Tax lien certificates grant investors the right to collect interest or recover property taxes from delinquent owners, providing secured returns backed by local government liens. Trust deeds involve investors holding a lien on real estate property as collateral for a loan, allowing potential foreclosure if the borrower defaults. Explore the differences between these investment options to identify the best fit for your portfolio goals.

Why it is important

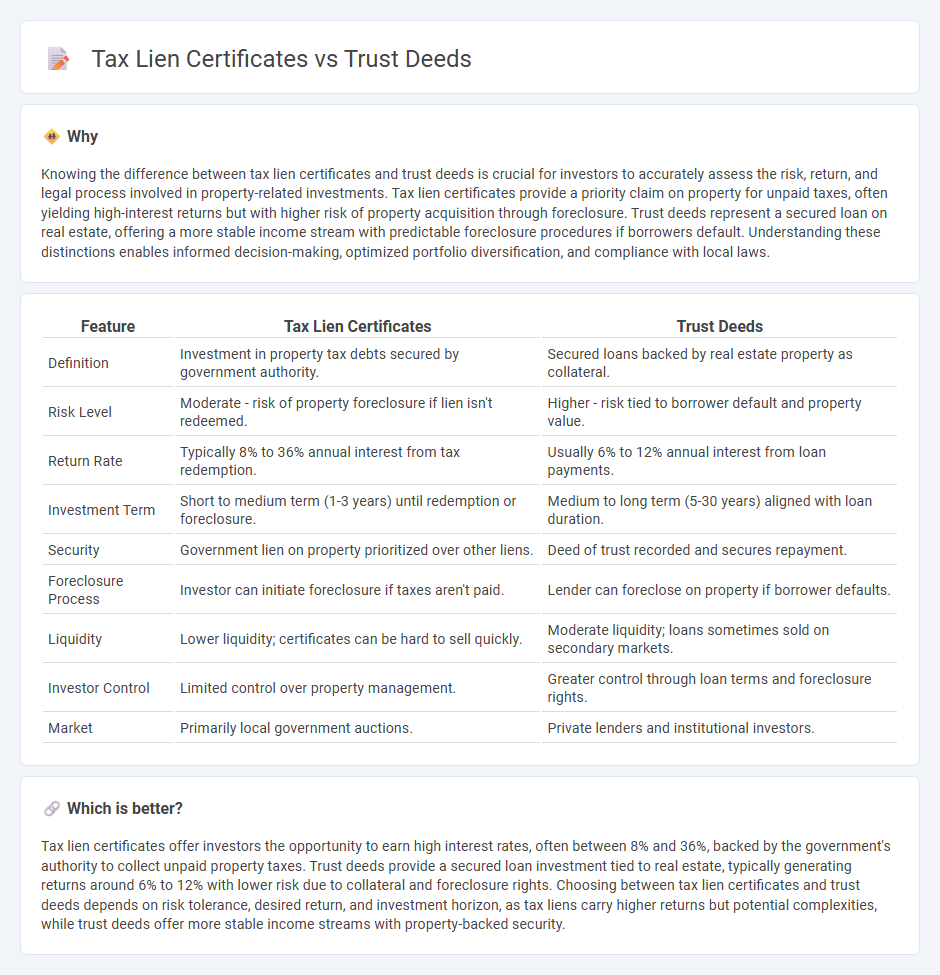

Knowing the difference between tax lien certificates and trust deeds is crucial for investors to accurately assess the risk, return, and legal process involved in property-related investments. Tax lien certificates provide a priority claim on property for unpaid taxes, often yielding high-interest returns but with higher risk of property acquisition through foreclosure. Trust deeds represent a secured loan on real estate, offering a more stable income stream with predictable foreclosure procedures if borrowers default. Understanding these distinctions enables informed decision-making, optimized portfolio diversification, and compliance with local laws.

Comparison Table

| Feature | Tax Lien Certificates | Trust Deeds |

|---|---|---|

| Definition | Investment in property tax debts secured by government authority. | Secured loans backed by real estate property as collateral. |

| Risk Level | Moderate - risk of property foreclosure if lien isn't redeemed. | Higher - risk tied to borrower default and property value. |

| Return Rate | Typically 8% to 36% annual interest from tax redemption. | Usually 6% to 12% annual interest from loan payments. |

| Investment Term | Short to medium term (1-3 years) until redemption or foreclosure. | Medium to long term (5-30 years) aligned with loan duration. |

| Security | Government lien on property prioritized over other liens. | Deed of trust recorded and secures repayment. |

| Foreclosure Process | Investor can initiate foreclosure if taxes aren't paid. | Lender can foreclose on property if borrower defaults. |

| Liquidity | Lower liquidity; certificates can be hard to sell quickly. | Moderate liquidity; loans sometimes sold on secondary markets. |

| Investor Control | Limited control over property management. | Greater control through loan terms and foreclosure rights. |

| Market | Primarily local government auctions. | Private lenders and institutional investors. |

Which is better?

Tax lien certificates offer investors the opportunity to earn high interest rates, often between 8% and 36%, backed by the government's authority to collect unpaid property taxes. Trust deeds provide a secured loan investment tied to real estate, typically generating returns around 6% to 12% with lower risk due to collateral and foreclosure rights. Choosing between tax lien certificates and trust deeds depends on risk tolerance, desired return, and investment horizon, as tax liens carry higher returns but potential complexities, while trust deeds offer more stable income streams with property-backed security.

Connection

Tax lien certificates and trust deeds are connected through real estate investment strategies that involve securing debt against property. Tax lien certificates represent claims against a property for unpaid taxes, while trust deeds act as property liens securing loans, both serving as collateral instruments. Investors leverage these tools to earn returns through interest payments or property acquisition if obligations remain unmet.

Key Terms

Collateral

Trust deeds provide a secured interest in real property as collateral, allowing lenders to enforce property rights if borrowers default, making them a preferred instrument in real estate financing. Tax lien certificates represent a legal claim on a property due to unpaid taxes but do not grant ownership or direct control over the collateral unless the lienholder initiates a foreclosure process. Explore the differences in collateral impact and investment risk to better understand which option aligns with your financial goals.

Foreclosure

Trust deeds provide a secured interest in real property, allowing the lender to initiate foreclosure proceedings if the borrower defaults on the loan. Tax lien certificates represent claims against a property due to unpaid taxes, where the certificate holder can eventually enforce foreclosure to recover owed taxes after a redemption period. Explore the detailed differences in foreclosure processes and legal implications for trust deeds and tax lien certificates to better understand your investment options.

Interest Rate

Trust deeds typically offer interest rates ranging from 6% to 12%, reflecting the risk profile and loan-to-value ratios in real estate secured loans. Tax lien certificates often provide higher returns, sometimes exceeding 18%, since they represent a claim on unpaid property taxes and carry the potential for foreclosure. Explore the distinct interest rate dynamics and investment strategies associated with trust deeds and tax lien certificates to make informed financial decisions.

Source and External Links

deed of trust | Wex | US Law | LII / Legal Information Institute - A deed of trust is a secured real estate transaction involving three parties (lender, borrower, trustee), where the borrower transfers property interest to a trustee to secure loan payments, often allowing non-judicial foreclosure by the trustee if the borrower defaults.

What is deed of trust? - A deed of trust secures a home loan by transferring legal title of the property to a trustee until the mortgage is fully paid, involving the borrower (trustor), lender (beneficiary), and trustee, and includes key loan details and terms.

Trust deeds in Scotland - In Scotland, a trust deed is a voluntary debt agreement between a debtor and creditors where the debtor pays what they can over time and remaining debt may be written off, with a trustee managing assets to repay creditors as much as possible.

dowidth.com

dowidth.com