Rare whisky bottles trading and precious gemstones investment both offer unique opportunities for portfolio diversification and wealth preservation. While rare whisky markets fluctuate based on vintage rarity and provenance, precious gemstones derive value from their carat, cut, and clarity, appealing to different investor profiles. Explore the advantages and risks of each asset class to make informed investment decisions.

Why it is important

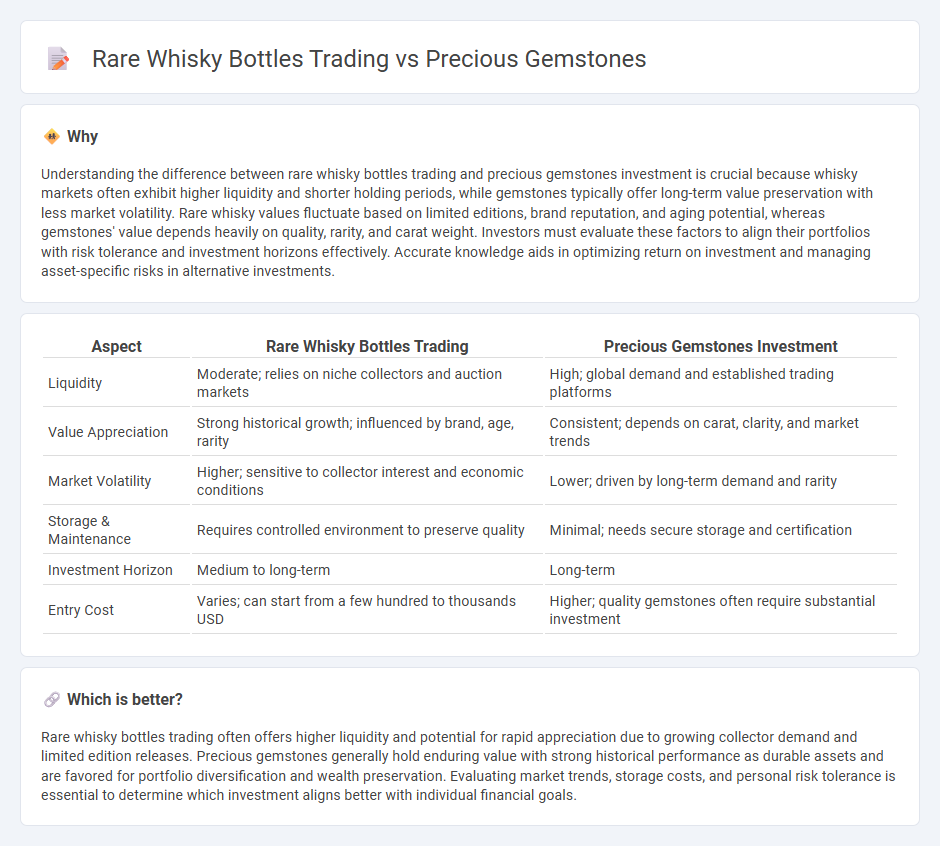

Understanding the difference between rare whisky bottles trading and precious gemstones investment is crucial because whisky markets often exhibit higher liquidity and shorter holding periods, while gemstones typically offer long-term value preservation with less market volatility. Rare whisky values fluctuate based on limited editions, brand reputation, and aging potential, whereas gemstones' value depends heavily on quality, rarity, and carat weight. Investors must evaluate these factors to align their portfolios with risk tolerance and investment horizons effectively. Accurate knowledge aids in optimizing return on investment and managing asset-specific risks in alternative investments.

Comparison Table

| Aspect | Rare Whisky Bottles Trading | Precious Gemstones Investment |

|---|---|---|

| Liquidity | Moderate; relies on niche collectors and auction markets | High; global demand and established trading platforms |

| Value Appreciation | Strong historical growth; influenced by brand, age, rarity | Consistent; depends on carat, clarity, and market trends |

| Market Volatility | Higher; sensitive to collector interest and economic conditions | Lower; driven by long-term demand and rarity |

| Storage & Maintenance | Requires controlled environment to preserve quality | Minimal; needs secure storage and certification |

| Investment Horizon | Medium to long-term | Long-term |

| Entry Cost | Varies; can start from a few hundred to thousands USD | Higher; quality gemstones often require substantial investment |

Which is better?

Rare whisky bottles trading often offers higher liquidity and potential for rapid appreciation due to growing collector demand and limited edition releases. Precious gemstones generally hold enduring value with strong historical performance as durable assets and are favored for portfolio diversification and wealth preservation. Evaluating market trends, storage costs, and personal risk tolerance is essential to determine which investment aligns better with individual financial goals.

Connection

Rare whisky bottles trading and precious gemstones share strong parallels in their appeal as alternative investment assets, characterized by scarcity, provenance, and market demand. Both markets rely on rigorous authentication and expert valuation to ensure asset quality and future appreciation potential. Investors leverage these tangible assets to diversify portfolios, hedge against economic volatility, and capitalize on growing global collector interest.

Key Terms

Authentication

Authenticating precious gemstones involves advanced techniques such as spectroscopy, microscopic analysis, and certification from gemological laboratories to verify their origin, cut, and purity. Rare whisky bottles require serial number verification, provenance documentation, and expert sensory evaluation to confirm authenticity and age. Discover more about effective authentication strategies in these high-value trading markets.

Provenance

Provenance plays a critical role in the valuation and authenticity of both precious gemstones and rare whisky bottles, ensuring their historical ownership and origin are verifiable and trustworthy. In gemstone trading, detailed certification and documented mining sources establish rarity and quality, while rare whisky bottles rely on limited production batches and distillery history to enhance desirability. Discover how understanding provenance can maximize investment potential in these exclusive markets.

Liquidity

Precious gemstones often offer higher liquidity due to established global markets and consistent demand from jewelers and collectors, making them easier to buy and sell promptly. Rare whisky bottles, while valuable, typically have lower liquidity owing to niche market interest and longer holding periods needed to realize significant returns. Explore the nuances of liquidity in both markets to optimize your investment strategy.

Source and External Links

Gemstone Names by Colour, Type & Origin - Complete List - Precious gemstones such as diamonds, rubies, sapphires, and emeralds are valued for their rarity, brilliance, and historical significance, often passed down as enduring treasures and investments.

Gemstone - Wikipedia - The traditional precious stones--diamonds, rubies, sapphires, and emeralds--are prized for superior qualities like color, clarity, and unusual optical phenomena, though other gems like pearls and opal are sometimes included in the category.

Precious & Semi-Precious Gemstones List: Pictures & Meanings - The most definitive list of precious gemstones includes diamond, ruby, sapphire, and emerald, with historical reasons for the distinction centered on rarity, value, and perceived healing powers.

dowidth.com

dowidth.com