Fine art micro-shares allow investors to purchase fractional ownership in valuable artworks, providing access to the art market with lower capital requirements and potential appreciation tied to the art's market value. Peer-to-peer lending offers direct lending opportunities to individuals or businesses via online platforms, generating returns through interest payments and diversifying income sources. Explore the advantages and risks of these innovative investment options to diversify your portfolio.

Why it is important

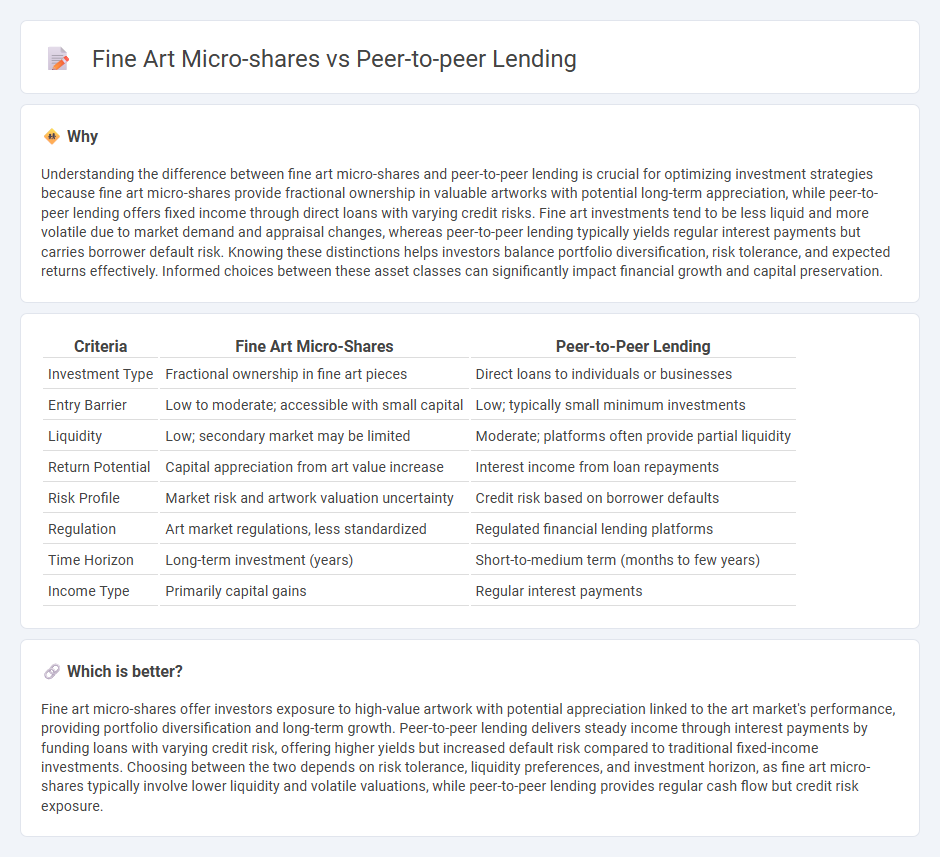

Understanding the difference between fine art micro-shares and peer-to-peer lending is crucial for optimizing investment strategies because fine art micro-shares provide fractional ownership in valuable artworks with potential long-term appreciation, while peer-to-peer lending offers fixed income through direct loans with varying credit risks. Fine art investments tend to be less liquid and more volatile due to market demand and appraisal changes, whereas peer-to-peer lending typically yields regular interest payments but carries borrower default risk. Knowing these distinctions helps investors balance portfolio diversification, risk tolerance, and expected returns effectively. Informed choices between these asset classes can significantly impact financial growth and capital preservation.

Comparison Table

| Criteria | Fine Art Micro-Shares | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Fractional ownership in fine art pieces | Direct loans to individuals or businesses |

| Entry Barrier | Low to moderate; accessible with small capital | Low; typically small minimum investments |

| Liquidity | Low; secondary market may be limited | Moderate; platforms often provide partial liquidity |

| Return Potential | Capital appreciation from art value increase | Interest income from loan repayments |

| Risk Profile | Market risk and artwork valuation uncertainty | Credit risk based on borrower defaults |

| Regulation | Art market regulations, less standardized | Regulated financial lending platforms |

| Time Horizon | Long-term investment (years) | Short-to-medium term (months to few years) |

| Income Type | Primarily capital gains | Regular interest payments |

Which is better?

Fine art micro-shares offer investors exposure to high-value artwork with potential appreciation linked to the art market's performance, providing portfolio diversification and long-term growth. Peer-to-peer lending delivers steady income through interest payments by funding loans with varying credit risk, offering higher yields but increased default risk compared to traditional fixed-income investments. Choosing between the two depends on risk tolerance, liquidity preferences, and investment horizon, as fine art micro-shares typically involve lower liquidity and volatile valuations, while peer-to-peer lending provides regular cash flow but credit risk exposure.

Connection

Fine art micro-shares and peer-to-peer lending intersect by democratizing investment opportunities and enhancing portfolio diversification. Both platforms leverage technology to allow fractional ownership and direct lending, reducing barriers for small investors while increasing market liquidity. This connection fosters alternative investment avenues that combine tangible asset appreciation with fixed-income returns.

Key Terms

Risk assessment

Peer-to-peer lending involves assessing credit risk through borrower credit scores, income verification, and historical repayment data to minimize defaults. Fine art micro-shares risk evaluation centers on market volatility, provenance authenticity, and liquidity challenges associated with fractional ownership. Explore detailed risk assessment frameworks to make informed investment choices in these alternative asset classes.

Liquidity

Peer-to-peer lending offers higher liquidity through structured loan terms and established secondary markets, enabling investors to exit positions relatively quickly. Fine art micro-shares, while providing access to high-value assets, often face limited liquidity due to fewer buyers and regulatory constraints. Explore the nuances of liquidity dynamics in both investment models to make informed financial decisions.

Diversification

Peer-to-peer lending offers diversification through spreading investments across multiple borrowers, mitigating risk by avoiding reliance on a single debt source. Fine art micro-shares enable investors to diversify into tangible assets by owning fractional interests in high-value artworks, providing exposure to an alternative asset class that often appreciates independently from traditional markets. Explore how combining these diversified investment options can enhance your portfolio's resilience and growth potential.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer (P2P) lending is a method where borrowers get loans from individual investors instead of banks through specialized online platforms, offering potentially lower eligibility requirements and flexible terms, while lenders earn interest as their profit.

Peer-to-peer lending - Wikipedia - P2P lending is an alternative financial service conducted online where individuals lend to others without traditional intermediaries, involving credit checks, loan servicing, and sometimes allowing lenders to select borrowers, with loans possibly unsecured and not government insured.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending connects people or businesses wanting to lend money with borrowers through online marketplaces, typically offering higher interest rates than savings accounts but with higher risk, sometimes spreading lenders' funds over multiple loans.

dowidth.com

dowidth.com