Social token investment leverages community-driven digital assets to create value tied directly to individual creators or interest groups, offering unique engagement opportunities beyond traditional cryptocurrencies. ICO investment, or Initial Coin Offering, focuses on raising capital for new blockchain projects by selling tokens that often promise returns or utility within a specific platform. Explore the nuances of these investment methods to understand how they align with your financial goals and risk appetite.

Why it is important

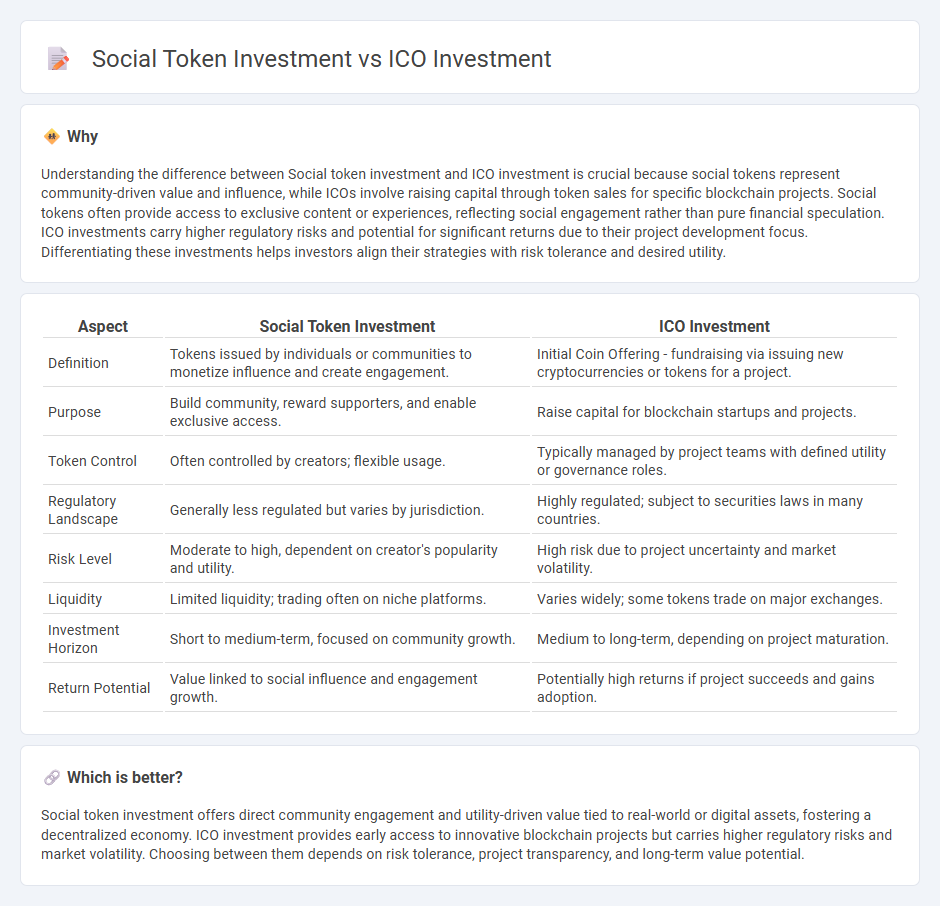

Understanding the difference between Social token investment and ICO investment is crucial because social tokens represent community-driven value and influence, while ICOs involve raising capital through token sales for specific blockchain projects. Social tokens often provide access to exclusive content or experiences, reflecting social engagement rather than pure financial speculation. ICO investments carry higher regulatory risks and potential for significant returns due to their project development focus. Differentiating these investments helps investors align their strategies with risk tolerance and desired utility.

Comparison Table

| Aspect | Social Token Investment | ICO Investment |

|---|---|---|

| Definition | Tokens issued by individuals or communities to monetize influence and create engagement. | Initial Coin Offering - fundraising via issuing new cryptocurrencies or tokens for a project. |

| Purpose | Build community, reward supporters, and enable exclusive access. | Raise capital for blockchain startups and projects. |

| Token Control | Often controlled by creators; flexible usage. | Typically managed by project teams with defined utility or governance roles. |

| Regulatory Landscape | Generally less regulated but varies by jurisdiction. | Highly regulated; subject to securities laws in many countries. |

| Risk Level | Moderate to high, dependent on creator's popularity and utility. | High risk due to project uncertainty and market volatility. |

| Liquidity | Limited liquidity; trading often on niche platforms. | Varies widely; some tokens trade on major exchanges. |

| Investment Horizon | Short to medium-term, focused on community growth. | Medium to long-term, depending on project maturation. |

| Return Potential | Value linked to social influence and engagement growth. | Potentially high returns if project succeeds and gains adoption. |

Which is better?

Social token investment offers direct community engagement and utility-driven value tied to real-world or digital assets, fostering a decentralized economy. ICO investment provides early access to innovative blockchain projects but carries higher regulatory risks and market volatility. Choosing between them depends on risk tolerance, project transparency, and long-term value potential.

Connection

Social token investment and ICO investment both represent innovative fundraising methods leveraging blockchain technology to democratize access to venture opportunities; social tokens typically offer utility or participation rights within specific communities, while ICOs (Initial Coin Offerings) primarily distribute new cryptocurrency tokens for project funding. Both investment types rely on decentralized platforms and smart contracts to ensure transparency, liquidity, and direct engagement between creators and investors. Market trends indicate increasing overlap as projects launch social tokens via ICO mechanisms, merging community-driven value creation with traditional crypto capital raising strategies.

Key Terms

ICO investment:

ICO investment involves purchasing tokens during an Initial Coin Offering, often granting early access to new blockchain projects and potential high returns. It carries risks such as regulatory uncertainty and market volatility but allows investors to participate in the foundational stages of innovative technologies. Explore deeper insights into ICO investment strategies and risk management to maximize your portfolio.

Whitepaper

ICO investments rely heavily on a comprehensive whitepaper that details the project's technology, tokenomics, use case, and roadmap, providing transparency and investor confidence. Social token investments often feature lighter, community-driven whitepapers emphasizing creator economy models, utility within social platforms, and engagement incentives rather than technical complexity. Explore the distinct whitepaper approaches to ICO and social token investments to make informed decisions.

Tokenomics

ICO investments involve acquiring tokens during an initial coin offering, typically with strong incentives such as early access, bonus tokens, and governance rights embedded in their tokenomics to drive demand and value appreciation. Social token investments center around tokens representing community value, often designed with utility, rewards, and engagement mechanisms that reflect the tokenomics aimed at fostering social interaction and creator support. Explore the intricate differences in tokenomics between ICO and social token investments to understand their potential impact on your portfolio.

Source and External Links

Initial coin offering - An ICO is a crowdfunding method where cryptocurrencies are sold as tokens to raise capital, often for startups, but it carries risks due to lack of regulation and frequent scams.

Initial Coin Offering (ICO) - Definition, Examples, Types - ICOs allow startups to raise capital by selling tokens directly to investors without intermediaries, with public ICOs open to general investors and private ICOs to accredited investors.

What are Initial Coin Offerings (ICOs) and how do they work? - ICOs are fundraising events where new cryptocurrency tokens are issued and sold to fund a project, with flexible structures in token supply and pricing, but they involve regulatory risks and potential for fraud.

dowidth.com

dowidth.com