Investing in viticulture land offers the potential for long-term value appreciation driven by vineyard yield and wine market demand, while commercial real estate provides more immediate cash flow through rental income and diversified tenant portfolios. Viticulture land requires specialized knowledge and carries agricultural risks but can benefit from increasing global wine consumption trends. Explore detailed comparisons and insights to determine which investment aligns best with your financial goals.

Why it is important

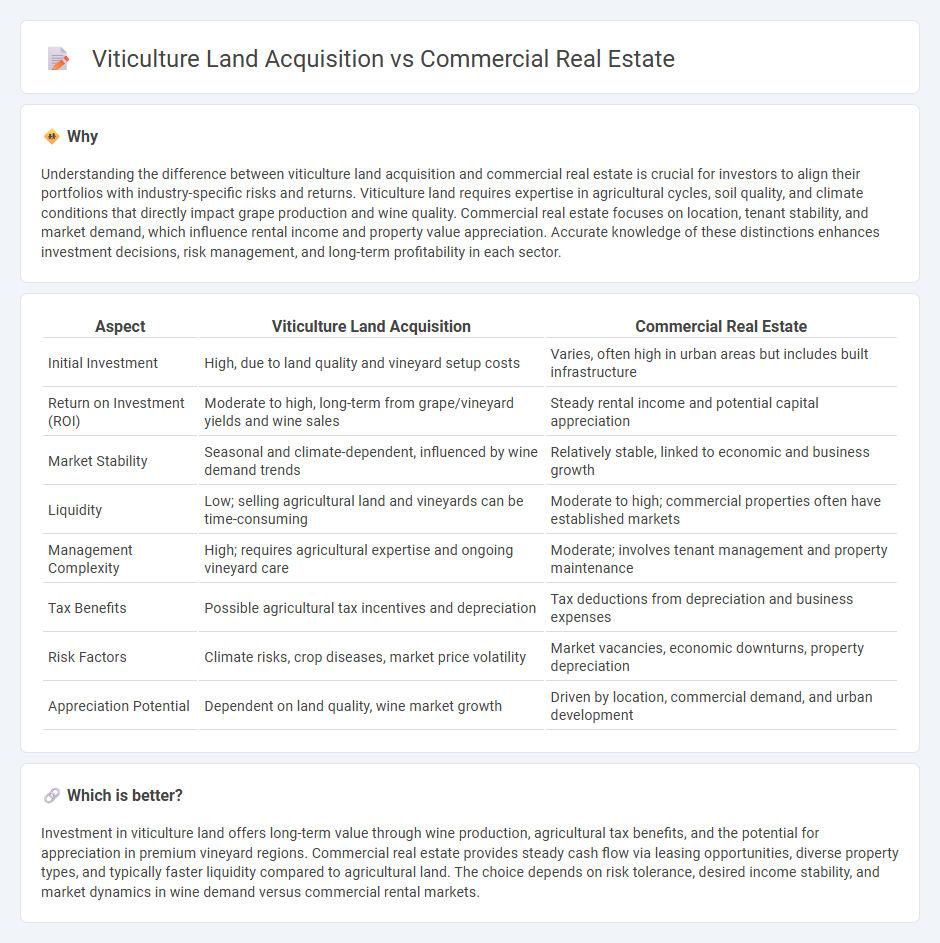

Understanding the difference between viticulture land acquisition and commercial real estate is crucial for investors to align their portfolios with industry-specific risks and returns. Viticulture land requires expertise in agricultural cycles, soil quality, and climate conditions that directly impact grape production and wine quality. Commercial real estate focuses on location, tenant stability, and market demand, which influence rental income and property value appreciation. Accurate knowledge of these distinctions enhances investment decisions, risk management, and long-term profitability in each sector.

Comparison Table

| Aspect | Viticulture Land Acquisition | Commercial Real Estate |

|---|---|---|

| Initial Investment | High, due to land quality and vineyard setup costs | Varies, often high in urban areas but includes built infrastructure |

| Return on Investment (ROI) | Moderate to high, long-term from grape/vineyard yields and wine sales | Steady rental income and potential capital appreciation |

| Market Stability | Seasonal and climate-dependent, influenced by wine demand trends | Relatively stable, linked to economic and business growth |

| Liquidity | Low; selling agricultural land and vineyards can be time-consuming | Moderate to high; commercial properties often have established markets |

| Management Complexity | High; requires agricultural expertise and ongoing vineyard care | Moderate; involves tenant management and property maintenance |

| Tax Benefits | Possible agricultural tax incentives and depreciation | Tax deductions from depreciation and business expenses |

| Risk Factors | Climate risks, crop diseases, market price volatility | Market vacancies, economic downturns, property depreciation |

| Appreciation Potential | Dependent on land quality, wine market growth | Driven by location, commercial demand, and urban development |

Which is better?

Investment in viticulture land offers long-term value through wine production, agricultural tax benefits, and the potential for appreciation in premium vineyard regions. Commercial real estate provides steady cash flow via leasing opportunities, diverse property types, and typically faster liquidity compared to agricultural land. The choice depends on risk tolerance, desired income stability, and market dynamics in wine demand versus commercial rental markets.

Connection

Investment in viticulture land acquisition and commercial real estate is interconnected through their shared potential for high returns and asset diversification. Viticulture land offers unique value due to its agricultural use for wine production, appealing to niche investors seeking stable income and capital growth. Commercial real estate complements this by providing liquidity and cash flow opportunities, balancing the agricultural investment's seasonal revenue cycles.

Key Terms

Zoning regulations

Zoning regulations for commercial real estate typically prioritize business activities, allowing various retail, office, and industrial uses, whereas viticulture land acquisition requires agricultural zoning to support vine cultivation and winery operations. Compliance with local zoning laws is critical for securing permits and ensuring the intended use is legally permitted, with many municipalities imposing restrictions to protect agricultural areas from commercial development. Explore more about zoning impacts on property investment strategies and regulatory frameworks.

Yield potential

Commercial real estate offers high yield potential through rental income, capital appreciation, and diverse tenant portfolios that provide steady cash flow. Viticulture land acquisition yields value by producing premium grapes for wine, with profitability influenced by soil quality, climate, and vineyard management practices. Explore detailed comparisons on yield potential to make informed investment decisions in these sectors.

Market liquidity

Commercial real estate typically offers higher market liquidity due to established transaction volumes, standardized property types, and diverse buyer pools, facilitating quicker sales and financing options. Viticulture land acquisition presents lower liquidity as properties are often specialized, with fewer buyers familiar with vineyard operations, leading to longer holding periods and potentially higher transaction costs. Explore expert insights to understand liquidity dynamics and strategic investment considerations in both markets.

Source and External Links

LoopNet - LoopNet is a leading platform for buying, selling, and leasing commercial real estate properties, offering a wide range of listings and marketing services.

Chenango County, NY Commercial Real Estate - This Crexi page lists commercial properties for sale in Chenango County, NY, including retail, office, and multifamily options.

Commercial Properties for Sale in Chenango County, NY - This webpage offers insights into commercial property listings in Chenango County, NY, including land and developed properties.

dowidth.com

dowidth.com