Carbon credit arbitrage leverages price differences in global carbon markets to generate quick returns by buying undervalued credits and selling higher-priced ones. Cleantech venture capital focuses on long-term growth by funding innovative renewable energy and sustainable technology startups with high scalability potential. Explore deeper insights into how these distinct investment strategies impact the transition to a low-carbon economy.

Why it is important

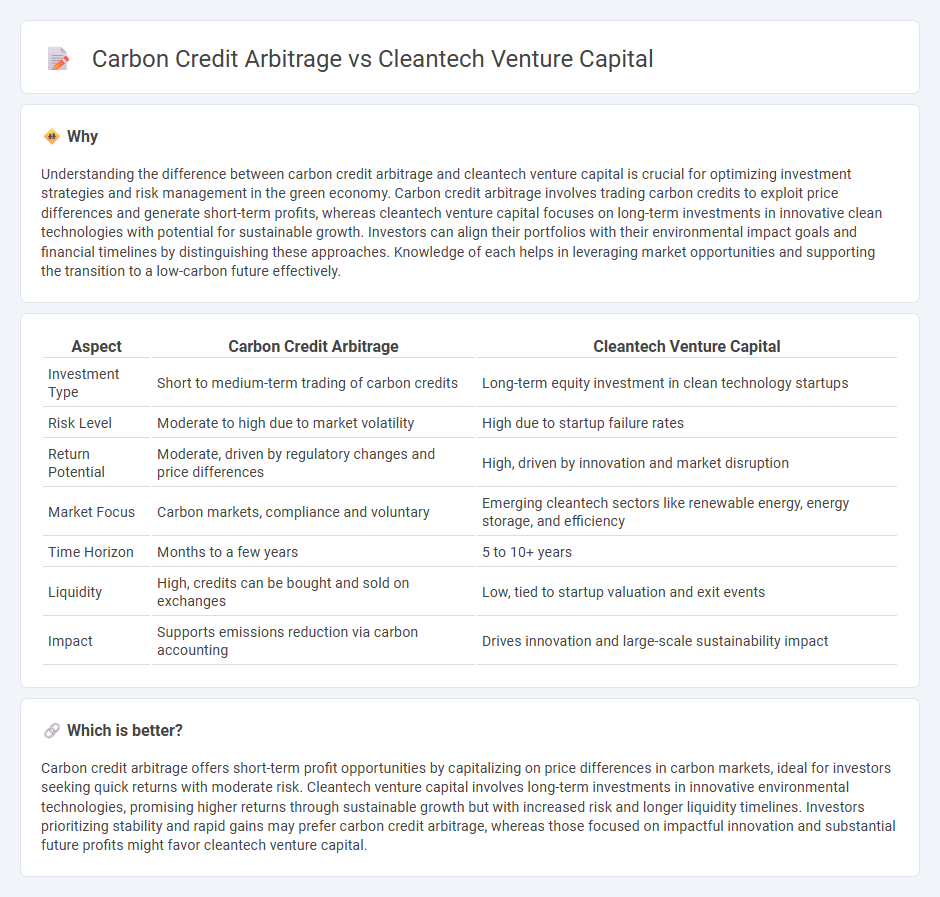

Understanding the difference between carbon credit arbitrage and cleantech venture capital is crucial for optimizing investment strategies and risk management in the green economy. Carbon credit arbitrage involves trading carbon credits to exploit price differences and generate short-term profits, whereas cleantech venture capital focuses on long-term investments in innovative clean technologies with potential for sustainable growth. Investors can align their portfolios with their environmental impact goals and financial timelines by distinguishing these approaches. Knowledge of each helps in leveraging market opportunities and supporting the transition to a low-carbon future effectively.

Comparison Table

| Aspect | Carbon Credit Arbitrage | Cleantech Venture Capital |

|---|---|---|

| Investment Type | Short to medium-term trading of carbon credits | Long-term equity investment in clean technology startups |

| Risk Level | Moderate to high due to market volatility | High due to startup failure rates |

| Return Potential | Moderate, driven by regulatory changes and price differences | High, driven by innovation and market disruption |

| Market Focus | Carbon markets, compliance and voluntary | Emerging cleantech sectors like renewable energy, energy storage, and efficiency |

| Time Horizon | Months to a few years | 5 to 10+ years |

| Liquidity | High, credits can be bought and sold on exchanges | Low, tied to startup valuation and exit events |

| Impact | Supports emissions reduction via carbon accounting | Drives innovation and large-scale sustainability impact |

Which is better?

Carbon credit arbitrage offers short-term profit opportunities by capitalizing on price differences in carbon markets, ideal for investors seeking quick returns with moderate risk. Cleantech venture capital involves long-term investments in innovative environmental technologies, promising higher returns through sustainable growth but with increased risk and longer liquidity timelines. Investors prioritizing stability and rapid gains may prefer carbon credit arbitrage, whereas those focused on impactful innovation and substantial future profits might favor cleantech venture capital.

Connection

Carbon credit arbitrage leverages price discrepancies across carbon markets to generate profits, providing liquidity and validation for emissions reduction projects. Cleantech venture capital funds invest in innovative technologies that produce verifiable carbon offsets, driving demand for carbon credits and enhancing market stability. Together, they create a synergistic ecosystem where capital flow accelerates low-carbon technology adoption and maximizes returns through strategic carbon credit trading.

Key Terms

Cleantech venture capital:

Cleantech venture capital involves investing in innovative technologies that reduce environmental impact, supporting startups developing renewable energy, energy storage, and sustainable materials. This sector attracts substantial capital due to growing global commitments to net-zero emissions and government incentives driving clean technology adoption. Explore the transformative potential of cleantech venture capital to accelerate the green economy and discover investment opportunities reshaping sustainability.

Equity financing

Cleantech venture capital focuses on equity financing by investing in innovative companies developing sustainable technologies, aiming for long-term growth and market transformation in renewable energy, energy efficiency, and green infrastructure. Carbon credit arbitrage involves the strategic buying and selling of carbon offsets, leveraging price differentials in regulatory or voluntary markets, often with shorter-term profit horizons and less emphasis on company equity participation. Explore detailed comparisons and strategic insights to understand which equity financing approach aligns best with your sustainability investment goals.

Technology scalability

Cleantech venture capital focuses on funding innovative technologies with high scalability potential to accelerate sustainable energy solutions and reduce carbon emissions globally. Carbon credit arbitrage leverages market inefficiencies to generate profits by trading carbon credits, but its scalability depends on regulatory frameworks and market dynamics rather than technology innovation. Explore further to understand how technology scalability influences investment strategies and environmental impact in these sectors.

Source and External Links

Cleantech Ventures Fund I - Industry-led Canadian venture capital fund investing in cleantech startups with value propositions for the energy sector, backed by a global network and strategic partners in heavy industry.

Clean Energy Ventures - Early-stage climate tech VC focused on startups with potential to mitigate 2.5 gigatons of CO2 by 2050, leveraging a team of scientists and engineers for deep technology assessment.

Breakthrough Energy Ventures - Prominent US/EU climate VC fund backed by Bill Gates, investing billions in technologies like green hydrogen, aviation fuel, and energy storage to achieve net-zero by 2050.

dowidth.com

dowidth.com