprises investing capital to gain significant control or influence, through means like greenfield (building new facilities) or brownfield (acquiring existing entities) investments; governments often encourage such investments through incentives and specialized zones to benefit economic growth.

dowidth.com

dowidth.com