Esports franchises focus on developing competitive teams, creating content, and building brand loyalty within the gaming community, generating revenue through sponsorships, merchandise, and media rights. Betting firms capitalize on the rapidly growing esports betting market by offering wagering opportunities, leveraging data analytics and odds-making to attract gamblers and boost turnover. Explore the distinct investment potentials and market dynamics of esports franchises versus betting firms for a deeper understanding.

Why it is important

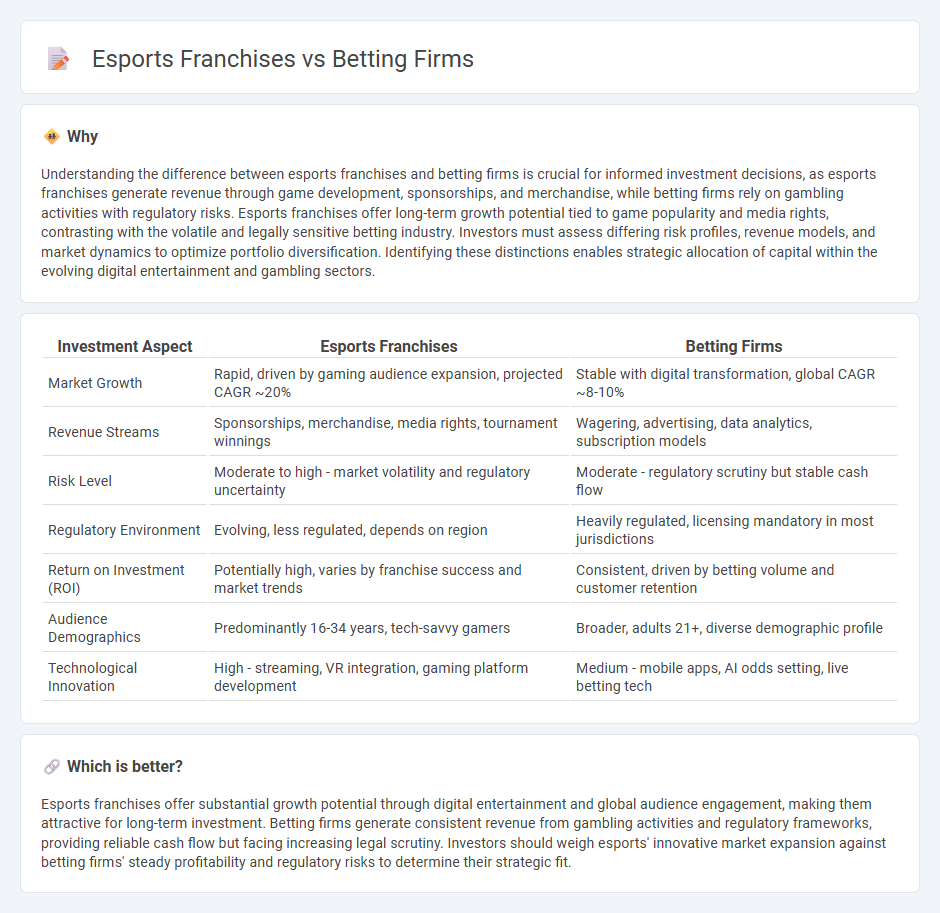

Understanding the difference between esports franchises and betting firms is crucial for informed investment decisions, as esports franchises generate revenue through game development, sponsorships, and merchandise, while betting firms rely on gambling activities with regulatory risks. Esports franchises offer long-term growth potential tied to game popularity and media rights, contrasting with the volatile and legally sensitive betting industry. Investors must assess differing risk profiles, revenue models, and market dynamics to optimize portfolio diversification. Identifying these distinctions enables strategic allocation of capital within the evolving digital entertainment and gambling sectors.

Comparison Table

| Investment Aspect | Esports Franchises | Betting Firms |

|---|---|---|

| Market Growth | Rapid, driven by gaming audience expansion, projected CAGR ~20% | Stable with digital transformation, global CAGR ~8-10% |

| Revenue Streams | Sponsorships, merchandise, media rights, tournament winnings | Wagering, advertising, data analytics, subscription models |

| Risk Level | Moderate to high - market volatility and regulatory uncertainty | Moderate - regulatory scrutiny but stable cash flow |

| Regulatory Environment | Evolving, less regulated, depends on region | Heavily regulated, licensing mandatory in most jurisdictions |

| Return on Investment (ROI) | Potentially high, varies by franchise success and market trends | Consistent, driven by betting volume and customer retention |

| Audience Demographics | Predominantly 16-34 years, tech-savvy gamers | Broader, adults 21+, diverse demographic profile |

| Technological Innovation | High - streaming, VR integration, gaming platform development | Medium - mobile apps, AI odds setting, live betting tech |

Which is better?

Esports franchises offer substantial growth potential through digital entertainment and global audience engagement, making them attractive for long-term investment. Betting firms generate consistent revenue from gambling activities and regulatory frameworks, providing reliable cash flow but facing increasing legal scrutiny. Investors should weigh esports' innovative market expansion against betting firms' steady profitability and regulatory risks to determine their strategic fit.

Connection

Esports franchises and betting firms share a symbiotic relationship where betting companies sponsor teams and tournaments, driving increased visibility and revenue for both sectors. The integration of real-time match data and player statistics enables betting firms to offer dynamic wagering options tailored to esports events, enhancing user engagement. Regulatory frameworks are evolving to address integrity concerns, ensuring transparent and fair betting practices within the rapidly expanding esports market.

Key Terms

Revenue Streams

Betting firms generate significant revenue through odds setting, commission on bets, and live betting markets, capitalizing on high betting volumes and user engagement. Esports franchises primarily earn income from sponsorships, media rights, merchandise sales, and tournament prize winnings, leveraging fan loyalty and digital content monetization. Explore deeper insights into the distinct revenue models driving these thriving industries.

Intellectual Property Rights

Betting firms leverage Intellectual Property Rights (IPR) primarily to protect proprietary betting algorithms, trademarks, and digital platforms, ensuring competitive advantage and regulatory compliance. Esports franchises focus on IPR to safeguard team branding, game content collaboration, and merchandising, capitalizing on fan loyalty and exclusive licensing deals. Explore the nuanced interplay between betting firms and esports franchises in managing Intellectual Property Rights to maximize business potential.

Market Valuation

Esports franchises have experienced rapid market valuation growth, driven by increasing audience engagement and sponsorship deals, reaching multi-billion-dollar valuations in key markets like North America and Asia. Betting firms, while traditionally valuing stability and regulatory compliance, are expanding into esports betting markets that are projected to grow at a CAGR of over 15% by 2027. Explore detailed market trends and future forecasts to better understand the competitive landscape between betting firms and esports franchises.

Source and External Links

Best Betting Sites: Top 7 Online Sportsbooks in the US July 2025 - The top US sports betting platforms for July 2025 include BetMGM, Caesars, bet365, FanDuel, DraftKings, Fanatics, and BetRivers, each offering competitive welcome bonuses and tailored promo codes for new users.

Best Online Sports Betting Sites for US Players - Legal online sportsbooks like BetMGM, DraftKings, FanDuel, bet365, Caesars, BetRivers, Fanatics, Hard Rock Bet, ESPN Bet, Bally Bet, Borgata, and Crab Sports are highlighted for their diverse welcome offers, fast payouts, and broad market coverage across various US states.

Sports Betting Sites - Tutorials - Odds - SportsBetting3.com - Provides comprehensive overviews of major betting firms such as BetMGM, including details on licensing, deposit/withdrawal methods, customer support, and notable features for bettors in legal US states.

dowidth.com

dowidth.com