Wine investing platforms specialize in enabling investors to purchase and trade fine wines, leveraging the appreciation potential of rare vintages and market demand. Peer-to-peer lending platforms connect borrowers directly with individual lenders, offering attractive interest rates and portfolio diversification through unsecured personal loans. Explore the pros and cons of each to determine the best fit for your investment strategy.

Why it is important

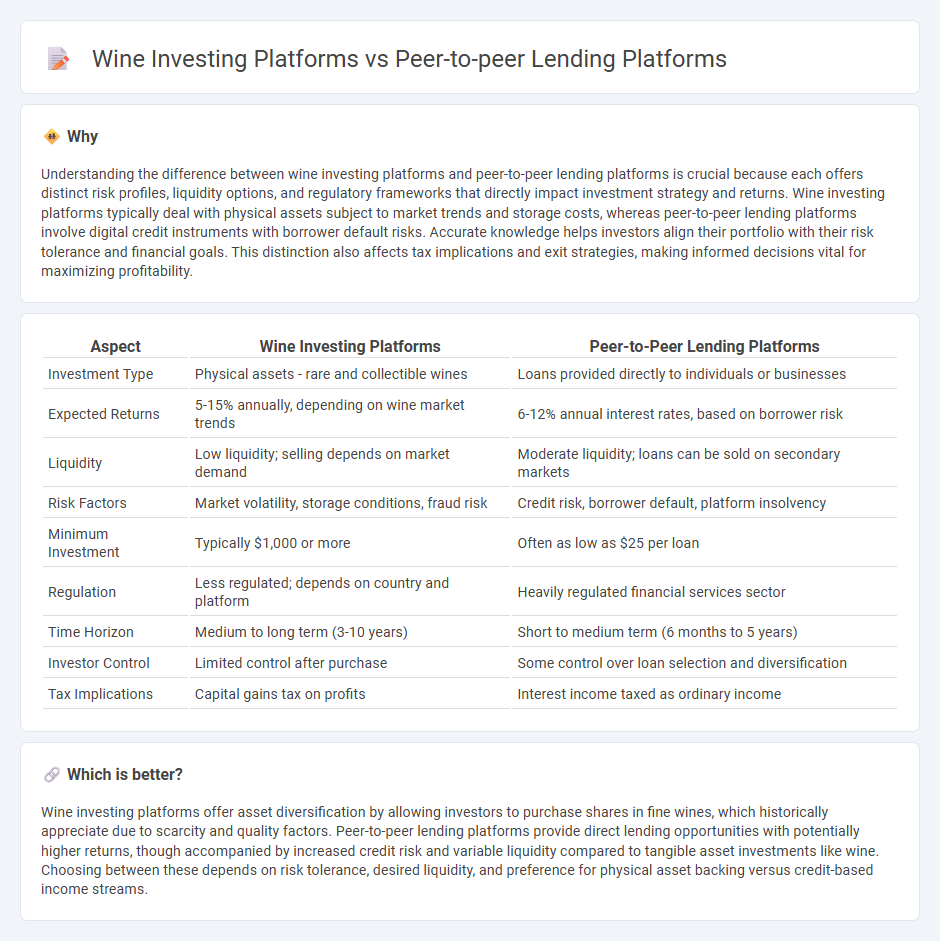

Understanding the difference between wine investing platforms and peer-to-peer lending platforms is crucial because each offers distinct risk profiles, liquidity options, and regulatory frameworks that directly impact investment strategy and returns. Wine investing platforms typically deal with physical assets subject to market trends and storage costs, whereas peer-to-peer lending platforms involve digital credit instruments with borrower default risks. Accurate knowledge helps investors align their portfolio with their risk tolerance and financial goals. This distinction also affects tax implications and exit strategies, making informed decisions vital for maximizing profitability.

Comparison Table

| Aspect | Wine Investing Platforms | Peer-to-Peer Lending Platforms |

|---|---|---|

| Investment Type | Physical assets - rare and collectible wines | Loans provided directly to individuals or businesses |

| Expected Returns | 5-15% annually, depending on wine market trends | 6-12% annual interest rates, based on borrower risk |

| Liquidity | Low liquidity; selling depends on market demand | Moderate liquidity; loans can be sold on secondary markets |

| Risk Factors | Market volatility, storage conditions, fraud risk | Credit risk, borrower default, platform insolvency |

| Minimum Investment | Typically $1,000 or more | Often as low as $25 per loan |

| Regulation | Less regulated; depends on country and platform | Heavily regulated financial services sector |

| Time Horizon | Medium to long term (3-10 years) | Short to medium term (6 months to 5 years) |

| Investor Control | Limited control after purchase | Some control over loan selection and diversification |

| Tax Implications | Capital gains tax on profits | Interest income taxed as ordinary income |

Which is better?

Wine investing platforms offer asset diversification by allowing investors to purchase shares in fine wines, which historically appreciate due to scarcity and quality factors. Peer-to-peer lending platforms provide direct lending opportunities with potentially higher returns, though accompanied by increased credit risk and variable liquidity compared to tangible asset investments like wine. Choosing between these depends on risk tolerance, desired liquidity, and preference for physical asset backing versus credit-based income streams.

Connection

Wine investing platforms and peer-to-peer lending platforms are connected through their role in alternative finance, enabling investors to diversify portfolios beyond traditional assets. Both facilitate direct transactions: wine platforms allow buying shares in rare vintages, while peer-to-peer lending connects borrowers with individual lenders, promoting liquidity and access to niche markets. Their digital infrastructures harness technology to optimize investment opportunities, risk management, and transparent asset tracking.

Key Terms

**Peer-to-peer lending platforms:**

Peer-to-peer lending platforms facilitate direct loans between individual borrowers and investors, bypassing traditional financial institutions and often offering higher returns compared to savings accounts. These platforms use credit scoring algorithms and risk diversification strategies to mitigate default risks and increase transparency. Explore how peer-to-peer lending can diversify your investment portfolio and enhance your passive income potential.

Default risk

Peer-to-peer lending platforms expose investors to default risk when borrowers fail to repay loans, which is typically quantified by historical default rates often ranging from 2% to 10% depending on credit grading systems. In contrast, wine investing platforms bear lower default risk as physical assets like fine wine do not default; however, market liquidity and valuation volatility present alternative investment risks. Explore detailed data on risk profiles and returns to better understand how these platforms compare in managing investor exposure.

Interest rate

Peer-to-peer lending platforms typically offer interest rates ranging from 5% to 12%, depending on borrower creditworthiness and loan terms, providing steady income streams for investors. Wine investing platforms, on the other hand, generate returns through the appreciation of rare and collectible wines, with historical annual growth rates averaging around 8% to 12%, though these returns are influenced by market trends and auction results. Explore the advantages and risks of each investment type to determine which suits your portfolio best.

Source and External Links

Top 10 Peer-to-Peer Lending Platforms - Highlights leading global P2P lending platforms like Prosper Marketplace, Bondora, and PeerBerry, known for connecting borrowers directly with investors and offering alternatives to traditional banking with lower interest rates and higher investor returns.

P2P Lending Software - Provides customizable white-label software solutions for businesses to launch, test, and scale their own P2P lending platforms, supporting various lending models including real estate, SME, and microloan platforms.

Peer-to-Peer Lending for Your Startup - Explains how P2P lending platforms allow individuals and businesses to borrow from multiple investors online, often at lower rates than banks, with loan amounts typically ranging from $1,000 to $40,000 and a streamlined application process.

dowidth.com

dowidth.com