Sports card fractionalization allows investors to own shares of high-value collectibles, leveraging blockchain technology to ensure transparent ownership and liquidity in a traditionally illiquid market. Digital assets fractionalization expands this concept to a broader range of tokenized assets, including NFTs and crypto tokens, providing diversified investment opportunities with enhanced accessibility. Discover how these innovative investment models are transforming asset ownership and creating new avenues for portfolio growth.

Why it is important

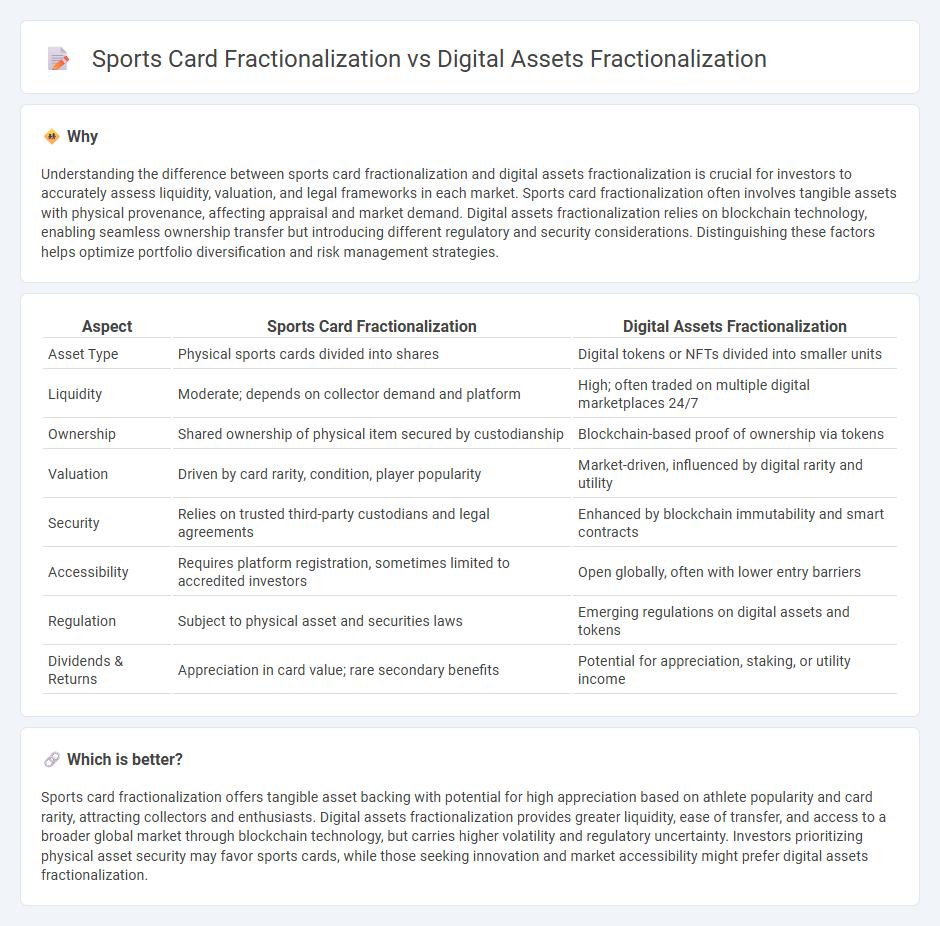

Understanding the difference between sports card fractionalization and digital assets fractionalization is crucial for investors to accurately assess liquidity, valuation, and legal frameworks in each market. Sports card fractionalization often involves tangible assets with physical provenance, affecting appraisal and market demand. Digital assets fractionalization relies on blockchain technology, enabling seamless ownership transfer but introducing different regulatory and security considerations. Distinguishing these factors helps optimize portfolio diversification and risk management strategies.

Comparison Table

| Aspect | Sports Card Fractionalization | Digital Assets Fractionalization |

|---|---|---|

| Asset Type | Physical sports cards divided into shares | Digital tokens or NFTs divided into smaller units |

| Liquidity | Moderate; depends on collector demand and platform | High; often traded on multiple digital marketplaces 24/7 |

| Ownership | Shared ownership of physical item secured by custodianship | Blockchain-based proof of ownership via tokens |

| Valuation | Driven by card rarity, condition, player popularity | Market-driven, influenced by digital rarity and utility |

| Security | Relies on trusted third-party custodians and legal agreements | Enhanced by blockchain immutability and smart contracts |

| Accessibility | Requires platform registration, sometimes limited to accredited investors | Open globally, often with lower entry barriers |

| Regulation | Subject to physical asset and securities laws | Emerging regulations on digital assets and tokens |

| Dividends & Returns | Appreciation in card value; rare secondary benefits | Potential for appreciation, staking, or utility income |

Which is better?

Sports card fractionalization offers tangible asset backing with potential for high appreciation based on athlete popularity and card rarity, attracting collectors and enthusiasts. Digital assets fractionalization provides greater liquidity, ease of transfer, and access to a broader global market through blockchain technology, but carries higher volatility and regulatory uncertainty. Investors prioritizing physical asset security may favor sports cards, while those seeking innovation and market accessibility might prefer digital assets fractionalization.

Connection

Sports card fractionalization and digital assets fractionalization are connected through the shared use of blockchain technology to enable partial ownership and trading of high-value items. Both markets leverage tokenization to increase liquidity and accessibility, allowing investors to buy and sell fractions of collectibles or assets without transferring entire ownership. This innovation democratizes investment by lowering entry barriers and providing transparent, secure transactions on decentralized platforms.

Key Terms

Tokenization

Digital assets fractionalization leverages blockchain technology to divide ownership of various assets, including real estate and art, into tradable tokens, enhancing liquidity and accessibility. Sports card fractionalization utilizes tokenization to transform valuable collectible cards into digital shares, allowing multiple investors to participate without owning the physical card. Explore the nuances of tokenization and its impact on asset ownership by diving deeper into these innovative financial models.

Ownership Shares

Digital assets fractionalization enables investors to own precise ownership shares of high-value items like NFTs or cryptocurrencies, enhancing liquidity and accessibility. In sports card fractionalization, ownership shares represent partial stakes in rare, tangible collectibles, allowing enthusiasts to diversify their portfolios without full commitment. Explore the evolving benefits and mechanisms behind fractional ownership in both digital and physical asset markets.

Secondary Market

Digital assets fractionalization enables investors to buy and trade partial ownership in blockchain-based tokens, enhancing liquidity and accessibility on secondary markets where instant and transparent transactions are key. Sports card fractionalization involves dividing high-value collectible cards into shares, allowing broader participation but often facing challenges with valuation consistency and market liquidity in secondary trades. Explore the dynamics of these fractionalized markets to understand the future of investing and asset ownership.

Source and External Links

Fractional NFTs 2024 Ultimate Guide - This guide explains how fractional NFTs enable shared ownership of digital assets by dividing them into smaller, fungible parts.

What is Tokenization and Fractionalization - This article discusses how tokenization and fractionalization allow investors to own parts of valuable assets like real estate or artwork through digital tokens.

Advantages of fractionalizing assets through tokenization - This blog explores the benefits of asset fractionalization through tokenization, including increased liquidity and accessibility for small-scale investors.

dowidth.com

dowidth.com