Esports franchises represent a dynamic investment opportunity fueled by rapid industry growth, global audience expansion exceeding 450 million viewers, and innovative revenue streams such as sponsorships, media rights, and merchandise sales. Real estate holdings offer stable, long-term value through property appreciation, rental income, and portfolio diversification across residential, commercial, and industrial assets. Explore how combining esports ventures with real estate can balance high growth potential and steady returns for diversified investment portfolios.

Why it is important

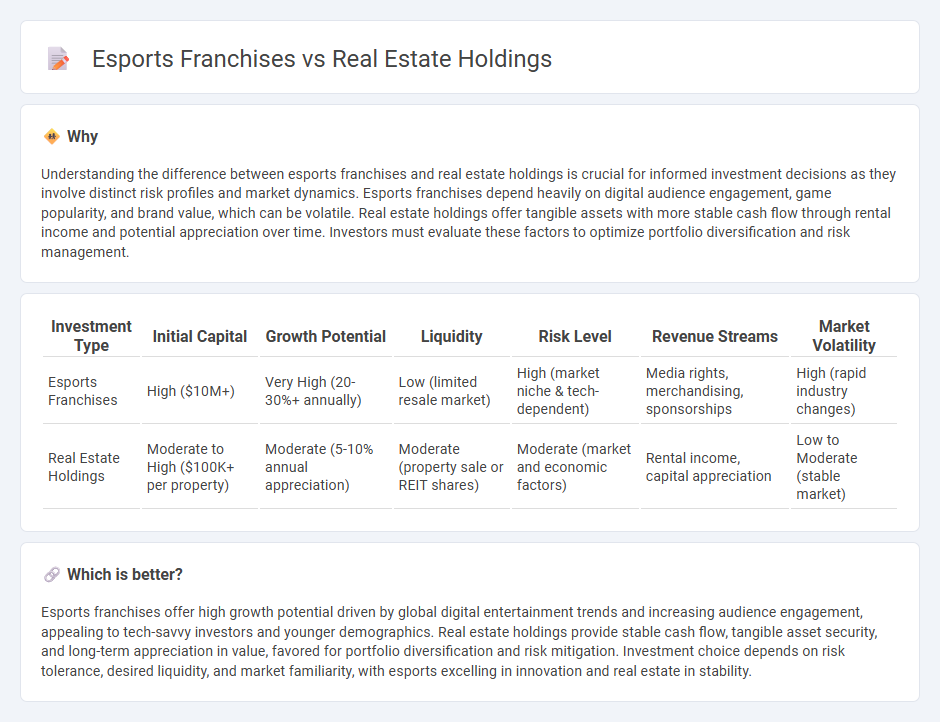

Understanding the difference between esports franchises and real estate holdings is crucial for informed investment decisions as they involve distinct risk profiles and market dynamics. Esports franchises depend heavily on digital audience engagement, game popularity, and brand value, which can be volatile. Real estate holdings offer tangible assets with more stable cash flow through rental income and potential appreciation over time. Investors must evaluate these factors to optimize portfolio diversification and risk management.

Comparison Table

| Investment Type | Initial Capital | Growth Potential | Liquidity | Risk Level | Revenue Streams | Market Volatility |

|---|---|---|---|---|---|---|

| Esports Franchises | High ($10M+) | Very High (20-30%+ annually) | Low (limited resale market) | High (market niche & tech-dependent) | Media rights, merchandising, sponsorships | High (rapid industry changes) |

| Real Estate Holdings | Moderate to High ($100K+ per property) | Moderate (5-10% annual appreciation) | Moderate (property sale or REIT shares) | Moderate (market and economic factors) | Rental income, capital appreciation | Low to Moderate (stable market) |

Which is better?

Esports franchises offer high growth potential driven by global digital entertainment trends and increasing audience engagement, appealing to tech-savvy investors and younger demographics. Real estate holdings provide stable cash flow, tangible asset security, and long-term appreciation in value, favored for portfolio diversification and risk mitigation. Investment choice depends on risk tolerance, desired liquidity, and market familiarity, with esports excelling in innovation and real estate in stability.

Connection

Esports franchises increasingly invest in real estate holdings, leveraging venue ownership to host tournaments and enhance fan experiences. Owning arenas and training facilities boosts franchise valuations by creating additional revenue streams through events and sponsorships. This strategic integration of esports and real estate maximizes asset utilization and long-term financial growth.

Key Terms

**Real Estate Holdings:**

Real estate holdings generate stable, long-term passive income through rental yields and property appreciation, serving as tangible assets with relatively low volatility compared to esports franchises. These investments benefit from established market demand, tax advantages, and diversification across residential, commercial, or industrial sectors. Explore detailed strategies to maximize returns and mitigate risks in real estate holdings for informed asset allocation.

Property Valuation

Real estate holdings are evaluated based on factors like location, market trends, and comparable sales, providing tangible asset valuation and consistent income streams. Esports franchises derive value from brand reputation, audience engagement, and digital asset monetization, making their valuations more volatile and dependent on market sentiment. Explore further insights into how these distinct valuation methods impact investment strategies.

Cash Flow

Real estate holdings generate steady cash flow through rental income, offering predictable and long-term financial stability, while esports franchises rely on variable revenue streams including sponsorships, media rights, and merchandise sales which can result in fluctuating cash flows. Real estate's lower operational costs contrast with the high marketing and talent acquisition expenses typical in esports, impacting overall profitability. Explore deeper financial analyses to understand how cash flow dynamics shape investment strategies in these divergent sectors.

Source and External Links

Example uses of a Real Estate Holding Company - A real estate holding company is a legal entity designed to protect personal assets from liabilities tied to real estate investments by holding properties, collecting profits, and assuming legal responsibility separate from the individual owner.

What Is a Real Estate Holding Company and How Do They Work? - Real estate holding companies, often structured as parent companies to LLCs or corporations, do not engage in daily operations but exist to reduce personal liability and legal risk for property investors.

Real Estate Holding Company | Protecting Property - Establishing a real estate holding company, especially as an LLC, offers asset protection, tax advantages, privacy, and streamlined management of multiple properties by limiting cross-liability and simplifying ownership transfers.

dowidth.com

dowidth.com