Sports memorabilia funds capitalize on the rising value of rare collectibles and auctions within the $9 billion global sports memorabilia market. Agribusiness funds focus on the growing demand for sustainable food production, driven by a projected 70% increase in global food consumption by 2050. Explore the unique opportunities and risks of these niche investment sectors to align with your financial goals.

Why it is important

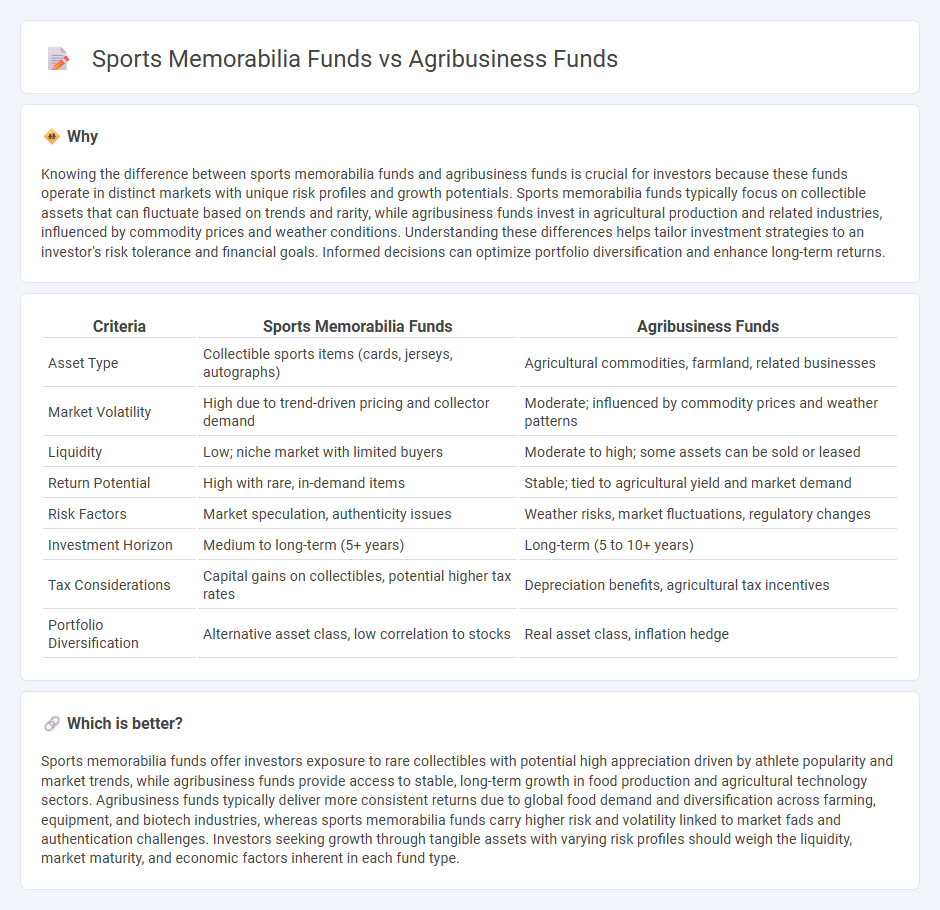

Knowing the difference between sports memorabilia funds and agribusiness funds is crucial for investors because these funds operate in distinct markets with unique risk profiles and growth potentials. Sports memorabilia funds typically focus on collectible assets that can fluctuate based on trends and rarity, while agribusiness funds invest in agricultural production and related industries, influenced by commodity prices and weather conditions. Understanding these differences helps tailor investment strategies to an investor's risk tolerance and financial goals. Informed decisions can optimize portfolio diversification and enhance long-term returns.

Comparison Table

| Criteria | Sports Memorabilia Funds | Agribusiness Funds |

|---|---|---|

| Asset Type | Collectible sports items (cards, jerseys, autographs) | Agricultural commodities, farmland, related businesses |

| Market Volatility | High due to trend-driven pricing and collector demand | Moderate; influenced by commodity prices and weather patterns |

| Liquidity | Low; niche market with limited buyers | Moderate to high; some assets can be sold or leased |

| Return Potential | High with rare, in-demand items | Stable; tied to agricultural yield and market demand |

| Risk Factors | Market speculation, authenticity issues | Weather risks, market fluctuations, regulatory changes |

| Investment Horizon | Medium to long-term (5+ years) | Long-term (5 to 10+ years) |

| Tax Considerations | Capital gains on collectibles, potential higher tax rates | Depreciation benefits, agricultural tax incentives |

| Portfolio Diversification | Alternative asset class, low correlation to stocks | Real asset class, inflation hedge |

Which is better?

Sports memorabilia funds offer investors exposure to rare collectibles with potential high appreciation driven by athlete popularity and market trends, while agribusiness funds provide access to stable, long-term growth in food production and agricultural technology sectors. Agribusiness funds typically deliver more consistent returns due to global food demand and diversification across farming, equipment, and biotech industries, whereas sports memorabilia funds carry higher risk and volatility linked to market fads and authentication challenges. Investors seeking growth through tangible assets with varying risk profiles should weigh the liquidity, market maturity, and economic factors inherent in each fund type.

Connection

Sports memorabilia funds and agribusiness funds intersect through alternative investment strategies that diversify portfolios beyond traditional markets. Both fund types leverage niche assets, with sports memorabilia funds capitalizing on the growing collectibles market while agribusiness funds invest in agricultural commodities and land assets. This connection highlights a trend where investors seek unique opportunities in tangible assets to hedge against market volatility and inflation.

Key Terms

**Agribusiness Funds:**

Agribusiness funds invest in companies involved in agriculture production, equipment, fertilizers, and agritech innovations, offering exposure to essential food supply chains and sustainable farming practices. These funds tend to provide stable returns influenced by global food demand, commodity prices, and technological advancements in crop yield and livestock management. Explore more to understand how agribusiness funds can diversify your portfolio with long-term growth potential.

Crop Yield

Agribusiness funds investing in crop yield enhance returns by leveraging advanced agricultural technologies, climate data, and commodity market trends to optimize crop production and reduce risk. Sports memorabilia funds, by contrast, do not directly influence crop yield but instead capitalize on the rarity and value appreciation of collectible items in the sports market. Explore more about how agribusiness funding strategies impact global crop productivity and investment performance.

Commodity Prices

Agribusiness funds primarily invest in commodities like wheat, corn, and soybeans, directly influenced by global supply-demand dynamics and weather conditions impacting commodity prices. Sports memorabilia funds derive their value from the rarity and market demand of collectible items, showing less correlation to traditional commodity price fluctuations. Explore in-depth analysis to understand how commodity prices distinctly affect these unique investment types.

Source and External Links

The ABC Fund (Agri-Business Capital) - An impact fund that offers direct catalytic funding, indirect finance through intermediaries, and technical assistance to smallholder farmers, cooperatives, and agribusiness SMEs in developing countries, aiming to transform rural areas and create sustainable jobs, especially for women and youth.

Agri-Business Capital Fund (IFAD) - Provides loans and equity investments tailored to rural SMEs, farmers' organizations, and rural financial institutions focusing on commercially viable and climate-smart agribusiness ventures to improve rural livelihoods and create employment, targeting mobilization of EUR 200 million over ten years.

The Agribusiness Challenge Fund - A grant fund offering $500,000 to $2,500,000 over three years to SMEs in agribusiness, emphasizing work creation for youth, women, refugees, and those with disabilities, with a focus on scalability, climate impact, and digital integration in agriculture value chains.

dowidth.com

dowidth.com