Wine investing offers potential appreciation through rare vintages and global demand, often providing portfolio diversification with relatively low correlation to traditional assets. Farmland investing delivers steady income via crop production and benefits from land value appreciation driven by increasing food demand and limited supply. Explore the unique advantages and risks of each asset class to refine your investment strategy.

Why it is important

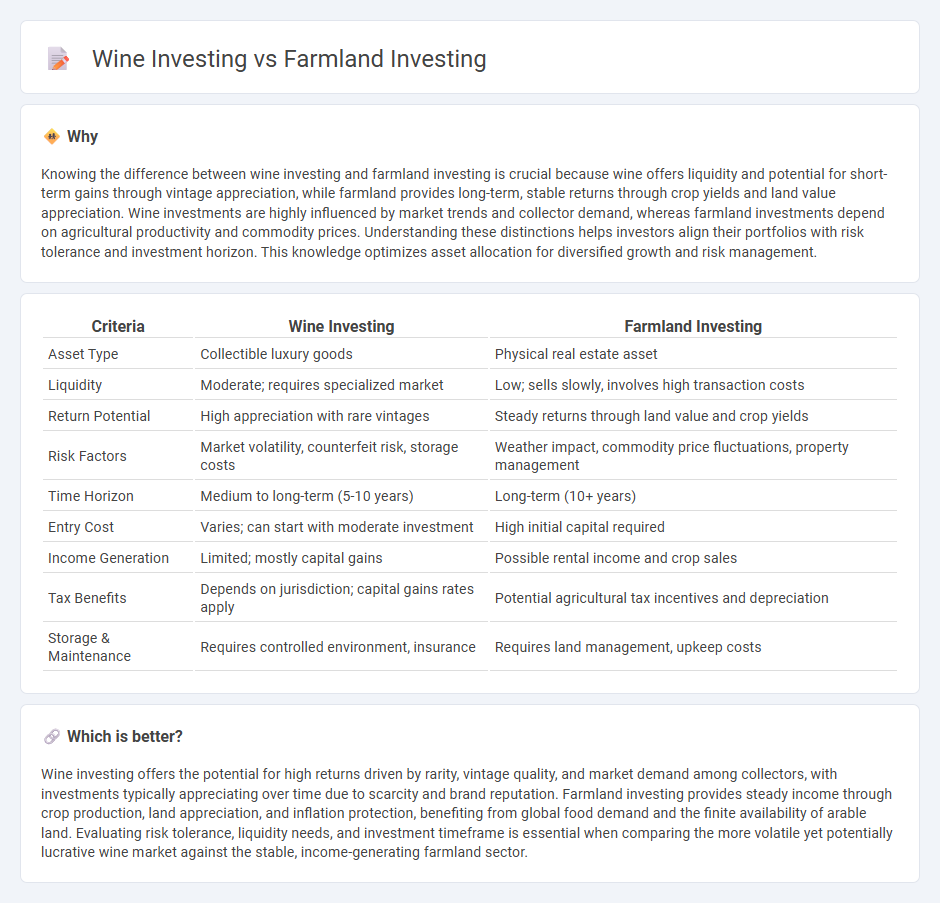

Knowing the difference between wine investing and farmland investing is crucial because wine offers liquidity and potential for short-term gains through vintage appreciation, while farmland provides long-term, stable returns through crop yields and land value appreciation. Wine investments are highly influenced by market trends and collector demand, whereas farmland investments depend on agricultural productivity and commodity prices. Understanding these distinctions helps investors align their portfolios with risk tolerance and investment horizon. This knowledge optimizes asset allocation for diversified growth and risk management.

Comparison Table

| Criteria | Wine Investing | Farmland Investing |

|---|---|---|

| Asset Type | Collectible luxury goods | Physical real estate asset |

| Liquidity | Moderate; requires specialized market | Low; sells slowly, involves high transaction costs |

| Return Potential | High appreciation with rare vintages | Steady returns through land value and crop yields |

| Risk Factors | Market volatility, counterfeit risk, storage costs | Weather impact, commodity price fluctuations, property management |

| Time Horizon | Medium to long-term (5-10 years) | Long-term (10+ years) |

| Entry Cost | Varies; can start with moderate investment | High initial capital required |

| Income Generation | Limited; mostly capital gains | Possible rental income and crop sales |

| Tax Benefits | Depends on jurisdiction; capital gains rates apply | Potential agricultural tax incentives and depreciation |

| Storage & Maintenance | Requires controlled environment, insurance | Requires land management, upkeep costs |

Which is better?

Wine investing offers the potential for high returns driven by rarity, vintage quality, and market demand among collectors, with investments typically appreciating over time due to scarcity and brand reputation. Farmland investing provides steady income through crop production, land appreciation, and inflation protection, benefiting from global food demand and the finite availability of arable land. Evaluating risk tolerance, liquidity needs, and investment timeframe is essential when comparing the more volatile yet potentially lucrative wine market against the stable, income-generating farmland sector.

Connection

Wine investing and farmland investing share a strong connection through their reliance on agricultural production and land value appreciation. Both asset classes benefit from favorable climate conditions, land quality, and long-term sustainability, which drive the quality and market value of wine and crops. Diversification across these tangible assets provides investors with inflation protection and potential steady income from vineyard yields or farm produce sales.

Key Terms

Farmland investing:

Farmland investing offers tangible asset value through agricultural land, providing steady income streams from crop production and potential appreciation linked to rising food demand and limited arable land. It presents diversification benefits and inflation hedging due to its physical nature and essential role in the global economy. Explore our in-depth analysis to understand why farmland investing can be a resilient addition to your portfolio.

Crop yield

Farmland investing offers consistent returns driven by crop yield metrics such as bushels per acre, seasonal weather patterns, and soil fertility, making it a tangible asset with quantifiable productivity. Wine investing hinges on vineyard output quality and grape harvest quantities, often influenced by terroir and vintage variations that affect the final wine valuation. Explore the nuances of crop yield factors to better understand how these asset classes compare in generating investment returns.

Land appreciation

Farmland investing offers consistent land appreciation driven by increasing global food demand and limited arable land, with average annual returns often exceeding 6%. Wine investing, while potentially profitable, relies more on the wine's age and rarity than land value, making its appreciation less stable and more market-sensitive. Explore the distinct benefits of each investment type to determine which aligns best with your financial goals.

Source and External Links

Farmland Investing - Farmland investing can be accessed indirectly through Farmland REITs, which offer liquidity and diversification without the need to operate farms directly, making it an attractive option for investors seeking stable, long-term value.

Investing in farmland - Direct farmland investment offers stable returns, inflation hedging, and portfolio diversification, with opportunities varying between U.S. markets known for stability and emerging markets which offer higher growth potential.

FarmTogether - Invest in US Farmland - FarmTogether provides fractional ownership in U.S. farmland, enabling accredited investors to participate in farmland investments with lower entry costs and benefit from farmland's low volatility, inflation hedge, and attractive yields.

dowidth.com

dowidth.com