Music royalties investment offers steady income streams through royalties generated by song plays and licensing, often benefiting from long-term, recurring revenue. Film rights investment typically involves higher initial costs but can yield significant returns from box office sales, streaming, and distribution deals. Explore the advantages and risks of each to make informed decisions on diversifying your investment portfolio.

Why it is important

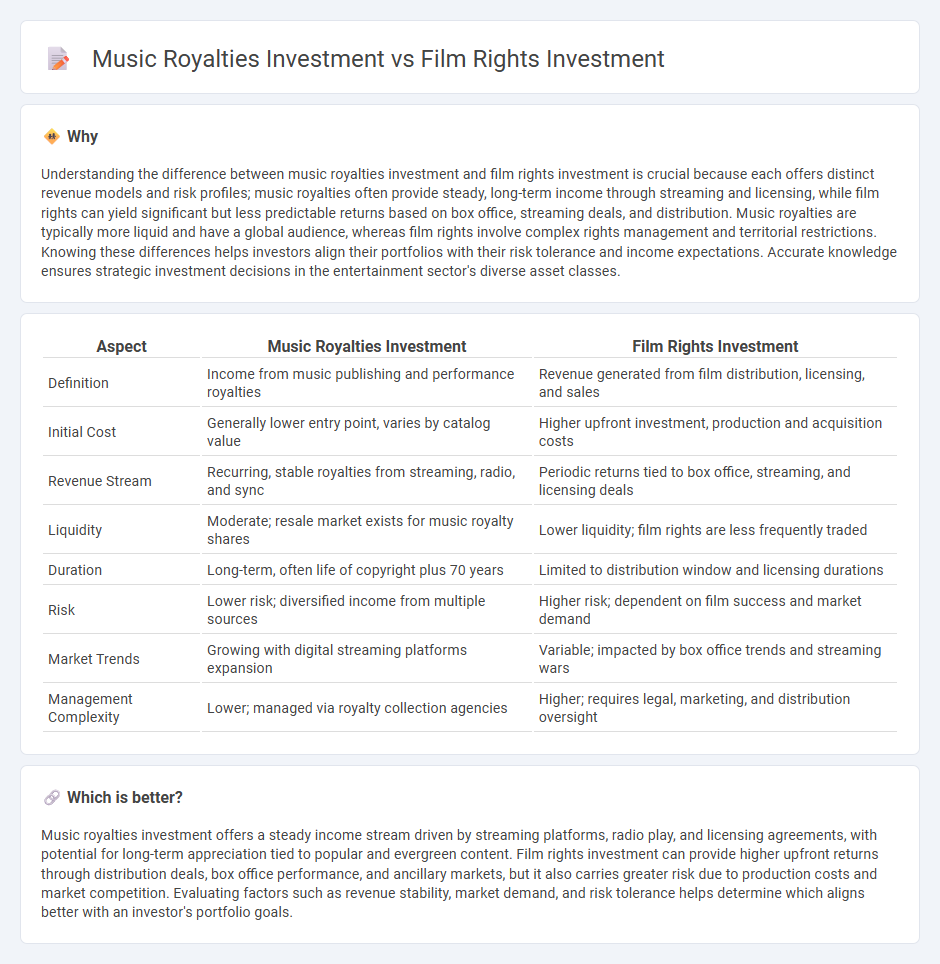

Understanding the difference between music royalties investment and film rights investment is crucial because each offers distinct revenue models and risk profiles; music royalties often provide steady, long-term income through streaming and licensing, while film rights can yield significant but less predictable returns based on box office, streaming deals, and distribution. Music royalties are typically more liquid and have a global audience, whereas film rights involve complex rights management and territorial restrictions. Knowing these differences helps investors align their portfolios with their risk tolerance and income expectations. Accurate knowledge ensures strategic investment decisions in the entertainment sector's diverse asset classes.

Comparison Table

| Aspect | Music Royalties Investment | Film Rights Investment |

|---|---|---|

| Definition | Income from music publishing and performance royalties | Revenue generated from film distribution, licensing, and sales |

| Initial Cost | Generally lower entry point, varies by catalog value | Higher upfront investment, production and acquisition costs |

| Revenue Stream | Recurring, stable royalties from streaming, radio, and sync | Periodic returns tied to box office, streaming, and licensing deals |

| Liquidity | Moderate; resale market exists for music royalty shares | Lower liquidity; film rights are less frequently traded |

| Duration | Long-term, often life of copyright plus 70 years | Limited to distribution window and licensing durations |

| Risk | Lower risk; diversified income from multiple sources | Higher risk; dependent on film success and market demand |

| Market Trends | Growing with digital streaming platforms expansion | Variable; impacted by box office trends and streaming wars |

| Management Complexity | Lower; managed via royalty collection agencies | Higher; requires legal, marketing, and distribution oversight |

Which is better?

Music royalties investment offers a steady income stream driven by streaming platforms, radio play, and licensing agreements, with potential for long-term appreciation tied to popular and evergreen content. Film rights investment can provide higher upfront returns through distribution deals, box office performance, and ancillary markets, but it also carries greater risk due to production costs and market competition. Evaluating factors such as revenue stability, market demand, and risk tolerance helps determine which aligns better with an investor's portfolio goals.

Connection

Music royalties investment and film rights investment are interconnected through their shared reliance on intellectual property rights that generate passive income streams from licensing and usage fees. Both types of investments capitalize on the continuous revenue generated by publicly consumed content, with music royalties deriving income from streaming, broadcasts, and public performances, while film rights income stems from distribution, broadcasting, and digital streaming platforms. Investors benefit from the growing demand for entertainment content, leveraging legal ownership to secure long-term, inflation-resistant cash flows within the broader media and entertainment investment sector.

Key Terms

Film rights investment:

Film rights investment offers significant revenue potential through box office sales, streaming licenses, and merchandising, often yielding higher returns compared to music royalties due to larger audience reach and varied income streams. This asset class benefits from long-term value appreciation as popular films maintain relevance through multiple distribution channels, including theatrical re-releases and digital platforms. Explore how diversifying your portfolio with film rights can unlock lucrative opportunities in media investments.

Distribution agreements

Film rights investment offers revenue streams through distribution agreements that grant investors participation in box office, streaming, and DVD sales, often tied to specific territories and time frames. Music royalties investment relies on distribution agreements that channel income from digital platforms, radio play, and physical sales, with rights typically segmented by mechanical, performance, and synchronization royalties. Explore how strategic distribution agreements influence cash flow and long-term returns in both film rights and music royalties investment.

Box office gross

Investing in film rights offers potential returns tied directly to box office gross, with earnings influenced by ticket sales performance and distribution deals. Music royalties investment relies on streaming, airplay, and licensing fees, generating steady income independent of box office trends. Explore in-depth comparisons and data insights to determine the optimal investment strategy.

Source and External Links

Essential Elements of an Investor Contract in Filmmaking - Film rights investment typically involves equity or debt investment where investors get repaid first, then share profits; filmmakers maintain control over key elements to maximize long-term earnings from various revenue streams including merchandising and sequel rights.

Independent Film Financing - How It Works - Hrbek Law - Investors in films often receive a share of net proceeds based on their investment, getting repaid first with interest, then sharing in profits typically split equally between investors and producers after all costs are covered.

Action: How your investment funds movies at every stage of filmmaking - Film rights investment can happen at development or production stages, with investors funding acquisition of intellectual property and film packaging or financing production costs, receiving returns as a premium on capital plus profit shares, often split 50/50 with producers.

dowidth.com

dowidth.com