Farmland funds offer investors exposure to agricultural land assets, providing potential income through crop yields and land appreciation, while real estate investment trusts (REITs) focus on diversified real estate portfolios including residential, commercial, or industrial properties with regular dividend distributions. Farmland investments typically show lower volatility and correlation to traditional markets compared to REITs, which are more sensitive to economic cycles and interest rate fluctuations. Explore the unique benefits and risks of farmland funds versus REITs to optimize your investment strategy.

Why it is important

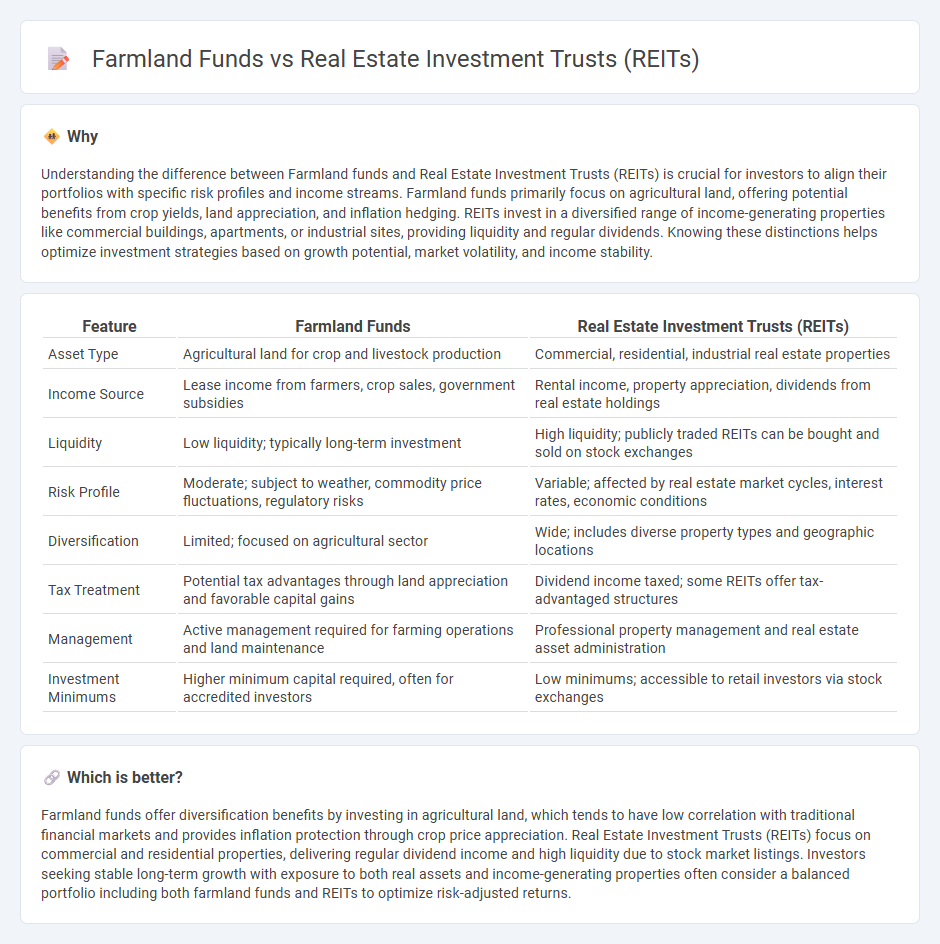

Understanding the difference between Farmland funds and Real Estate Investment Trusts (REITs) is crucial for investors to align their portfolios with specific risk profiles and income streams. Farmland funds primarily focus on agricultural land, offering potential benefits from crop yields, land appreciation, and inflation hedging. REITs invest in a diversified range of income-generating properties like commercial buildings, apartments, or industrial sites, providing liquidity and regular dividends. Knowing these distinctions helps optimize investment strategies based on growth potential, market volatility, and income stability.

Comparison Table

| Feature | Farmland Funds | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Asset Type | Agricultural land for crop and livestock production | Commercial, residential, industrial real estate properties |

| Income Source | Lease income from farmers, crop sales, government subsidies | Rental income, property appreciation, dividends from real estate holdings |

| Liquidity | Low liquidity; typically long-term investment | High liquidity; publicly traded REITs can be bought and sold on stock exchanges |

| Risk Profile | Moderate; subject to weather, commodity price fluctuations, regulatory risks | Variable; affected by real estate market cycles, interest rates, economic conditions |

| Diversification | Limited; focused on agricultural sector | Wide; includes diverse property types and geographic locations |

| Tax Treatment | Potential tax advantages through land appreciation and favorable capital gains | Dividend income taxed; some REITs offer tax-advantaged structures |

| Management | Active management required for farming operations and land maintenance | Professional property management and real estate asset administration |

| Investment Minimums | Higher minimum capital required, often for accredited investors | Low minimums; accessible to retail investors via stock exchanges |

Which is better?

Farmland funds offer diversification benefits by investing in agricultural land, which tends to have low correlation with traditional financial markets and provides inflation protection through crop price appreciation. Real Estate Investment Trusts (REITs) focus on commercial and residential properties, delivering regular dividend income and high liquidity due to stock market listings. Investors seeking stable long-term growth with exposure to both real assets and income-generating properties often consider a balanced portfolio including both farmland funds and REITs to optimize risk-adjusted returns.

Connection

Farmland funds and Real Estate Investment Trusts (REITs) intersect through their shared focus on income-generating real estate assets, with farmland funds targeting agricultural land and REITs encompassing various property types including commercial and residential. Both investment vehicles offer diversification and inflation hedging by leveraging tangible assets, attracting investors seeking stable, long-term returns. The rise of farmland REITs exemplifies the convergence, allowing investors to access farmland exposure through publicly traded securities, blending the benefits of traditional farmland funds with the liquidity of REITs.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer higher liquidity compared to farmland funds due to their public market listings, enabling investors to buy and sell shares swiftly. Farmland funds typically involve longer lock-up periods and less frequent trading opportunities, resulting in reduced liquidity. Explore the liquidity characteristics of REITs and farmland funds to make informed investment decisions.

Asset Diversification

Real estate investment trusts (REITs) offer exposure to commercial, residential, and industrial properties, providing liquidity and regular income through dividends. Farmland funds invest directly in agricultural land, delivering stable returns linked to crop yields and commodity prices, often less correlated with traditional real estate markets. Explore more about how asset diversification through these options can balance risk and enhance portfolio growth.

Yield Sources

REITs primarily generate yield through rental income from commercial or residential properties, benefiting from consistent cash flows and property appreciation. Farmland funds derive yield by leasing agricultural land and profiting from crop sales, with returns influenced by commodity prices and land value appreciation. Explore detailed comparisons on yield stability and growth potential between REITs and farmland funds to optimize your investment portfolio.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and typically operates income-producing real estate such as offices, apartments, hospitals, and shopping centers, and they can be equity REITs or mortgage REITs, with most publicly traded on major exchanges.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate, offering investors steady dividend income, diversification, and long-term capital appreciation, often trading publicly on stock exchanges.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale income-producing real estate, including office buildings, malls, apartments, and mortgages, with public, non-traded, and private REIT types affecting liquidity and risk.

dowidth.com

dowidth.com