Livestock investment platforms offer direct exposure to agricultural assets, enabling investors to participate in the growing global demand for animal protein, while stock trading platforms provide access to diversified equity markets with varying risk and return profiles. Investment in livestock assets often involves tangible goods and biological cycles, contrasting with the financial instruments traded on stock exchanges. Explore the benefits and risks of each to determine which investment approach aligns with your portfolio goals.

Why it is important

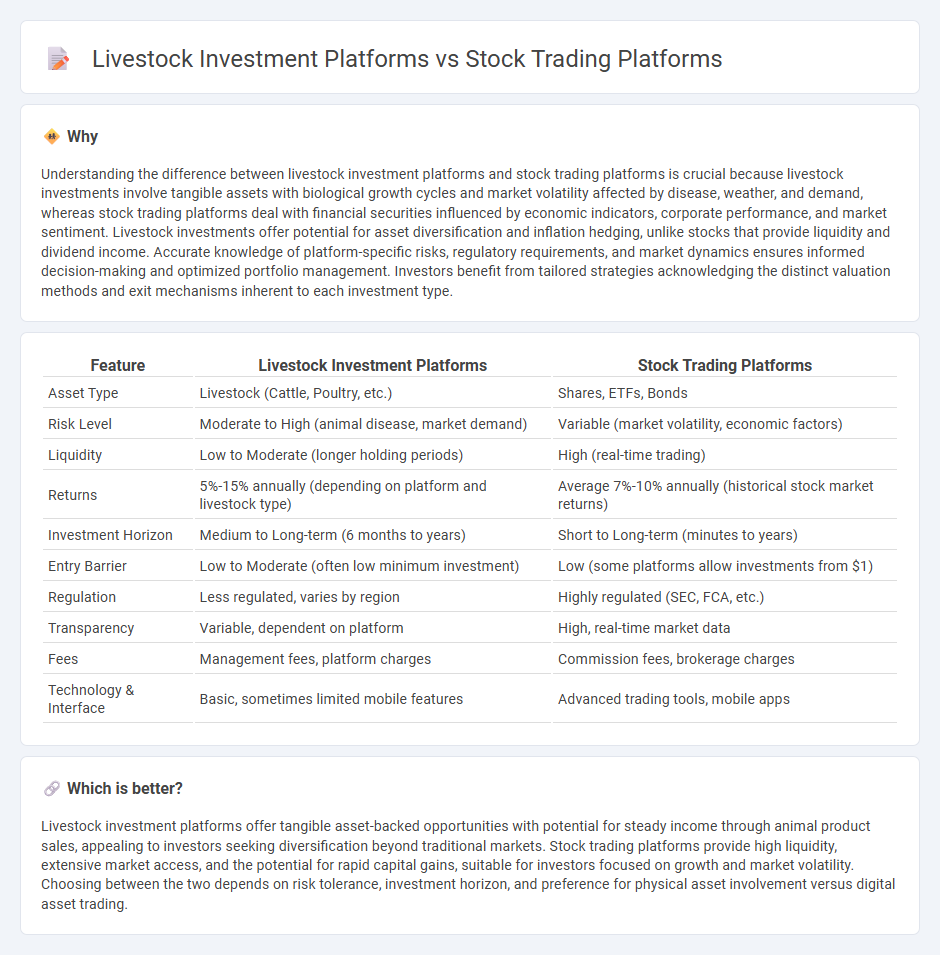

Understanding the difference between livestock investment platforms and stock trading platforms is crucial because livestock investments involve tangible assets with biological growth cycles and market volatility affected by disease, weather, and demand, whereas stock trading platforms deal with financial securities influenced by economic indicators, corporate performance, and market sentiment. Livestock investments offer potential for asset diversification and inflation hedging, unlike stocks that provide liquidity and dividend income. Accurate knowledge of platform-specific risks, regulatory requirements, and market dynamics ensures informed decision-making and optimized portfolio management. Investors benefit from tailored strategies acknowledging the distinct valuation methods and exit mechanisms inherent to each investment type.

Comparison Table

| Feature | Livestock Investment Platforms | Stock Trading Platforms |

|---|---|---|

| Asset Type | Livestock (Cattle, Poultry, etc.) | Shares, ETFs, Bonds |

| Risk Level | Moderate to High (animal disease, market demand) | Variable (market volatility, economic factors) |

| Liquidity | Low to Moderate (longer holding periods) | High (real-time trading) |

| Returns | 5%-15% annually (depending on platform and livestock type) | Average 7%-10% annually (historical stock market returns) |

| Investment Horizon | Medium to Long-term (6 months to years) | Short to Long-term (minutes to years) |

| Entry Barrier | Low to Moderate (often low minimum investment) | Low (some platforms allow investments from $1) |

| Regulation | Less regulated, varies by region | Highly regulated (SEC, FCA, etc.) |

| Transparency | Variable, dependent on platform | High, real-time market data |

| Fees | Management fees, platform charges | Commission fees, brokerage charges |

| Technology & Interface | Basic, sometimes limited mobile features | Advanced trading tools, mobile apps |

Which is better?

Livestock investment platforms offer tangible asset-backed opportunities with potential for steady income through animal product sales, appealing to investors seeking diversification beyond traditional markets. Stock trading platforms provide high liquidity, extensive market access, and the potential for rapid capital gains, suitable for investors focused on growth and market volatility. Choosing between the two depends on risk tolerance, investment horizon, and preference for physical asset involvement versus digital asset trading.

Connection

Livestock investment platforms and stock trading platforms are connected through their shared use of digital technology to facilitate asset ownership and trading for investors. Both platforms leverage real-time data analytics and market trends to optimize investment decisions and maximize returns. Integration of blockchain technology enhances transparency, security, and trust in transactions across these diverse investment sectors.

Key Terms

Brokerage

Stock trading platforms offer real-time market data, advanced charting tools, and a wide range of brokerage services designed for equity, options, and futures trading, catering to diverse investor needs with competitive commission rates and regulatory compliance. Livestock investment platforms function as niche brokerage intermediaries providing access to physical or tokenized livestock assets, emphasizing agricultural market expertise, asset valuation, and risk management specific to livestock markets. Explore the detailed comparison of brokerage features and investment strategies to determine which platform suits your portfolio goals best.

Asset type

Stock trading platforms primarily facilitate the buying and selling of financial securities such as equities, ETFs, and derivatives, which represent ownership or claims on tangible assets or corporate earnings. Livestock investment platforms, on the other hand, enable investors to allocate capital to physical livestock assets like cattle, sheep, or poultry, often deriving returns from asset appreciation and agricultural yields. Explore the distinct asset types and risks involved to make informed investment decisions.

Liquidity

Stock trading platforms offer high liquidity, allowing investors to buy and sell shares quickly with minimal price impact, supported by large volumes and continuous market hours. Livestock investment platforms exhibit lower liquidity as animals cannot be sold instantly; transactions often span longer periods with complexities like animal health and market demand influencing sale speed. Explore the differences further to understand which investment suits your liquidity needs best.

Source and External Links

Trading | Charles Schwab - Charles Schwab provides a robust suite of trading platforms--including thinkorswim, Schwab.com, and Schwab Mobile--with 24/5 trading on stocks, ETFs, and futures, award-winning tools, and zero commissions on stock and ETF trades.

Firstrade Securities - Online Stock Trading, Investing, Online Broker - Firstrade offers $0 commission trades on stocks and options, customizable desktop and mobile platforms, extended-hours trading, and access to advanced analytics and research tools from top providers.

7 Best Stock Trading Platforms for Beginners of 2025 - Major platforms like Charles Schwab, Fidelity, Interactive Brokers, Moomoo, Public, Robinhood, and Webull stand out for beginners due to their low fees, user-friendly interfaces, and quality customer support.

dowidth.com

dowidth.com