Carbon offset investing involves funding projects that reduce greenhouse gas emissions to compensate for one's carbon footprint, while clean energy stocks represent shares in companies developing renewable energy technologies such as solar, wind, and hydropower. Both investment strategies target sustainability but differ in approach: carbon offsets focus on mitigating existing emissions, whereas clean energy stocks aim to drive innovation and growth in the green energy sector. Explore the advantages and considerations of each to determine which aligns best with your investment goals.

Why it is important

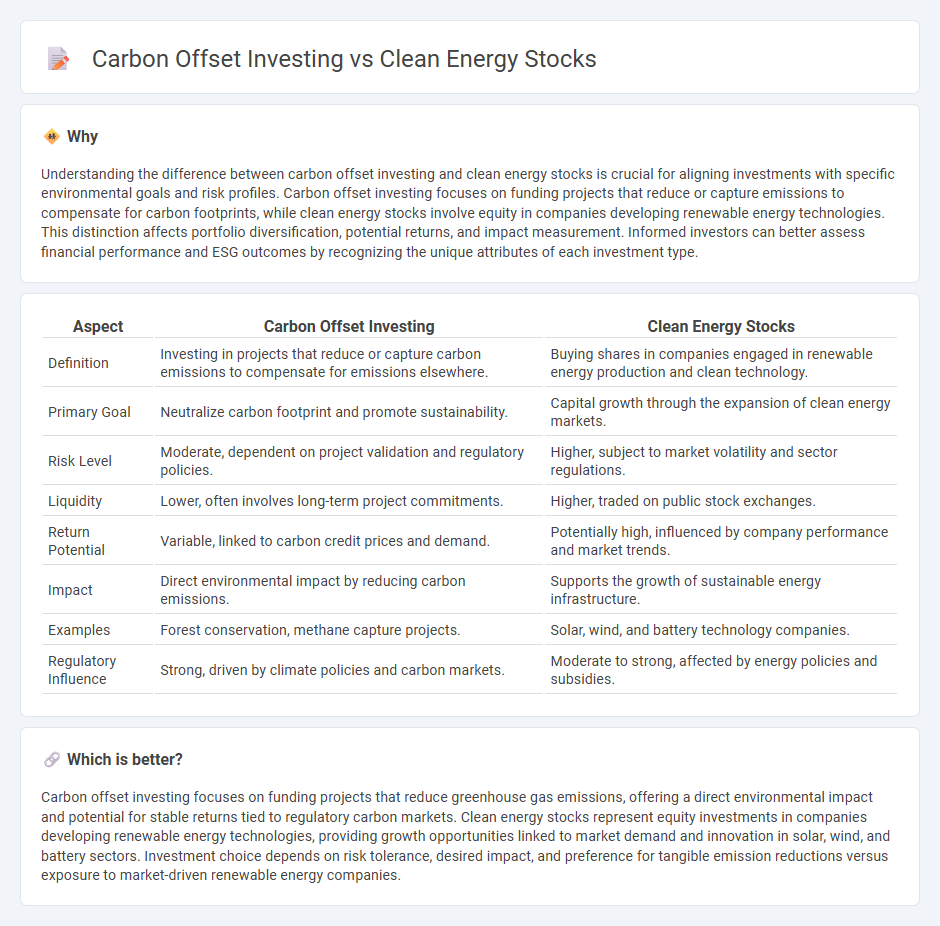

Understanding the difference between carbon offset investing and clean energy stocks is crucial for aligning investments with specific environmental goals and risk profiles. Carbon offset investing focuses on funding projects that reduce or capture emissions to compensate for carbon footprints, while clean energy stocks involve equity in companies developing renewable energy technologies. This distinction affects portfolio diversification, potential returns, and impact measurement. Informed investors can better assess financial performance and ESG outcomes by recognizing the unique attributes of each investment type.

Comparison Table

| Aspect | Carbon Offset Investing | Clean Energy Stocks |

|---|---|---|

| Definition | Investing in projects that reduce or capture carbon emissions to compensate for emissions elsewhere. | Buying shares in companies engaged in renewable energy production and clean technology. |

| Primary Goal | Neutralize carbon footprint and promote sustainability. | Capital growth through the expansion of clean energy markets. |

| Risk Level | Moderate, dependent on project validation and regulatory policies. | Higher, subject to market volatility and sector regulations. |

| Liquidity | Lower, often involves long-term project commitments. | Higher, traded on public stock exchanges. |

| Return Potential | Variable, linked to carbon credit prices and demand. | Potentially high, influenced by company performance and market trends. |

| Impact | Direct environmental impact by reducing carbon emissions. | Supports the growth of sustainable energy infrastructure. |

| Examples | Forest conservation, methane capture projects. | Solar, wind, and battery technology companies. |

| Regulatory Influence | Strong, driven by climate policies and carbon markets. | Moderate to strong, affected by energy policies and subsidies. |

Which is better?

Carbon offset investing focuses on funding projects that reduce greenhouse gas emissions, offering a direct environmental impact and potential for stable returns tied to regulatory carbon markets. Clean energy stocks represent equity investments in companies developing renewable energy technologies, providing growth opportunities linked to market demand and innovation in solar, wind, and battery sectors. Investment choice depends on risk tolerance, desired impact, and preference for tangible emission reductions versus exposure to market-driven renewable energy companies.

Connection

Carbon offset investing complements clean energy stocks by funding projects that reduce greenhouse gas emissions, which enhances the overall impact of clean energy initiatives. Investing in clean energy stocks promotes the growth of renewable energy companies, while carbon offset projects provide measurable environmental benefits that support corporate sustainability goals. Both investment strategies drive the transition to a low-carbon economy by encouraging innovation and reducing dependency on fossil fuels.

Key Terms

Renewable Energy

Clean energy stocks represent direct investment in companies developing solar, wind, and other renewable technologies, offering potential growth aligned with the global shift to sustainable power. Carbon offset investing involves funding projects that reduce or capture greenhouse gas emissions, complementing renewable energy efforts by mitigating environmental impact but often with less direct market exposure. Explore deeper insights into renewable energy investment strategies to optimize your portfolio impact.

Greenhouse Gas Emissions

Clean energy stocks represent direct investments in companies developing renewable energy technologies such as solar, wind, and hydro power, significantly reducing greenhouse gas emissions by replacing fossil fuel-based energy sources. In contrast, carbon offset investing involves funding projects that capture or reduce emissions elsewhere, such as reforestation or methane capture, to compensate for emissions produced, often providing a more indirect impact. Explore the differences and impacts of these strategies to find out which approach aligns better with your sustainability goals.

Carbon Credits

Carbon credits represent a market-based mechanism designed to reduce greenhouse gas emissions by allowing companies to purchase credits to offset their carbon footprint. Unlike clean energy stocks, which involve direct investment in renewable energy companies, carbon offset investing focuses on funding projects that sequester or reduce emissions indirectly, such as reforestation or methane capture. Explore how carbon credits can complement your investment strategy by providing both environmental impact and potential financial returns.

Source and External Links

Best green energy stocks to watch - IG - Highlights key clean energy stocks including NextEra Energy, a leading U.S. wind and solar company, and Tesla, known for EVs and energy storage solutions, emphasizing steady growth and industry leadership in renewables.

Top 5 Renewable Energy Stocks to Watch for July 2025 - NerdWallet - Provides a list of notable renewable energy stocks like Eco Wave Power, Constellation Energy, and Clearway Energy, along with their recent performance, focusing on investment and growth potential in clean energy utilities.

Our Top Picks for Investing in US Renewable Energy - Morningstar - Recommends First Solar and Brookfield Renewable Partners as attractive clean energy investments based on valuation, diversification, and growth strategies in the solar and broader renewable energy sectors.

dowidth.com

dowidth.com