Wine investing platforms offer tangible asset exposure with historically stable returns driven by global demand for fine wines, attracting investors interested in alternative, inflation-resistant portfolios. Angel investing networks provide access to high-growth potential startups, enabling investors to diversify through equity stakes while benefiting from hands-on opportunities in emerging industries. Explore these distinct investment avenues to align your portfolio with your financial goals and risk tolerance.

Why it is important

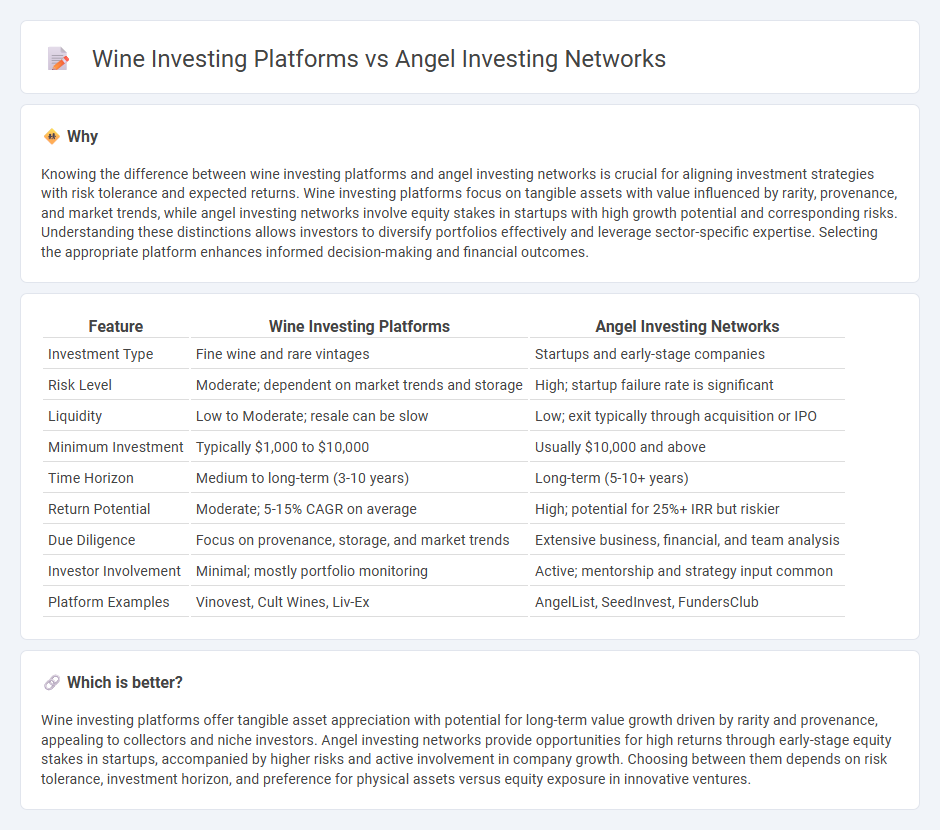

Knowing the difference between wine investing platforms and angel investing networks is crucial for aligning investment strategies with risk tolerance and expected returns. Wine investing platforms focus on tangible assets with value influenced by rarity, provenance, and market trends, while angel investing networks involve equity stakes in startups with high growth potential and corresponding risks. Understanding these distinctions allows investors to diversify portfolios effectively and leverage sector-specific expertise. Selecting the appropriate platform enhances informed decision-making and financial outcomes.

Comparison Table

| Feature | Wine Investing Platforms | Angel Investing Networks |

|---|---|---|

| Investment Type | Fine wine and rare vintages | Startups and early-stage companies |

| Risk Level | Moderate; dependent on market trends and storage | High; startup failure rate is significant |

| Liquidity | Low to Moderate; resale can be slow | Low; exit typically through acquisition or IPO |

| Minimum Investment | Typically $1,000 to $10,000 | Usually $10,000 and above |

| Time Horizon | Medium to long-term (3-10 years) | Long-term (5-10+ years) |

| Return Potential | Moderate; 5-15% CAGR on average | High; potential for 25%+ IRR but riskier |

| Due Diligence | Focus on provenance, storage, and market trends | Extensive business, financial, and team analysis |

| Investor Involvement | Minimal; mostly portfolio monitoring | Active; mentorship and strategy input common |

| Platform Examples | Vinovest, Cult Wines, Liv-Ex | AngelList, SeedInvest, FundersClub |

Which is better?

Wine investing platforms offer tangible asset appreciation with potential for long-term value growth driven by rarity and provenance, appealing to collectors and niche investors. Angel investing networks provide opportunities for high returns through early-stage equity stakes in startups, accompanied by higher risks and active involvement in company growth. Choosing between them depends on risk tolerance, investment horizon, and preference for physical assets versus equity exposure in innovative ventures.

Connection

Wine investing platforms and angel investing networks intersect through their focus on alternative asset classes that attract high-net-worth individuals seeking portfolio diversification. Both channels offer exclusive access to niche markets--wine investing leverages rare vintages with historical appreciation trends, while angel investing connects investors with early-stage startups promising potential high returns. Their shared emphasis on curated investment opportunities and community-driven platforms fosters trust and informed decision-making among sophisticated investors.

Key Terms

**Angel investing networks:**

Angel investing networks connect accredited investors with early-stage startups, providing access to high-growth potential ventures and opportunities to diversify investment portfolios. These networks offer mentorship, due diligence support, and collaborative investment opportunities across various industries. Explore how angel investing networks can accelerate your startup investments and wealth building strategies.

Deal flow

Angel investing networks provide curated deal flow with early-stage startup opportunities vetted by experienced investors, often ensuring higher quality and growth potential. Wine investing platforms offer access to rare and collectible wines, with deal flow driven by market trends and auction availability rather than company fundamentals. Explore how each approach impacts investment strategies and returns by learning more about their deal flow dynamics.

Due diligence

Angel investing networks emphasize rigorous due diligence by thoroughly evaluating startup founders, market potential, and financial projections to mitigate high risks and maximize returns. Wine investing platforms typically focus due diligence on provenance, authenticity, condition, and market trends for collectible wines to ensure asset quality and liquidity. Explore deeper insights into due diligence practices across these investment avenues to make informed decisions.

Source and External Links

Angel Networks - Lists several faith-driven angel investing groups like Ambassadors Impact Network, Beyond Angel Network, and Commonwealth Impact Investing, connecting investors with startups focused on social impact and faith-based missions.

IU Angel Network | Information For Investors - Facilitates connections between Indiana University startups and angel investors using an online platform, focusing on curated early-stage companies and providing members access to deal flow and educational resources.

13 Best Angel Investor Groups for Startups - Highlights top angel groups such as Pasadena Angels, Alliance of Angels, Band of Angels, and Hyde Park Angels, describing their regional focus, investment size, and industry specialties.

dowidth.com

dowidth.com