Crowdlending platforms enable investors to directly fund loans to businesses or individuals, often offering higher returns with increased risk and less liquidity compared to mutual funds. Mutual funds pool money from multiple investors to invest in diversified portfolios managed by professionals, providing greater risk management and regulatory oversight. Explore the benefits and drawbacks of each investment option to determine the best fit for your financial goals.

Why it is important

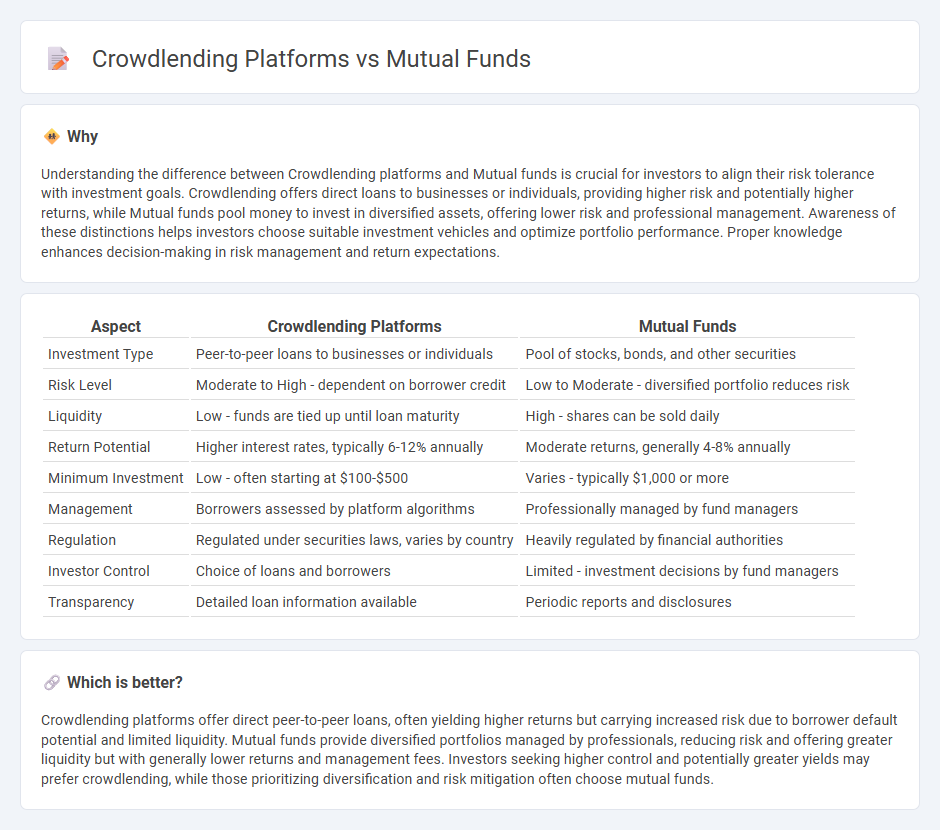

Understanding the difference between Crowdlending platforms and Mutual funds is crucial for investors to align their risk tolerance with investment goals. Crowdlending offers direct loans to businesses or individuals, providing higher risk and potentially higher returns, while Mutual funds pool money to invest in diversified assets, offering lower risk and professional management. Awareness of these distinctions helps investors choose suitable investment vehicles and optimize portfolio performance. Proper knowledge enhances decision-making in risk management and return expectations.

Comparison Table

| Aspect | Crowdlending Platforms | Mutual Funds |

|---|---|---|

| Investment Type | Peer-to-peer loans to businesses or individuals | Pool of stocks, bonds, and other securities |

| Risk Level | Moderate to High - dependent on borrower credit | Low to Moderate - diversified portfolio reduces risk |

| Liquidity | Low - funds are tied up until loan maturity | High - shares can be sold daily |

| Return Potential | Higher interest rates, typically 6-12% annually | Moderate returns, generally 4-8% annually |

| Minimum Investment | Low - often starting at $100-$500 | Varies - typically $1,000 or more |

| Management | Borrowers assessed by platform algorithms | Professionally managed by fund managers |

| Regulation | Regulated under securities laws, varies by country | Heavily regulated by financial authorities |

| Investor Control | Choice of loans and borrowers | Limited - investment decisions by fund managers |

| Transparency | Detailed loan information available | Periodic reports and disclosures |

Which is better?

Crowdlending platforms offer direct peer-to-peer loans, often yielding higher returns but carrying increased risk due to borrower default potential and limited liquidity. Mutual funds provide diversified portfolios managed by professionals, reducing risk and offering greater liquidity but with generally lower returns and management fees. Investors seeking higher control and potentially greater yields may prefer crowdlending, while those prioritizing diversification and risk mitigation often choose mutual funds.

Connection

Crowdlending platforms and mutual funds both serve as alternative investment vehicles that pool capital from multiple investors to finance various projects or assets. Crowdlending offers direct peer-to-peer loans with fixed interest returns, while mutual funds invest pooled money across diversified portfolios of stocks, bonds, or other securities managed by professionals. This connection lies in the shared goal of risk diversification and accessibility to investment opportunities for individual investors.

Key Terms

Diversification

Mutual funds offer diversification by pooling investors' money to invest in a wide range of assets, reducing overall risk through exposure to stocks, bonds, and other securities. Crowdlending platforms diversify risk by enabling investors to spread their capital across numerous loans to various borrowers, mitigating default impact. Explore our detailed analysis to understand which diversification strategy aligns best with your investment goals.

Liquidity

Mutual funds offer higher liquidity with the ability to redeem shares quickly, often on a daily basis, making them suitable for investors seeking flexible access to capital. Crowdlending platforms typically feature lower liquidity due to fixed loan terms and delayed secondary market options, which may lock investments for months or years. Explore the detailed liquidity profiles of these investment vehicles to align with your financial goals.

Risk profile

Mutual funds typically offer diversified investment portfolios managed by professionals, presenting moderate to low risk depending on the fund type, while crowdlending platforms involve lending to businesses or individuals, carrying higher risk due to borrower default potential. Mutual funds benefit from regulatory oversight and liquidity, whereas crowdlending platforms often lack extensive regulation and may experience lower liquidity. Explore detailed risk comparisons and investment suitability between these options to make informed decisions.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities, managed by professional investment advisers, with shares bought and sold directly from the fund at net asset value (NAV).

Mutual Funds | FINRA.org - A mutual fund is a regulated, open-end investment vehicle that allows investors to jointly own a portfolio of assets, sharing in its profits, losses, and income distributions, with the option to reinvest earnings or receive them as cash.

Understanding mutual funds - Charles Schwab - Mutual funds provide affordable access to a diversified mix of investments through professional management, enabling investors to participate in various asset classes with relatively low costs and straightforward purchasing options.

dowidth.com

dowidth.com