Fractional real estate investing allows individuals to purchase a specific portion of a property, offering direct equity ownership and potential rental income, whereas Real Estate Investment Trusts (REITs) provide exposure to diversified, professionally managed real estate portfolios through publicly traded shares. Fractional investing requires active management decisions, while REITs offer liquidity and passive income with lower entry barriers. Explore the distinct benefits and risks of each approach to determine the best fit for your investment strategy.

Why it is important

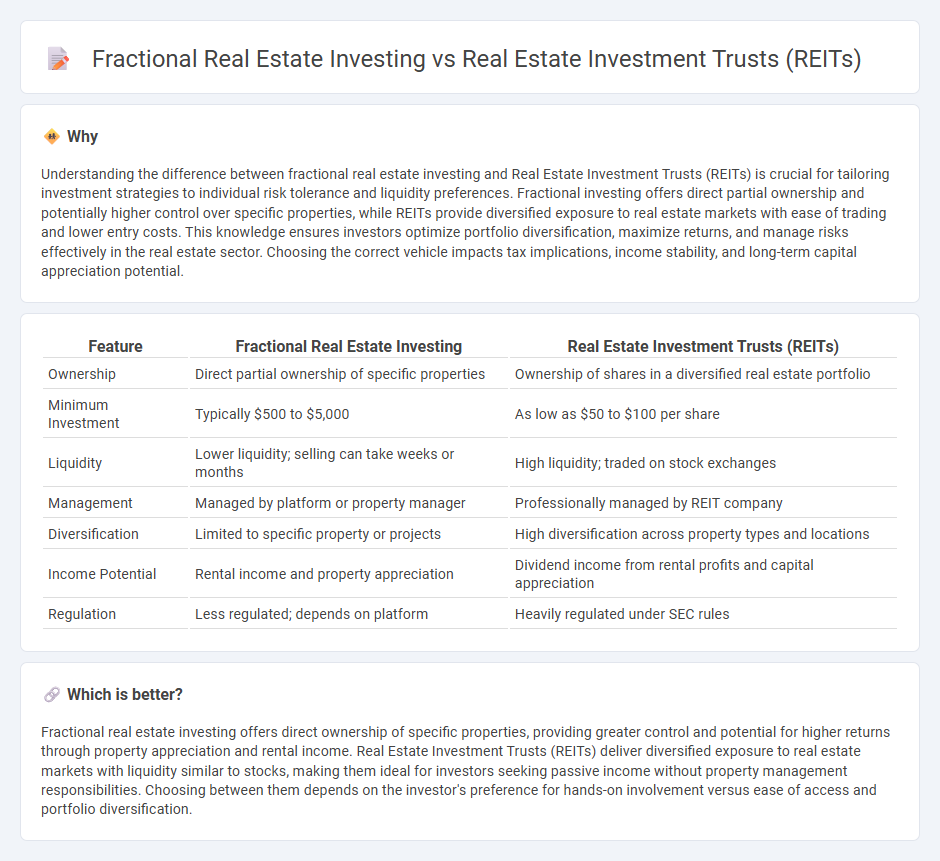

Understanding the difference between fractional real estate investing and Real Estate Investment Trusts (REITs) is crucial for tailoring investment strategies to individual risk tolerance and liquidity preferences. Fractional investing offers direct partial ownership and potentially higher control over specific properties, while REITs provide diversified exposure to real estate markets with ease of trading and lower entry costs. This knowledge ensures investors optimize portfolio diversification, maximize returns, and manage risks effectively in the real estate sector. Choosing the correct vehicle impacts tax implications, income stability, and long-term capital appreciation potential.

Comparison Table

| Feature | Fractional Real Estate Investing | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Ownership | Direct partial ownership of specific properties | Ownership of shares in a diversified real estate portfolio |

| Minimum Investment | Typically $500 to $5,000 | As low as $50 to $100 per share |

| Liquidity | Lower liquidity; selling can take weeks or months | High liquidity; traded on stock exchanges |

| Management | Managed by platform or property manager | Professionally managed by REIT company |

| Diversification | Limited to specific property or projects | High diversification across property types and locations |

| Income Potential | Rental income and property appreciation | Dividend income from rental profits and capital appreciation |

| Regulation | Less regulated; depends on platform | Heavily regulated under SEC rules |

Which is better?

Fractional real estate investing offers direct ownership of specific properties, providing greater control and potential for higher returns through property appreciation and rental income. Real Estate Investment Trusts (REITs) deliver diversified exposure to real estate markets with liquidity similar to stocks, making them ideal for investors seeking passive income without property management responsibilities. Choosing between them depends on the investor's preference for hands-on involvement versus ease of access and portfolio diversification.

Connection

Fractional real estate investing and Real Estate Investment Trusts (REITs) both enable investors to acquire partial ownership in real estate assets, lowering the entry barrier. Fractional investing often involves pooling funds to buy a single property, while REITs offer shares in a diversified portfolio of income-generating properties traded like stocks. Both methods provide liquidity and diversification benefits, making real estate accessible without full property purchase.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer high liquidity through publicly traded shares that can be bought or sold on stock exchanges quickly, providing investors with easy access to their capital. Fractional real estate investing, while offering lower entry costs and ownership in physical properties, often involves longer holding periods and limited secondary markets, resulting in reduced liquidity. Explore in-depth comparisons to understand which investment suits your liquidity needs best.

Ownership structure

Real Estate Investment Trusts (REITs) offer investors shares in a diversified portfolio of income-generating properties managed by professionals, enabling indirect ownership without property management responsibilities. Fractional real estate investing provides direct partial ownership of specific properties, granting investors more control and potential tax benefits but also more involvement in property decisions. Explore the nuances of these ownership structures to determine which investment aligns with your financial goals.

Dividend distribution

Real estate investment trusts (REITs) typically distribute at least 90% of their taxable income as dividends to shareholders, providing a steady income stream. Fractional real estate investing offers income through proportional rental earnings or profit shares, though dividend frequency and amounts can vary widely based on property performance. Explore detailed comparisons to determine which strategy aligns best with your income goals.

Source and External Links

Real estate investment trust - Wikipedia - A real estate investment trust (REIT) is a company that owns and usually operates income-producing real estate, including offices, apartments, shopping centers, and more, with key types being equity REITs and mortgage REITs (mREITs).

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate, providing investors with regular income streams, diversification, and long-term capital appreciation, often trading on major stock exchanges.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale income-producing real estate, typically owning and operating properties for rental income and capital appreciation, with publicly traded and non-traded varieties available.

dowidth.com

dowidth.com