Play-to-earn gaming allows users to earn digital assets and cryptocurrencies through gameplay, offering immediate rewards and a lower entry barrier compared to traditional investing. The stock market involves buying shares of companies with potential long-term growth and dividend income, but requires market knowledge and patience. Explore how combining these investment pathways can diversify your portfolio and maximize returns.

Why it is important

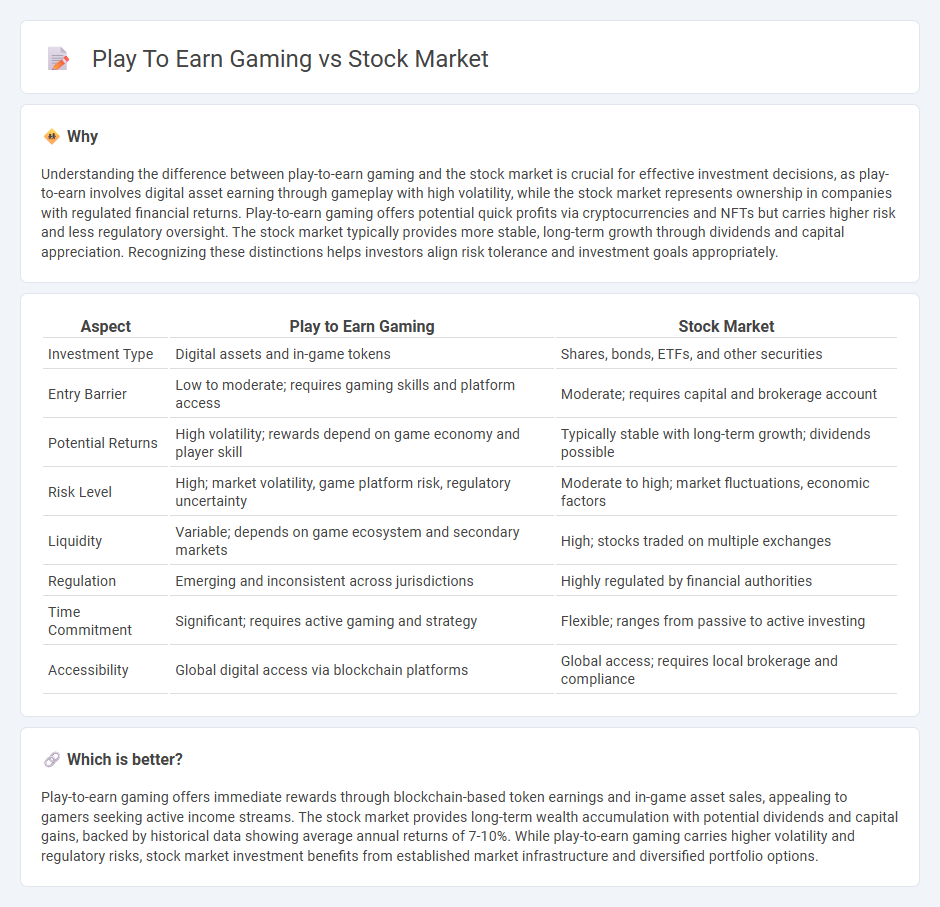

Understanding the difference between play-to-earn gaming and the stock market is crucial for effective investment decisions, as play-to-earn involves digital asset earning through gameplay with high volatility, while the stock market represents ownership in companies with regulated financial returns. Play-to-earn gaming offers potential quick profits via cryptocurrencies and NFTs but carries higher risk and less regulatory oversight. The stock market typically provides more stable, long-term growth through dividends and capital appreciation. Recognizing these distinctions helps investors align risk tolerance and investment goals appropriately.

Comparison Table

| Aspect | Play to Earn Gaming | Stock Market |

|---|---|---|

| Investment Type | Digital assets and in-game tokens | Shares, bonds, ETFs, and other securities |

| Entry Barrier | Low to moderate; requires gaming skills and platform access | Moderate; requires capital and brokerage account |

| Potential Returns | High volatility; rewards depend on game economy and player skill | Typically stable with long-term growth; dividends possible |

| Risk Level | High; market volatility, game platform risk, regulatory uncertainty | Moderate to high; market fluctuations, economic factors |

| Liquidity | Variable; depends on game ecosystem and secondary markets | High; stocks traded on multiple exchanges |

| Regulation | Emerging and inconsistent across jurisdictions | Highly regulated by financial authorities |

| Time Commitment | Significant; requires active gaming and strategy | Flexible; ranges from passive to active investing |

| Accessibility | Global digital access via blockchain platforms | Global access; requires local brokerage and compliance |

Which is better?

Play-to-earn gaming offers immediate rewards through blockchain-based token earnings and in-game asset sales, appealing to gamers seeking active income streams. The stock market provides long-term wealth accumulation with potential dividends and capital gains, backed by historical data showing average annual returns of 7-10%. While play-to-earn gaming carries higher volatility and regulatory risks, stock market investment benefits from established market infrastructure and diversified portfolio options.

Connection

Play-to-earn gaming integrates blockchain technology, allowing gamers to earn cryptocurrencies or digital assets that can be traded on stock market platforms. This convergence creates new investment opportunities as gaming tokens gain market value and attract investors seeking high-growth assets. The connection between decentralized gaming economies and traditional financial markets drives innovation in asset liquidity and portfolio diversification.

Key Terms

**Stock Market:**

The stock market offers investors opportunities to buy shares in publicly traded companies, enabling wealth growth through dividends and capital appreciation. Market performance is influenced by economic indicators, corporate earnings, and investor sentiment, requiring informed decision-making and risk management strategies. Explore more about how strategic investments in the stock market can build long-term financial stability.

Dividend

Dividend distribution in the stock market offers investors a regular income based on company profits, providing predictable cash flow and long-term wealth growth. In play-to-earn gaming, dividends or rewards typically come as in-game tokens or cryptocurrencies, which can fluctuate in value and are influenced by game popularity and blockchain market trends. Explore the evolving dynamics of dividends in these sectors to understand their potential benefits and risks.

Portfolio

Stock market portfolios typically consist of diversified assets like stocks, bonds, and ETFs aimed at risk management and long-term growth. Play-to-earn gaming portfolios, featuring digital assets such as NFTs and in-game tokens, offer unique opportunities for active earning and real-time asset appreciation. Explore how integrating both approaches can optimize your investment strategy and portfolio diversification.

Source and External Links

United States Stock Market Index - The main U.S. stock market index (US500) reached 6306 points on July 21, 2025, up 0.15% for the day, with a 4.64% gain over the past month and a 13.31% rise compared to the same time last year.

Stock market - Wikipedia - The stock market aggregates buyers and sellers of stocks and is a crucial mechanism for companies to raise capital by offering shares of ownership to the public.

How Stock Markets Work | Investor.gov - The stock market facilitates the trading of stocks through public companies, various market participants, and different types of orders executed via brokerage accounts.

dowidth.com

dowidth.com