Investment in song catalog purchases offers a unique opportunity to generate royalty income through streaming, licensing, and public performances, with major artists and estates increasingly monetizing their music rights. Art collections provide value appreciation based on the rarity, provenance, and demand within the art market, often serving as a tangible asset and a hedge against inflation. Explore the distinctive benefits and risks of these alternative investments to make informed decisions in your portfolio.

Why it is important

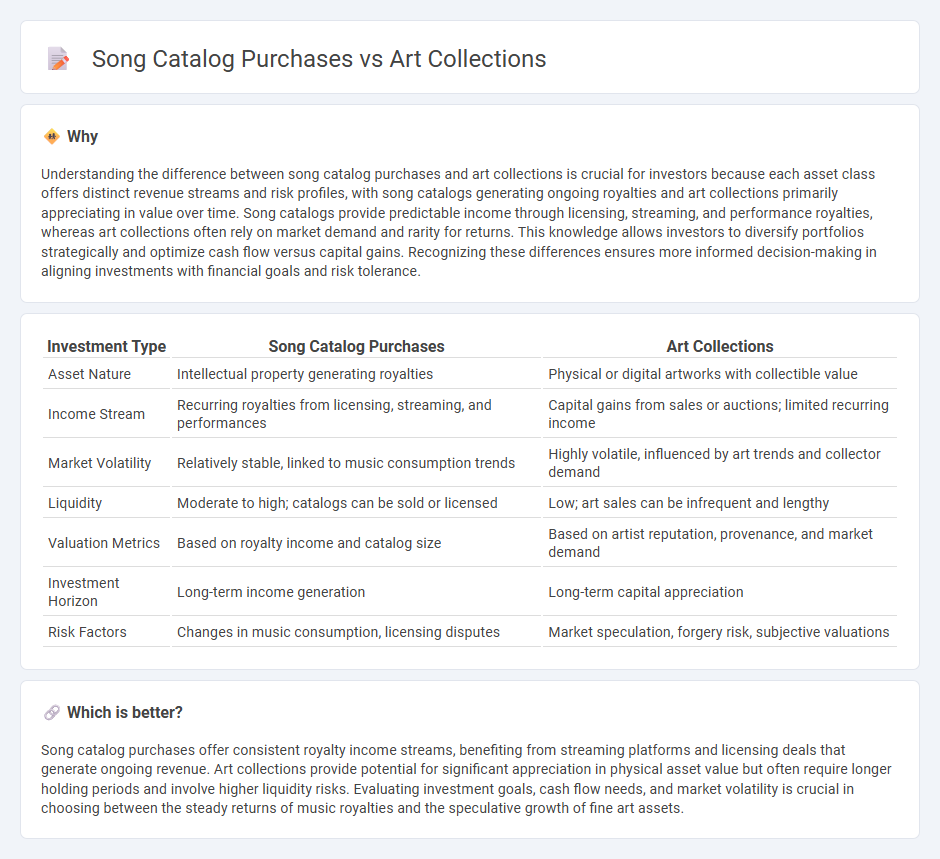

Understanding the difference between song catalog purchases and art collections is crucial for investors because each asset class offers distinct revenue streams and risk profiles, with song catalogs generating ongoing royalties and art collections primarily appreciating in value over time. Song catalogs provide predictable income through licensing, streaming, and performance royalties, whereas art collections often rely on market demand and rarity for returns. This knowledge allows investors to diversify portfolios strategically and optimize cash flow versus capital gains. Recognizing these differences ensures more informed decision-making in aligning investments with financial goals and risk tolerance.

Comparison Table

| Investment Type | Song Catalog Purchases | Art Collections |

|---|---|---|

| Asset Nature | Intellectual property generating royalties | Physical or digital artworks with collectible value |

| Income Stream | Recurring royalties from licensing, streaming, and performances | Capital gains from sales or auctions; limited recurring income |

| Market Volatility | Relatively stable, linked to music consumption trends | Highly volatile, influenced by art trends and collector demand |

| Liquidity | Moderate to high; catalogs can be sold or licensed | Low; art sales can be infrequent and lengthy |

| Valuation Metrics | Based on royalty income and catalog size | Based on artist reputation, provenance, and market demand |

| Investment Horizon | Long-term income generation | Long-term capital appreciation |

| Risk Factors | Changes in music consumption, licensing disputes | Market speculation, forgery risk, subjective valuations |

Which is better?

Song catalog purchases offer consistent royalty income streams, benefiting from streaming platforms and licensing deals that generate ongoing revenue. Art collections provide potential for significant appreciation in physical asset value but often require longer holding periods and involve higher liquidity risks. Evaluating investment goals, cash flow needs, and market volatility is crucial in choosing between the steady returns of music royalties and the speculative growth of fine art assets.

Connection

Song catalog purchases and art collections are both emerging as lucrative alternative investment assets, providing portfolio diversification with low correlation to traditional stocks and bonds. High-profile acquisitions of music rights and blue-chip artwork demonstrate strong demand driven by steady revenue streams from royalties and increasing market appreciation. Investors leverage these tangible and intangible assets to hedge against inflation while capitalizing on cultural value and long-term capital gains.

Key Terms

Provenance

Art collections emphasize provenance as a critical factor, tracing the ownership history to verify authenticity and value, which protects against forgery and enhances market trust. Song catalog purchases rely on detailed rights and royalty provenance, ensuring clear ownership and revenue streams from licensing and royalties. Discover how understanding provenance impacts investment security and profitability in both sectors.

Copyright

Art collections involve acquiring physical or digital artworks, with ownership primarily tied to the tangible or digital asset, while song catalog purchases grant rights to musical compositions and recordings, emphasizing copyright control and revenue streams from licensing and royalties. Song catalog acquisitions often include copyrights, mechanical rights, performance rights, and synchronization rights, making them complex intellectual property assets with potential for ongoing income. Explore how copyright distinctions impact investment strategies and revenue potential in art and music industries.

Valuation

Art collections are typically valued based on provenance, rarity, artist reputation, and market trends, making appraisal highly subjective and influenced by aesthetic significance. Song catalog purchases rely on predictable royalty income, publishing rights, and streaming performance data, offering more quantifiable and transparent valuation metrics. Explore detailed insights into valuation methods and market dynamics of both investment types to make informed decisions.

Source and External Links

Artworks - National Gallery of Art - Offers a collection of nearly 160,000 works spanning Western art history from the Middle Ages to today, with many images available for free download.

The Collection | MoMA - Features an evolving collection of almost 200,000 works of modern and contemporary art, with over 105,000 works accessible online including current exhibitions.

The Met Collection - The Metropolitan Museum of Art - Contains more than 490,000 works covering 5,000 years and diverse global cultures, with advanced search and public domain images available.

dowidth.com

dowidth.com