Forestry investment offers sustainable returns through timber growth, carbon credits, and land appreciation, providing long-term environmental and economic benefits. Mineral rights investment focuses on owning subsurface resources such as oil, gas, or minerals, often yielding higher but more volatile returns dependent on extraction and market demand. Explore the advantages and risks of both sectors to determine the best investment strategy for your portfolio.

Why it is important

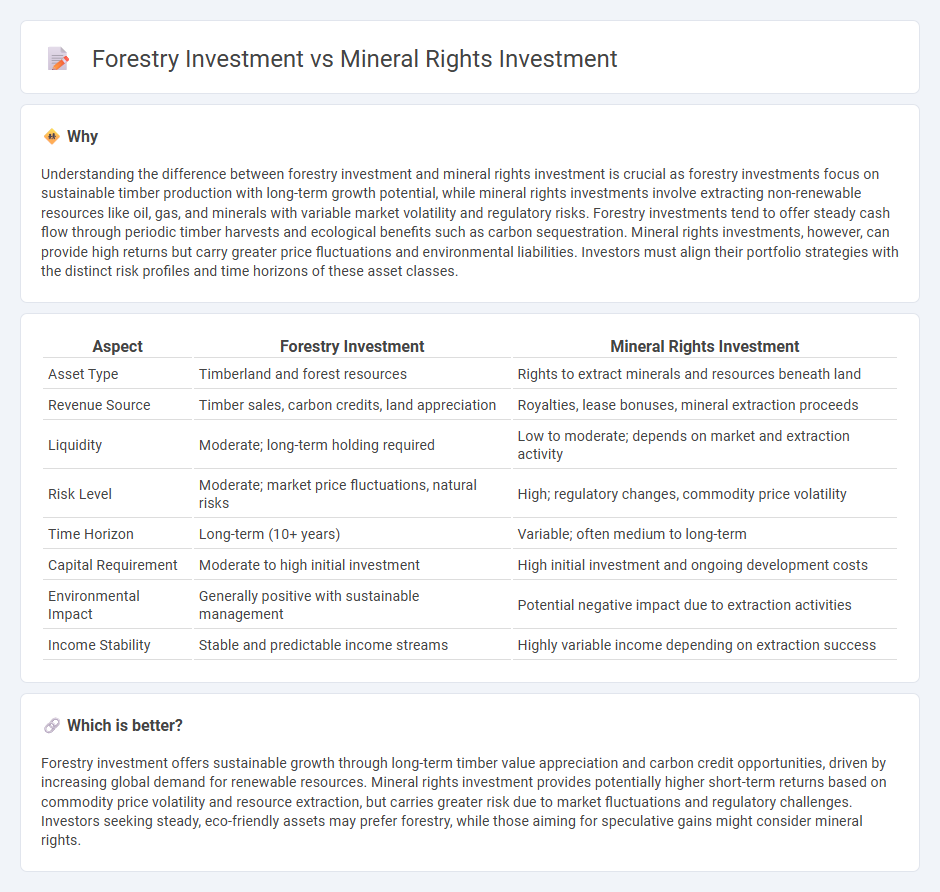

Understanding the difference between forestry investment and mineral rights investment is crucial as forestry investments focus on sustainable timber production with long-term growth potential, while mineral rights investments involve extracting non-renewable resources like oil, gas, and minerals with variable market volatility and regulatory risks. Forestry investments tend to offer steady cash flow through periodic timber harvests and ecological benefits such as carbon sequestration. Mineral rights investments, however, can provide high returns but carry greater price fluctuations and environmental liabilities. Investors must align their portfolio strategies with the distinct risk profiles and time horizons of these asset classes.

Comparison Table

| Aspect | Forestry Investment | Mineral Rights Investment |

|---|---|---|

| Asset Type | Timberland and forest resources | Rights to extract minerals and resources beneath land |

| Revenue Source | Timber sales, carbon credits, land appreciation | Royalties, lease bonuses, mineral extraction proceeds |

| Liquidity | Moderate; long-term holding required | Low to moderate; depends on market and extraction activity |

| Risk Level | Moderate; market price fluctuations, natural risks | High; regulatory changes, commodity price volatility |

| Time Horizon | Long-term (10+ years) | Variable; often medium to long-term |

| Capital Requirement | Moderate to high initial investment | High initial investment and ongoing development costs |

| Environmental Impact | Generally positive with sustainable management | Potential negative impact due to extraction activities |

| Income Stability | Stable and predictable income streams | Highly variable income depending on extraction success |

Which is better?

Forestry investment offers sustainable growth through long-term timber value appreciation and carbon credit opportunities, driven by increasing global demand for renewable resources. Mineral rights investment provides potentially higher short-term returns based on commodity price volatility and resource extraction, but carries greater risk due to market fluctuations and regulatory challenges. Investors seeking steady, eco-friendly assets may prefer forestry, while those aiming for speculative gains might consider mineral rights.

Connection

Forestry investment and mineral rights investment intersect through the shared asset of land ownership, where investors capitalize on the natural resources available beneath and above the surface. Both investments rely on the sustainable management and long-term appreciation of land assets, balancing ecological considerations with economic returns from timber and mineral extraction. This connection enhances portfolio diversification by integrating renewable timber growth cycles with finite mineral resource exploitation.

Key Terms

Resource Ownership

Investing in mineral rights offers long-term royalties from valuable resources like oil, gas, and minerals, providing a steady income stream as extraction continues. Forestry investments generate returns through sustainable timber harvesting and carbon credit trading, leveraging renewable natural assets. Explore detailed comparisons to determine which resource ownership aligns best with your portfolio goals.

Lease/Royalty Agreements

Lease and royalty agreements in mineral rights investments typically provide consistent passive income derived from resource extraction, with royalties calculated as a percentage of production or revenue. Forestry lease agreements often involve longer-term commitments with lease payments based on timber harvesting schedules and can include royalty-like arrangements tied to timber volume or sales prices. Explore the nuances of lease and royalty structures in mineral and forestry investments to maximize returns and manage risks effectively.

Land Appreciation

Mineral rights investment often yields higher land appreciation due to the potential extraction of valuable resources like oil, gas, or minerals, driving up property value significantly. Forestry investments provide steady, long-term appreciation influenced by timber growth, sustainable harvesting practices, and increasing demand for wood products. Explore the key differences in land value growth to determine which investment aligns best with your financial goals.

Source and External Links

Investing in mineral rights: A path to passive income - Mineral rights investments generate passive income primarily through royalty payments from resource extraction, and success requires due diligence, diversification, and expert advice.

Investing In Mineral Rights: Benefits, Risk, Considerations & Advices - Mineral rights investment methods include direct ownership, partnerships, royalty interests, and ETFs, offering diversification and passive revenue without management hassles.

A Primer On Mineral Rights - Siltstone Capital - Mineral rights investments provide portfolio diversification, passive income, inflation hedging, and potentially high returns through strategic acquisitions and management.

dowidth.com

dowidth.com